[ad_1]

In the brand new weekly replace for pv journalOPIS, a Dow Jones firm, offers a fast overview of the principle value tendencies within the world PV trade.

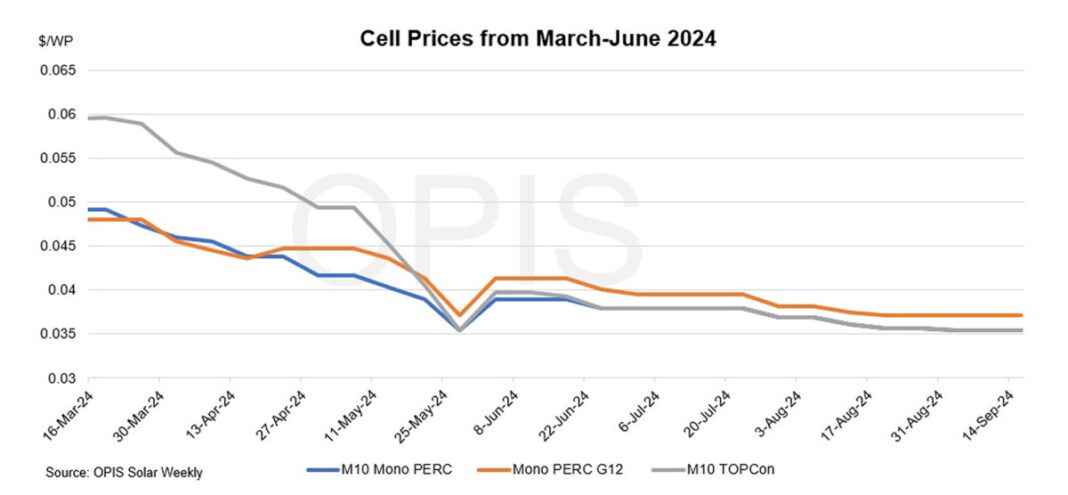

Cell costs are assessed to be secure within the week to Tuesday because the Chinese market stays closed on September 15-17 for the Mid-Autumn pageant. FOB China Mono PERC M10 cell and TOPCon M10 cell costs had been flat at $0.0354/W whereas FOB China Mono PERC G12 cell costs had been assessed unchanged at $0.0372/W on a weekly foundation with no buying and selling exercise.

Demand was gradual amongst market contributors who had been sidelined by the vacations. The latest drop in cell share costs, amid uncertainties as to when this downward pattern will cease, additionally dampened sentiment. M10 PERC cell costs fell by 21.68% since January this yr, whereas M10 TOPCon cell costs fell by 39.4% in the identical interval till Tuesday, in accordance with OPIS information.

An additional lower in cell costs will lead to cell producers closing manufacturing traces as a result of present cell costs are under manufacturing prices. On the opposite hand, some market contributors anticipate a slight improve in cell costs after the vacations as cell producers plan to extend costs amid a slight enchancment within the upstream section. wafer for the previous few weeks.

In China’s home market, costs are secure. Mono PERC M10 and TOPCon M10 had been assessed unchanged at CNY 0.290 ($0.041)/W, week-on-week whereas Mono PERC G12 costs had been flat at CNY 0.300/W from final week.

China exported about 4.65 GW of photo voltaic cells in July with the bulk going to India, an trade supply mentioned.

Outside of China, India’s Ministry of New and Renewable Energy (MNRE) is in search of suggestions on the draft pointers for the Approved List of Models and Manufacturers (ALMM) particularly for photo voltaic cells, which goals to be applied on April 1, 2026. in accordance with a memorandum launched. September 7.

The memorandum states that every one tasks below the supervision of ALMM should supply their photovoltaic modules from fashions and producers included in ALMM List-I for photo voltaic PV modules. These modules should, in flip, use photo voltaic PV cells from fashions and producers within the ALMM List-II for photo voltaic PV cells.

US commerce officers on Friday locked in a brand new 50% Section 301 tariff for cells, assembled into modules or not, from China. Those will likely be applied on September 27. More curiously, the USTR in the identical announcement prompt that the identical tariff must be utilized to polysilicon and wafers from China. This will push Chinese corporations to rethink their provide chains. The polysilicon and wafers proposal will likely be topic to a public remark interval, with particulars to be introduced individually.

OPIS, a Dow Jones firm, offers vitality costs, information, information, and evaluation on gasoline, diesel, jet gasoline, LPG/NGL, coal, metals, and chemical compounds, in addition to renewable fuels and environmental commodities. . It acquired pricing information property from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the creator, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and will not be reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link