[ad_1]

In the brand new weekly replace for pv journalOPIS, a Dow Jones firm, supplies a fast overview of the principle value traits within the world PV business.

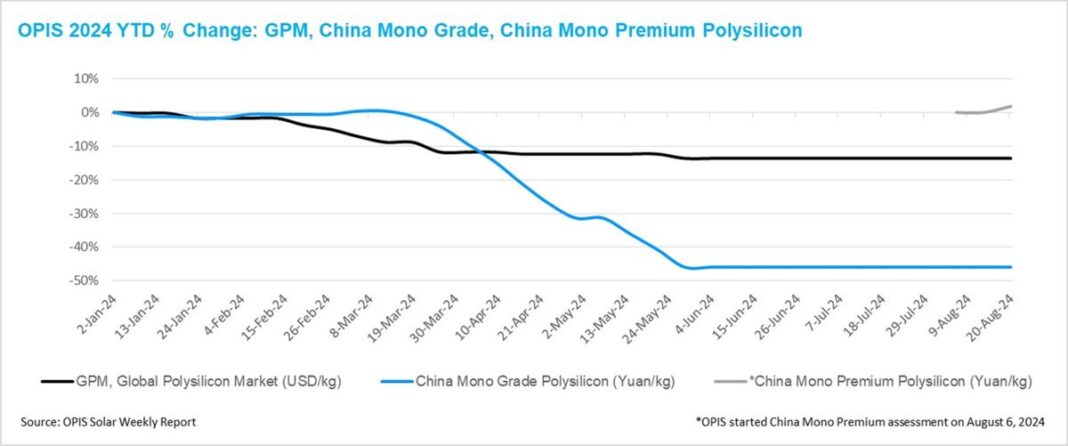

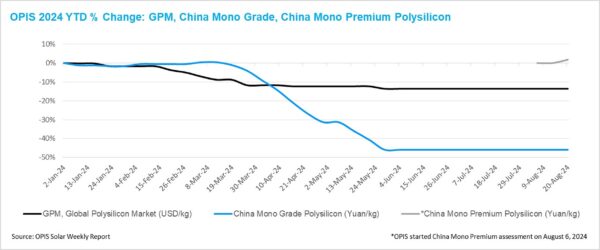

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outdoors of China, was assessed at $22.567/kg this week. It is unchanged from final week, as the basics of this market phase stay robust for now.

Wafer vegetation in Southeast Asia have reportedly ramped up their operations just lately, with the aim of redirecting these wafers to international locations within the area aside from the 4 international locations at the moment below investigation by the US, the place it’s processed into cells and modules meant on the market within the US market.

This development doesn’t result in modifications in world polysilicon transaction costs. A Southeast Asian wafer producer cited a desire for buying polysilicon from traceable areas in China to cut back prices. In addition, present world polysilicon inventories, constructed from a sluggish market within the space, are enough to satisfy the slight enhance in demand ensuing from greater wafer manufacturing charges in Southeast Asia.

A fireplace attributable to a pipe explosion at a world polysilicon manufacturing facility final week has garnered loads of market consideration. However, market individuals agreed that the incident had restricted influence on manufacturing facility manufacturing capability and was unlikely to have an effect on world polysilicon costs.

This is partly as a result of the producer has extra stock after a buyer posted some common month-to-month orders below a long-term buy settlement, in line with a market supply. In addition, with continued uncertainty surrounding US investigations into imported cells and modules from 4 Southeast Asian international locations, world polysilicon demand stays low, additional decreasing the potential influence on costs.

China Mono Grade, the OPIS evaluation for mono-grade polysilicon costs, remained regular at CNY 33 ($4.62)/kg this week, marking twelve consecutive weeks of stability. Meanwhile, China Mono Premium, the OPIS value evaluation for mono-grade polysilicon utilized in N-type ingot pulling, rose 1.79% from final week, reaching CNY 39.7 ($5.56)/kg.

The rise in costs of polysilicon utilized in N-type ingot pulling is due partially to some wafer producers restocking their polysilicon stock after depletion, and partially to futures and spot merchants gathering polysilicon in preparation for its potential itemizing as a commodity sooner or later.

The massive polysilicon giants, with their price benefits and management over many of the market’s stock, are more and more exhibiting robust pricing energy within the Chinese market. While small firms produce at restricted working charges, their common prospects now flip to those massive factories for spot purchases, additional strengthening the affect of the giants on costs. .

With summer season approaching in two months in Sichuan and Yunnan – areas that depend on hydroelectric energy and residential to many polysilicon factories – rising electrical energy prices are anticipated to drive up manufacturing prices. This is more likely to make it tougher for small, closed polysilicon companies to proceed operations, thereby growing the pricing energy of huge producers.

A market observer recommended that polysilicon giants might proceed to lift costs, which may attain round CNY 50 ($7.01)/kg, greater than their manufacturing prices. However, this stage stays far under the price worth for small producers and is unlikely to stimulate the reopening of closed small factories.

OPIS, a Dow Jones firm, supplies vitality costs, information, knowledge, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical compounds, in addition to renewable fuels and environmental commodities. . It acquired pricing knowledge belongings from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the creator, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link