[ad_1]

A brand new report from Clean Energy Associates (CEA) and the American Council on Renewable Energy reveals how antidumping tariffs and countervailing duties (AD/CVD) create value points not just for imported photo voltaic panels, but in addition for US-made photo voltaic panels.

From pv journal USA

United States ends two-year moratorium on photo voltaic AD/CVD tariffs. The tariffs will apply to photo voltaic parts shipped from Vietnam, Malaysia, Thailand, and Cambodia discovered to be concealing tariff-evading items from China.

The 4 Southeast Asian nations are answerable for practically 80% of the US provide of photo voltaic parts. AD/CVD tariffs have traditionally ranged from 50% to 250% of the price of shipped items. This tariff threat creates loads of uncertainty for consumers and suppliers. Clean Energy Associates (CEA) and the American Council on Renewable Energy (ACORE) issued a report assess these dangers.

The US Energy Information Administration says the specter of AD/CVD tariffs in 2022 has prompted delays or cancellations of about 20% of utility-scale photo voltaic era capability.

Now, following petition from US producers claiming that the dumped merchandise are harming their enterprise, the US International Trade Commission has determined to conduct a brand new spherical of AD/CVD investigations on element suppliers from 4 Southeast Asian nations.

The US Department of Commerce is predicted to launch its CVD preliminary willpower on Sept. For any willpower, Commerce will set up the tariff price primarily based on data of subsidization and its disposal. The last willpower is predicted to be made on April 4, 2025, for the Department of Commerce and May 19, 2025 for the International Trade Commission.

ACORE president and chief govt officer Ray Long mentioned a discovering of an AD/CVD violation “might inadvertently hand over US management within the photo voltaic trade to different nations.”

