[ad_1]

The researchers performed a techno-economic evaluation to evaluate the feasibility of a ten MW-80 MWh liquid air vitality storage system within the Chinese electrical energy market. Their evaluation reveals {that a} vital degree of value volatility is at the moment an essential issue for the industrial maturity of this storage expertise.

Researchers at Sichuan Normal University in China have launched an actual choices primarily based framework to guage the funding in giant liquid air vitality storage (LAES).

Their work builds on earlier analysis, the place they introduced a LAES system that shops electrical energy within the type of liquid air or nitrogen at cryogenic temperatures. “In our new evaluation, we think about unsure components, corresponding to funding prices and electrical energy costs in China,” the corresponding writer of the analysis, Xiaoyuan ChenSPOKE pv journal. “We additionally study the impression of varied incentives, together with subsidies and preferential tax insurance policies, on LAES funding.”

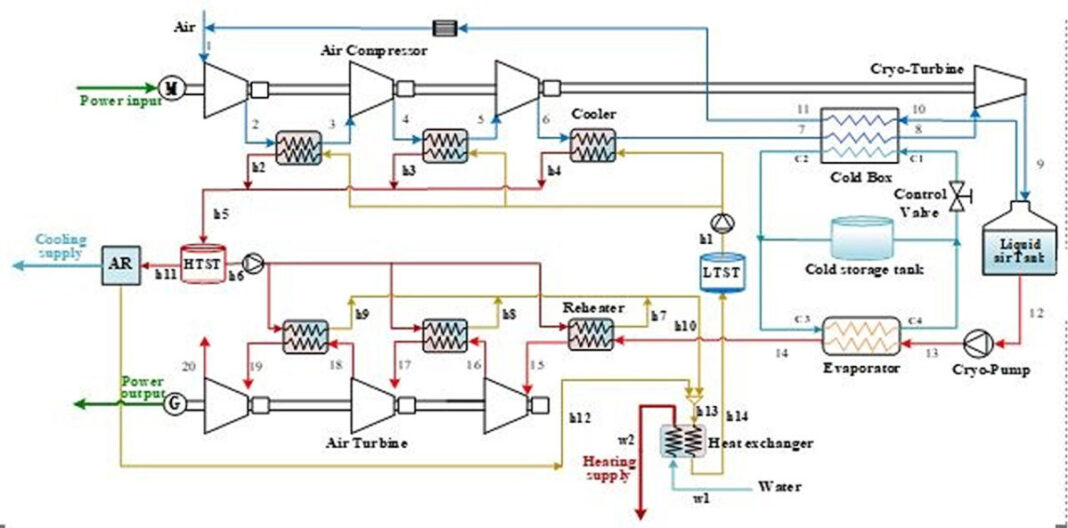

Their evaluation was carried out on a ten MW-80 MWh LAES system that depends on high-temperature thermal oil tanks to retailer compression warmth. During the vitality storage course of, the air is compressed by a three-stage compressor powered by off-peak electrical energy. Afterwards, the high-pressure air is cooled by intercoolers and additional liquid via a chilly field and a low-temperature turbine expander.

The liquefied air is then depressurized to atmospheric strain and saved in a liquid air tank. In this course of, the high-temperature air undergoes warmth alternate utilizing a warmth alternate medium, and the ensuing compressed warmth is straight away captured by thermal oil and saved in a high-temperature warmth storage tank (HTST) to facilitate heating. within the air through the unloading course of. .

During the vitality launch course of, the liquid air undergoes strain utilizing a cryogenic pump, adopted by vaporization in an evaporator. Then, the excessive strain air produced is additional heated by the recent oil from the HTST utilizing a reheater. It is then expanded right into a three-phase air turbine unit to generate electrical energy. The thermal oil used within the reheater is supplied and saved in a low-temperature warmth storage tank (LTST). The saved oil is used within the subsequent charging cycle.

“In multi-generation mode, the remaining high-temperature thermal oil serves as a warmth supply for the absorption fridge (AR), enabling the technology of chilly vitality,” Chen defined. “After releasing a part of the warmth in AR, the launched thermal oil is blended with low-temperature thermal oil. After warmth alternate via warmth exchangers (HEX), the blended thermal oil is saved in LTST. This course of permits the availability of sizzling water on the a part of the person.

System simulations and calculations have been carried out utilizing Aspen HYSYS software program. The energy consumption through the compression course of is eighteen.168 MW. The output energy of the air turbine is 10.02 MW. In addition, the multi-generation system is ready to present 3,942.44 kW of heating and a pair of,114.26 kW of cooling. The roundtrip effectivity for the system is 65.71%.

Photo: Sichuan Normal University

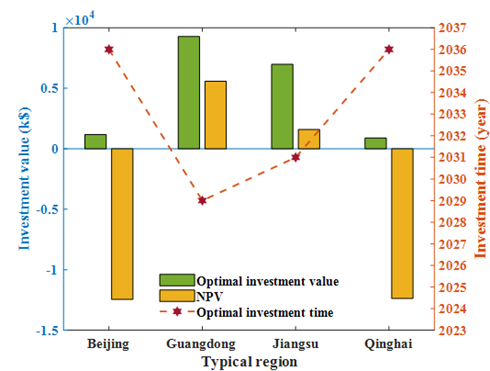

“Our financial evaluation reveals that, beneath the present situations of China’s electrical energy market, it’s virtually inconceivable to instantly set off the funding within the multi-generation LAES system,” mentioned Chen. “The advisable funding occasions are 2029 for Guangdong and 2031 for Jiangsu. For Beijing and Qinghai, one of the best funding interval is 2036. In one of the best funding interval, the precise expenditure of capital is estimated from $882/kW to 1,177/kW, whereas the levelized price of storage (LCOS) is from $0.105/kWh to $0.174/kWh. The greatest funding worth is about $1,176/kW$ for Beijing, $926/kW for Guangdong, and $882/kW for Qinghai.

For the impression of incentive insurance policies, the outcomes present that preferential taxation insurance policies can improve the funding worth of the LAES system, particularly in areas with greater peak-valley electrical energy value variations. . Increasing funding subsidies and technological studying results have a restricted impact on stimulating investments. On the opposite, the discharge subsidy coverage can advance the funding for at the very least one yr and is healthier for selling investments in LAES programs. “In Guangdong, it is suggested that buyers take instant funding motion as soon as the unit discharge subsidy reaches $0.133/kWh,” mentioned Chen.

The researchers say that making certain an acceptable degree of value volatility is a vital think about encouraging the participation of LAES within the electrical energy market.

It is advisable that time-of-use pricing mechanisms be additional developed to generate larger revenue potential for LAES operations. Second, policymakers ought to prioritize the introduction of discharge subsidy insurance policies due to the restricted enchancment within the optimum funding time and enchancment within the optimum funding quantity because of rising the funding subsidy and expertise studying impact. Third, governments ought to actively develop auxiliary service markets to supply varied advantages for LAES tasks as a result of insurance policies that concentrate on rising revenues quite than merely decreasing funding prices are more practical. to advertise LAES investments.

Details of their evaluation may be discovered within the examine “An actual options-based framework for multi-generation liquid wind vitality storage funding resolution beneath a number of uncertainties and coverage incentives,” printed in energy.

LAES at the moment has a expertise readiness degree (TRL) of 8. TRL measures the maturity of the expertise elements for a system and relies on a scale from one to 9, with 9 representing mature applied sciences for full industrial utility.

This content material is protected by copyright and might not be reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link