[ad_1]

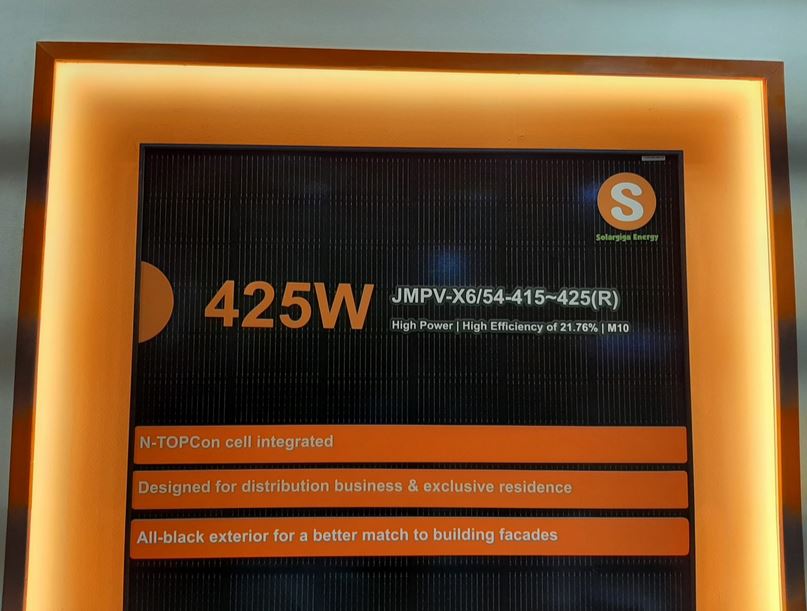

Solargiga’s TOPCon PV module

Image: pv journal

Solargiga stated it anticipated to report an unaudited lack of between CNY 95 million and CNY 115 million for the primary half of 2024, from income of almost CNY 100 million within the first six months of 2023. , a pointy decline in PV module costs, and stock write-downs. The module maker says it’s now planning to enhance operational effectivity and tightly management prices.

China Huaneng introduced its second 2024 photo voltaic module framework procurement train, focusing on an estimated 15 GW of capability. The procurement spherical consists of 13.5 GW of n-type tunnel oxide passivated contact (TOPCon) bifacial PV modules and 500 MW of n-type heterojunction (HJT) photo voltaic modules. The outcomes of the tender can be introduced on September 4.

Haita Solar stated it prolonged the development interval for its “2 GW HJT Solar Module R&D and Production Project” to March 31, 2025, and the “R&D Laboratory Expansion Project” to December 31, 2025. The firm stated the delay a choice primarily based on the present situation of the venture and doesn’t have an effect on the scope of the plan, implementation, fundraising objectives, or total funding.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link