[ad_1]

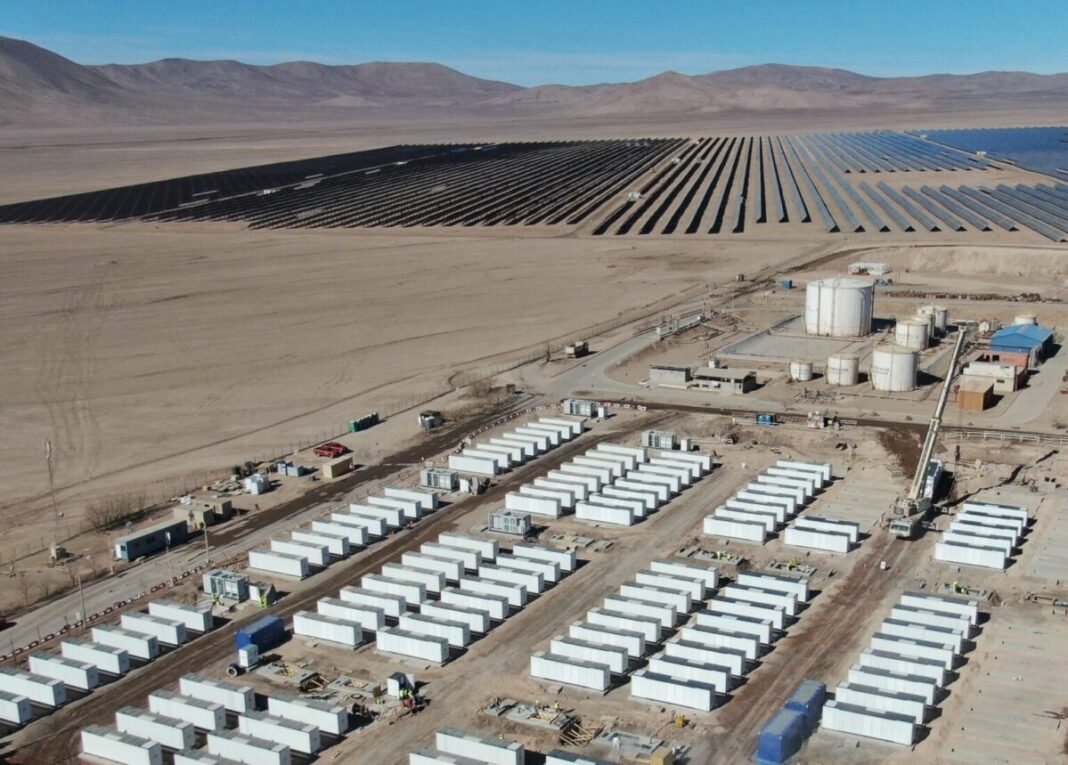

Tamaya BESS has 152 battery containers from Sungrow

Image: Engie

From ESS News

Battery makers and cell producers face a troublesome 2024 up to now, with diminished margins and earnings attributable to slower-than-expected international gross sales of electrical autos (EV), diminished volumes.

However, BloombergNEF (BNEF) stories that the stationary storage market has elevated by 61%, and costs for turnkey programs have decreased by 43% from 2023, which is a part of the deployment drive. In April, the determine was at a report low of $115/kWh for a two-hour vitality storage system.

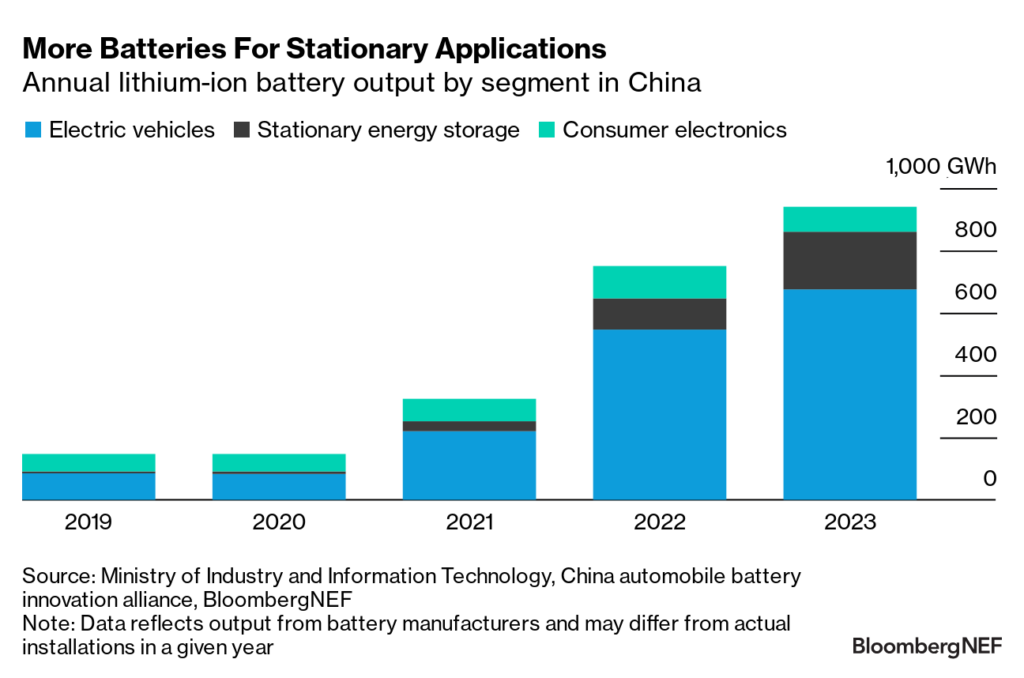

By wanting on the annual lithium-ion battery output from Chinese producers and assigning them to an software, stationary vitality storage surpassed shopper electronics because the second largest software for battery manufacturing. The international vitality storage market will practically triple by 2023.

Even when mixed, the 2 are far behind EVs. However, BNEF factors out that the ratio of EV battery demand to stationary battery demand has fallen from 15-to-1 to 6-to-1 over the previous 4 years:

Growth within the phase has been sooner than EV battery progress, nevertheless, from a smaller base, and forecasted demand signifies that the phase continues to develop quickly. This is because of China’s mandates for co-location of photo voltaic and wind for storage, together with the US Inflation Reduction Act, and measures applied in Europe, Japan, and Latin America, amongst others. Germany and Italy lead the residential market.

Regarding chemistry, BNEF expects NMC to carry a market share of solely about 1% by 2030, as cheaper and safer LFP chemistry will take market share.

To proceed studying, please go to our ESS News web site.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link