[ad_1]

Australian software program developer PV Lighthouse has secured almost AUD 1.97 million ($1.32 million) to gas improvement of its SunSolve Yield superior simulation engine, designed to enhance yield forecasting for photo voltaic utility projects- scale.

From pv journal Australia

Sydney-based PV Lighthouse has been awarded AUD 1.97 million by the Australian Renewable Energy Agency (ARENA) to fund the continued improvement of its SunSolve Yield energy and yield modeling platform.

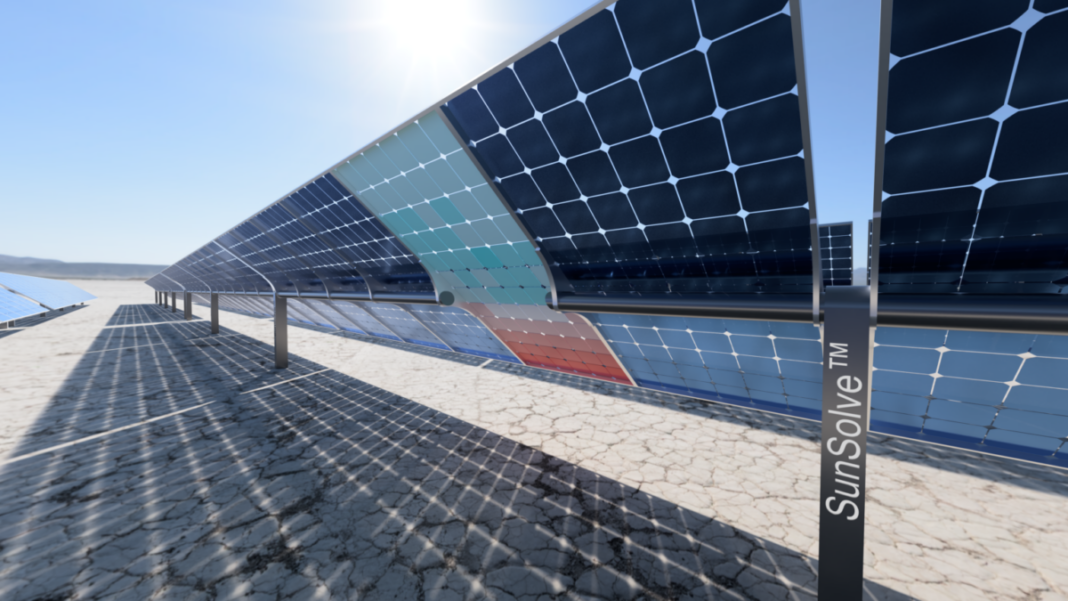

The firm mentioned the platform offers a digital twin of the buildings and PV modules utilized in utility-scale photo voltaic initiatives, permitting builders to find out the annual yield of their initiatives and discover the influence of various seasons, location and mounting buildings.

Keith McIntosh, founder and chief government officer of PV Lighthouse and SunSolve, mentioned pv journal the corporate’s software program can shortly and precisely reply design questions that used to take months to analyze and days to calculate.

What is SunSolve Yield and the way does it work?

SunSolve Yield is a robust simulation atmosphere that builders use to mannequin their utility-scale initiatives extra precisely than normal business software program. SunSolve takes a physics-first method to restrict the simplifications that at the moment cut back confidence in yield forecasts.

With SunSolve Yield, builders can shortly and simply create a 3D mannequin that precisely represents the structural elements of the system and the PV modules themselves. Using SunSolve Yield’s high-performance physics-based fashions, builders can decide the annual yield of their photo voltaic initiatives and assess the influence of various seasons, areas and mounting buildings.

What are the challenges that SunSolve Yield seeks to unravel?

The excessive stage of element within the SunSolve Yield mannequin implies that builders can have better confidence of their yield forecasts for inside and venture financing functions. With the price of financing utility-scale initiatives which have elevated with larger world rates of interest, financiers are searching for a better diploma of accuracy and class in forecasts to decrease the price of financing.

Before SunSolve existed, builders didn’t have an answer mannequin that might precisely signify their buildings and modules. This means they should guess on the many loss elements wanted for his or her yield predictions. Now builders can simply calculate these elements with SunSolve, giving them extra confidence of their predictions – a key benefit when negotiating venture financing.

Who is already utilizing SunSolve Yield expertise?

Released in 2021, SunSolve Yield is already utilized by 9 of the 25 largest builders, 5 monitoring firms, a few giant unbiased engineering corporations and a number of other institutes. Some clients use it to optimize their PV crops, others to enhance the accuracy of their yield predictions, others to quantify losses attributable to shading and mismatch, and the positive factors attributable to edge shining and higher monitoring routines.

Its companion product, SunSolve Power, was launched in 2014. It is utilized by many of the main module producers to help of their R&D, together with 4 of the 5 largest producers. In reality, SunSolve Power subscribers will ship about half of the worldwide provide of modules in 2023. Some of our higher recognized subscribers are Longi, Trina, Qcells and Maxeon. SunSolve Power has been referenced in over 100 tutorial publications.

What will this new funding mean you can obtain?

ARENA funding will speed up the event of SunSolve Yield by hiring further programmers and researchers. We start by first bettering the methodology for quantifying yield uncertainty. This will assist builders and lenders to make extra dependable forecasts, lowering the danger of the venture and due to this fact the price of financing.

By making use of that improved method, and with suggestions from business companions and clients, we are going to increase and validate the bodily fashions – climate, optics, thermodynamics, electronics – which have the best potential to scale back uncertainty. certainty.

Where do you see the alternatives forward for PV Lighthouse?

Our flagship product SunSolve Power has helped drive innovation in cell and module analysis. It is utilized by main cell and module producers to design world-record-breaking cells and discover next-generation applied sciences.

SunSolve Yield is already utilized by among the largest and most subtle utility-scale builders. Our objective is to use the sophistication supplied by SunSolve Yield to the analysis of any utility-scale venture over 100 MW. This will finally assist decrease the price of financing and promote innovation in any respect ranges of the photo voltaic business.

Our view is that extra correct predictions result in higher determination making. They empower everybody within the business to determine probably the most priceless path ahead. Wherever you’re within the provide chain you’re confronted with selections between competing alternate options. Without an correct mannequin to worth one possibility over one other, you may flip a coin.

What advantages past the precise design does the platform present?

One of the largest obstacles to the inexperienced vitality transition is the price of financing utility-scale initiatives, ie the curiosity paid by builders on the loans wanted to construct their photo voltaic initiatives. To put this barrier into perspective, the price of financing a venture in Australia is about half of the overall value of a utility-scale venture. One cause for the excessive value of financing is the issue in precisely predicting the vitality yield from a given venture earlier than the venture is constructed and, due to this fact, in precisely predicting the longer term earnings of the venture. Therefore, if a lender has little confidence within the profitability of a venture, it’ll think about the venture dangerous, and provide unfavorable financing phrases.

At PV Lighthouse, we imagine our biggest contribution to the PV business will finally be growing the boldness lenders have in yield forecasting, thereby lowering the price of financing the inexperienced vitality transition.

This content material is protected by copyright and is probably not reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link