[ad_1]

In the brand new weekly replace for pv journalOPIS, a Dow Jones firm, gives a fast overview of the principle value traits within the world PV business.

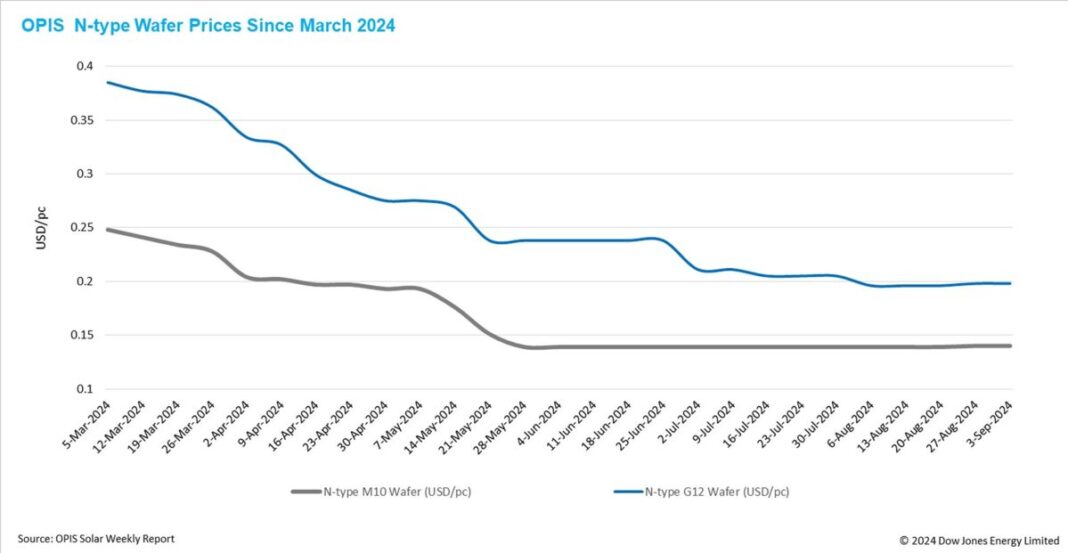

FOB China costs for N-type M10 and G12 wafers remained steady this week at $0.140/computer and $0.198/computer, respectively, after a quick price-driven enhance of the market leaders final week.

Cell corporations, each in China and internationally, have proven restricted acceptance of current wafer value will increase. The two primary wafer producers had been capable of safe a small enhance of round CNY0.01-0.02 ($0.0014-o.oo28) per piece, various by buyer. However, Tier-2 wafer producers haven’t succeeded of their makes an attempt to implement comparable value will increase, though this example additionally presents a big alternative for them to clear stock.

The continuation of the wafer value enhance is a subject of dialogue amongst market members, who imagine that in an setting of oversupply, it can primarily depend upon modifications in provide.

A Tier-1 wafer producer is reportedly altering its operational technique following current management modifications. The firm, which beforehand maintained a excessive working fee of greater than 90% for wafer manufacturing, has lowered it to round 70% for the reason that final week of August.

Given the corporate’s giant wafer manufacturing capability, the manufacturing unit’s choice to cut back output is anticipated to assist restore the market’s supply-demand stability over time and step by step shift costs from ranges of loss to make again to a extra rational vary. However, the probability of a sustained value enhance within the brief time period seems to be diminishing, as the corporate’s new management has reportedly ordered the PV enterprise to prioritize gross sales enlargement and stock discount.

Another main wafer producer, specializing in an built-in manufacturing mannequin all through the photo voltaic provide chain, is reported to be sustaining balanced ranges of output, gross sales, and stock within the wafer section by utilizing in most of its manufacturing for the manufacture of the in-house module. This positioning could permit the corporate to proceed to push for wafer value will increase, use the built-in mannequin to keep up price benefits and probably increase module gross sales as different producers wrestle with rising wafer price.

Some business voices fear that rising wafer costs may immediate smaller producers, who’ve been lowering or halting manufacturing, to rapidly increase their working charges. This rebound may disrupt efforts to optimize manufacturing capability and gradual business consolidation within the wafer market.

Overall, market members imagine that wafer market fundamentals stay unchanged, with overcapacity and excessive stock ranges prevailing. A sustainable and substantial enhance in wafer costs can solely happen if overcapacity is totally addressed.

OPIS, a Dow Jones firm, gives vitality costs, information, information, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical compounds, in addition to renewable fuels and environmental commodities. . It acquired pricing information belongings from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the creator, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and is probably not reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link