[ad_1]

In a brand new weekly replace for pv journalOPIS, a Dow Jones firm, supplies a fast overview of the primary worth traits within the world PV trade.

FOB China market

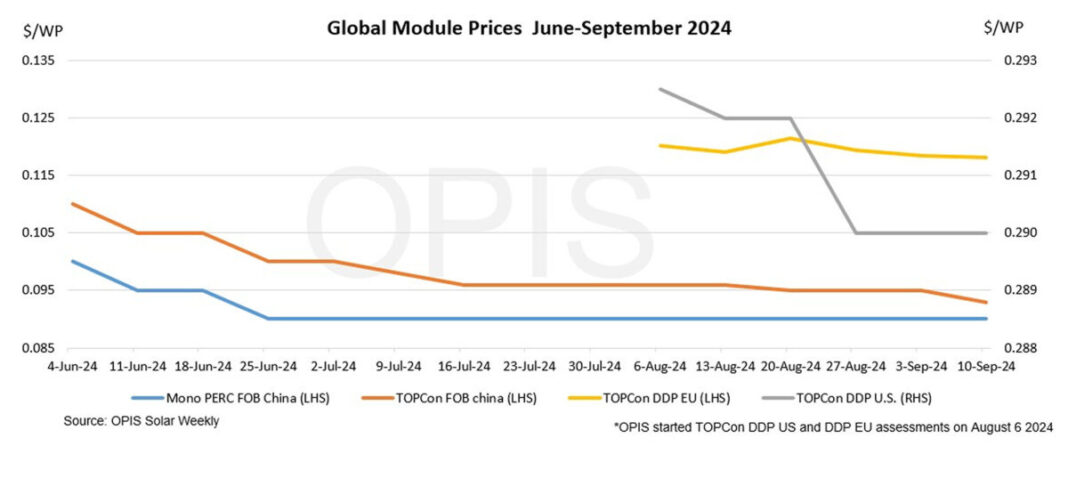

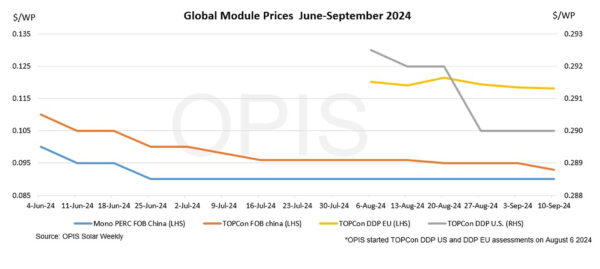

The Chinese Module Marker (CMM), the OPIS benchmark evaluation for TOPCon modules from China was assessed at $0.093/W Free-On-Board (FOB) China, down from $0.002/W week-to-week indicating the acquisition and buying and selling the symptoms heard. Most marketable indicators have been heard at $0.090-0.095/W FOB China. There are additionally TOPCon provides at $0.085-0.088/W from the Top 10 module makers circulating the market.

Market sentiment has turned bearish. Despite worth strain from the upstream polysilicon and wafer segments, extra capability will forestall any potential worth will increase within the cell and module phase, an trade supply mentioned. Domestic costs of China mono-grade polysilicon gained 1.89% weekly to CNY33.625 ($4.74)/kg whereas mono PERC M10 wafer rose 2.13% to CNY0.144/piece in the identical interval. Amid intense competitors amongst module distributors and strain to clear inventories, module costs will proceed to be weak till the tip of the 12 months, the supply added.

The worth unfold between Mono PERC and TOPCon modules has narrowed because of the lowered provide of Mono PERC modules and the decrease manufacturing prices of TOPCon modules. Prices for Mono PERC and TOPCon modules are anticipated to converge within the coming weeks, an trade supply mentioned. OPIS pegged Mono PERC module costs at $0.09/W FOB China for the week to Tuesday.

Europe

In Europe, TOPCon module costs remained agency at €0.107 ($0.118)/W, regardless of broader indications from a low of €0.090/W and a excessive of €0.122/W. On the freight aspect, Asia-North Europe Ocean freight charges declined one other 2% to $7,770 per forty-foot equal unit (FEU). This equates to $0.0184/W.

Market sources don’t anticipate DDP EU costs to vary within the close to future. At the second, there’s quite a lot of manufacturing capability and each producer desires to produce, even with extraordinarily low margins, commented the market gamers.

In phrases of European coverage, the European Commission launched on September 9 its long-awaited competitors report. The report requires a radical change in industrial insurance policies with elevated commerce protection measures and an accelerated legislative course of by ending the veto powers of particular person international locations throughout council votes.

United States

The spot worth for US-delivered duty-paid (DDP) TOPCon modules was unchanged week-over-week. The TOPCon module spot worth is estimated to be flat at $0.290/W, and supply in Q1 2025 stays at $0.301/W. Mono PERC Q1 supply is estimated to be flat at $0.291/W, and Q2 and Q3 2025 supply shipments stay unchanged at $0.294/W.

On the coverage entrance, US commerce officers have as soon as once more delayed releasing their closing determinations within the case of Section 301 tariff will increase, which can see duties on Chinese photo voltaic cells doubled to 50%, a transfer that some see as extremely symbolic, as most imported photo voltaic items now come from Vietnam, Malaysia, Thailand and Cambodia. Customs and Border Protection has elevated detentions of cargo and never simply from Indian producers making an attempt to enter the US market. Maxeon reported final week that every one of its shipments from Mexico to the US had been halted since July, with no clear timeline for his or her launch.

OPIS, a Dow Jones firm, supplies power costs, information, information, and evaluation on gasoline, diesel, jet gasoline, LPG/NGL, coal, metals, and chemical compounds, in addition to renewable fuels and environmental commodities. . It acquired pricing information belongings from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the creator, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and will not be reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link