[ad_1]

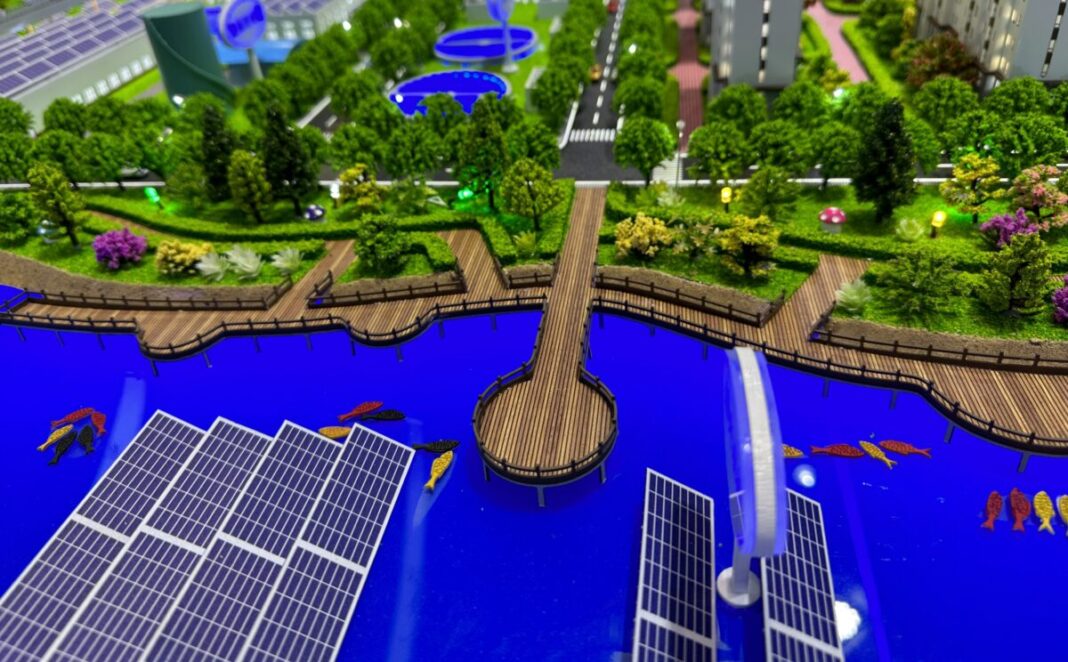

Researchers have evaluated the feasibility of floating PV by way of web current worth, inside charge of return, and LCOE. They included 25 European nations of their work, together with Germany, the United Kingdom, Spain, and Italy.

A gaggle of scientists from Italy and Spain analyzed the impression of adjusting financial circumstances on the viability of floating PV (FPV) initiatives in 25 European nations. In different phrases, they targeted on the web current worth (NPV), inside charge of return (IRR), and the levelized price of electrical energy (LCOE) of floating PV installations in your complete European area. While NPV tells how a lot revenue an funding could make, IRR reveals the anticipated charge of return, and LCOE calculates the typical price to provide electrical energy over the lifetime of the venture.

“The current work contributes to the event and deployment of FPV by investigating, on an unprecedented scale, the correlations between the financial viability of FPV and financial variables,” as teachers. “The outcomes of this evaluation can inform establishments and potential homeowners/traders concerning the financial profitability and price competitiveness of FPV, taking into consideration attainable adjustments within the necessary components of techno-economic.”

The research considers six financial parameters: day-ahead common electrical energy costs for 2010-2021; common nominal lending rate of interest in 2010-2020; common inflation in 2010-2021; nominal fairness IRR in 1900-2010; present company tax; and the weighted common price of capital (WACC). Conducting a sensitivity evaluation, every parameter decreases or will increase by 0-50%, in jumps of 10%, relative to the present reference measurements.

The nations analyzed are Albania, Austria, Belgium, Bulgaria, Croatia, Czech Republic, France, Germany, Greece, Hungary, Italy, Lithuania, Netherlands, Poland, Portugal, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Switzerland, Turkey, Ukraine, and the United Kingdom. In all nations, the set up is taken into account a south-facing tilt monofacial FPV system with a tilt angle of 10 levels.

The group discovered that, in all nations, capital expenditure (Capex) and WACC had probably the most vital impact on LCOE. On the opposite hand, working and upkeep bills (Omex), inflation, and revenue tax charges have a decrease impression.

“Therefore, in nations the place FPV isn’t but price aggressive, strategic interventions specializing in Capex and WACC are really helpful,” the scientists mentioned. “Support mechanisms can embrace grants or direct capital subsidies aimed toward decreasing Capex, for instance. On the opposite hand, low-interest and long-term loans will be put in place to scale back the WACC. In addition, mechanisms comparable to revenue tax credit can be utilized, though this alone is predicted to have a small impression on the FPV economic system in comparison with the earlier one.

In addition, the outcomes present that the tax charge, inflation charge, and Omex have a restricted impact on NPV, whereas Capex and electrical energy costs have a extra dominant affect. “A 1% distinction in Capex can result in a mean enhance in NPV of round €10 ($11.13)/kW. This is especially necessary, as a major discount in set up prices will be anticipated in future, because the FPV market grows and economies of scale start,” the researchers mentioned.

In phrases of IRR, it was discovered that Capex, electrical energy value, and power yield have a major impression, whereas Omex, inflation, and revenue tax have a small affect. “This signifies that, in nations the place FPV isn’t worthwhile, help mechanisms comparable to Feed-in Premiums (FiP), the place FPV power producers obtain a cost above the market value of electrical energy, will be constructed,” the lecturers recommended. “The identical help mechanisms can be utilized to extend the NPV of FPV, since it’s primarily influenced by Capex, electrical energy value, power yield, and WACC.”

Their findings are introduced in “Effect of variable financial circumstances on power prices and the financial viability of floating photovoltaics,” printed in Hellion. The analysis was carried out by teachers from the Sapienza University of Rome in Italy and the University of Jaén in Spain.

This content material is protected by copyright and is probably not reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link