[ad_1]

In the brand new weekly replace for pv journalOPIS, a Dow Jones firm, offers a fast overview of the principle worth traits within the international PV business.

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outdoors China, assessed at $22.068/kg this week, unchanged from final week on the again of buy-sell indicators heard.

The anticipated preliminary ruling from US investigations into photo voltaic cells and modules imported from 4 Southeast Asian nations has been formally delayed till November 27. The deadline for closing determinations stays 75 day after the preliminary ruling, though yet another. extension is feasible.

The uncertainty of tariff charges presently is described as “harmful” for international polysilicon suppliers. Reports counsel that suppliers are counting on long-term contracts to keep up worth stability and offset monetary losses from the primary half of the yr.

Similarly, experiences point out a rise in buy quantity and a diminished push for worth negotiations from main international polysilicon patrons, who beforehand halted spot purchases and delayed month-to-month deliveries of underneath long-term contracts. Insiders interpreted this as a response to elevated authorized strain from suppliers to implement contract compliance.

Another coverage replace, though in a roundabout way associated to international polysilicon, might have an effect on the long run structure of worldwide polysilicon capability. Beginning September 23, the US Trade Representative opened a docket to gather suggestions on the proposed 50% Section 301 tariff on polysilicon and wafers from China, with the remark window closing on October 22.

While this has little impression on present worldwide commerce patterns within the photo voltaic sector, continued commerce obstacles may additional spur development in polysilicon and wafer manufacturing outdoors of China, doubtlessly altering or the worldwide provide and demand dynamics for polysilicon.

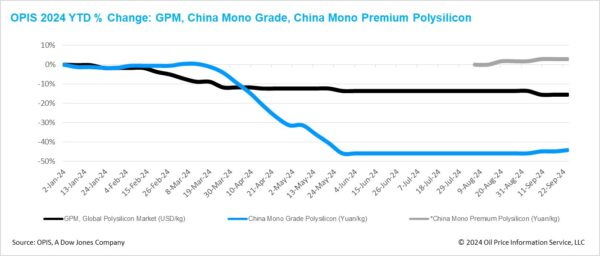

China Polysilicon: China Mono Grade, OPIS’ evaluation for mono-grade polysilicon costs within the nation, remained regular at CNY 33.625 ($4.80)/kg this week. China Mono Premium, OPIS’ worth evaluation for mono-grade polysilicon used for N-type ingot manufacturing, additionally remained regular at CNY 40.125/kg, unchanged from final week.

Market insiders usually agree that polysilicon costs in China have fallen and are actually anticipated to expertise sluggish, intermittent rebounds. However, these will increase are pushed extra by business methods than dynamic provide demand. Large producers can cut back their monetary losses, whereas much less aggressive producers can keep their survival throughout this potential worth improve.

The strategy of clearing extra capability on the polysilicon aspect is progressing slowly. Sources indicated that polysilicon manufacturing for September is estimated to be round 130,000 MT to 140,000 MT, whereas wafer manufacturing estimates for the month counsel polysilicon demand of lower than 100,000 MT. In addition, a significant producer is predicted to deliver new manufacturing capability on-line within the fourth quarter.

Another problem to clearing extra capability is the likelihood that polysilicon will formally be listed as a futures commodity in October or November. Reports counsel that some retailers started constructing warehouses to retailer items for future commerce; nevertheless, there may be little indication that main producers or patrons are actively taking part on this improvement.

The present extra stock of polysilicon has merely been transferred from producers to patrons, and attaining a wholesome supply-demand steadiness in China will take a whole lot of time.

OPIS, a Dow Jones firm, offers power costs, information, information, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. . It acquired pricing information property from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the writer, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link