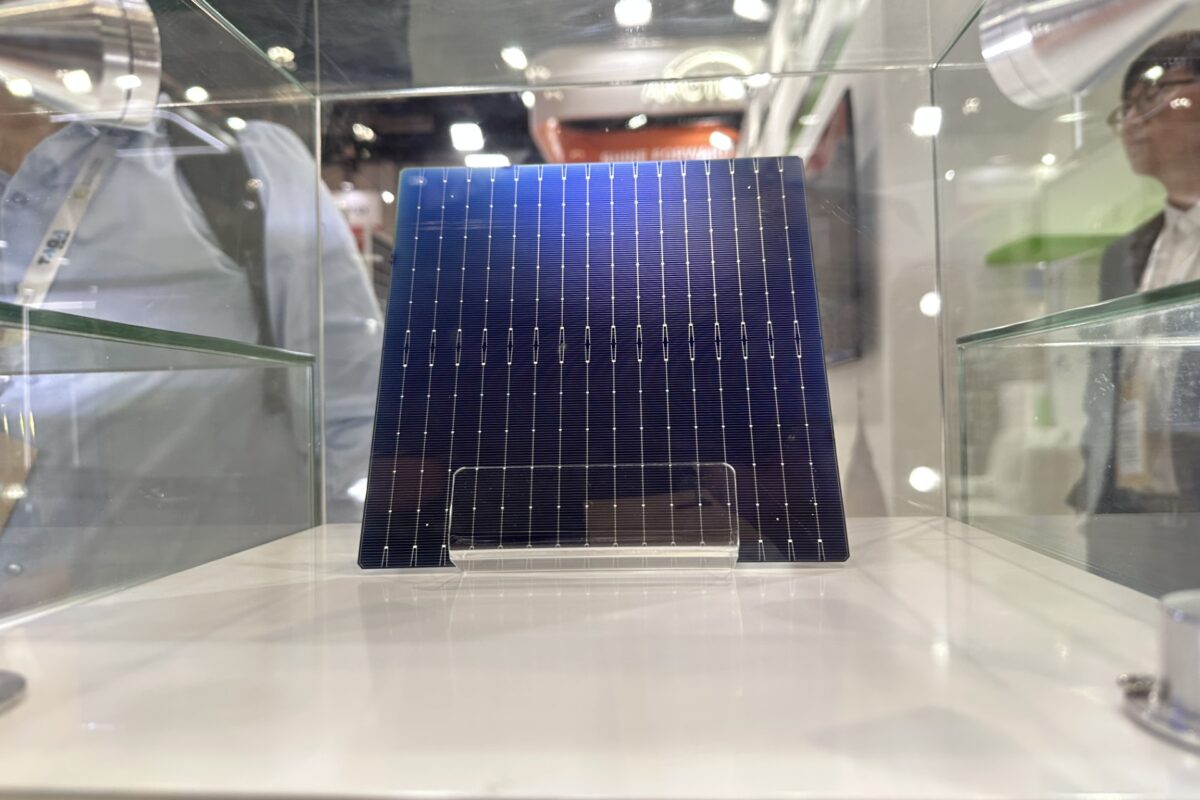

Domestic producers of photo voltaic parts petitioned in assist of the tariffs, however the CEA warned that implementation might negatively have an effect on their companies, too. This is as a result of there’s a enormous hole within the US photo voltaic provide chain. While many module meeting amenities have come on-line, the cells produced and built-in right into a photo voltaic module nonetheless depend on imports, with little home manufacturing capability.

The CEA mentioned that module manufacturing capability within the United States might develop from 31 GW in 2024 to about 60 GW in 2026. Cell capability could take extra time, it mentioned, to develop from about 1 GW in 2024 to 11 GW in 2027. The firm expects most Cell factories to complete increasing in 2027 whereas the Inflation Reduction Act 45X manufacturing incentives run out after 2030.

CEA fashions that photo voltaic AD/CVD tariffs will enhance home module prices by 10 cents per watt and imported module prices by 15 cents per watt, affecting the challenge’s economics. For reference, a purchaser instructed OPIS that present US Delivered Duty Paid (DDP) TOPCon photo voltaic module costs have elevated to the low to mid $0.30/W vary. This pricing contains the 201 bifacial tariff however excludes the brand new antidumping/countervailing duties.

“These increased costs applied on prime of different headwinds, together with home components and commerce restrictions already in place and affecting the trade’s trajectory, will significantly hinder the expansion of America in photo voltaic deployment,” mentioned ACORE.

Popular content material

ACORE notes that the US photo voltaic trade is in good well being. Private companies have introduced no less than 105,454 new jobs and greater than $123 billion in capital funding in clear power extensively for the reason that passage of the IRA, and photo voltaic is predicted to symbolize about 59% of all additions. of grid capability till 2028. however to realize the objectives of a 50-52% discount in greenhouse fuel emissions by 2030, the US photo voltaic trade should enhance from 177 GW of put in capability to greater than 500 GW. Worsening challenge economics might threaten to hit this fast-approaching goal.

The report argues that the United States wants extra time to construct photo voltaic cell capability to satisfy demand. It additionally acknowledges that the nation could also be depending on cell imports for a while.

It is harder to ascertain a photo voltaic cell manufacturing unit for a number of causes, says the CEA. Cell capability might be doubled with construct, coaching, and module capability ramp time. Uncertain content material guidelines make the worth of US cells extremely risky till last guidelines are revealed. And the price of cell capital expenditure might be two to a few occasions the price of a module manufacturing unit, which makes it troublesome for brand spanking new suppliers to lift funds.

The CEA predicts that the United States might want to import as much as 41 GW value of cells and/or modules to satisfy deliberate US installations till Section 201 tariffs are phased out in February 2026.

Implementation of AD/CVD could threaten the availability of present cells. The report mentioned the duties might create a state of affairs the place cell consumers and suppliers wouldn’t wish to threat the obligation, and cell transactions would stop.

The report warned {that a} discovering of AD/CVD might put US manufacturing jobs in danger. The duties might go away practically 34 GW of US photo voltaic module capability with out competitively priced cell inputs, harming practically 9,000 US manufacturing jobs.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link