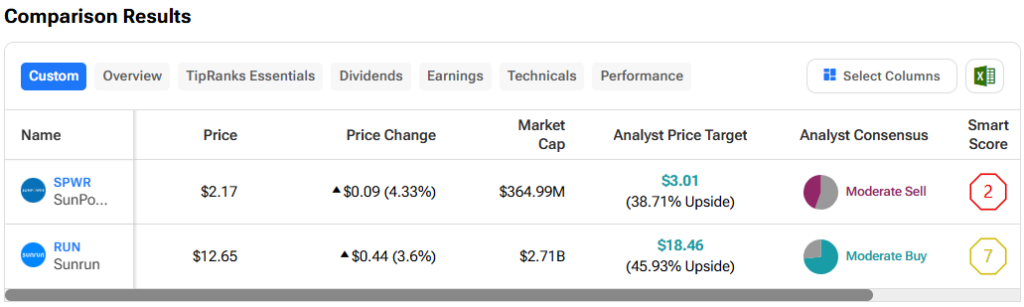

In this piece, I study two solar-energy shares, SolarPower (NASDAQ:SPWR) and Sunrun (NASDAQ: RUN), utilizing TipRanks’ Comparison Tool to see which one is best. A better look suggests a bearish view on SolarPower and a impartial view on Sunrun.

SolarPower designs, manufactures, and delivers photo voltaic panels, methods, and companies, whereas Sunrun designs, develops, installs, sells, and maintains residence photo voltaic power methods.

SolarPower shares are down 45% year-to-date and 72% over the previous 12 months, whereas Sunrun inventory is down 35% year-to-date, dragging its one-year return to purple at -29%.

The undeniable fact that each shares are down by comparable percentages this 12 months is indicative of broader points affecting photo voltaic shares particularly. High rates of interest have hit the trade exhausting, making it troublesome for folks and companies to finance photo voltaic power methods.

In response, photo voltaic power shares fell, as evidenced by the 27% drop within the Invesco Solar ETF (NYSEARCA: TAN). Let’s see if a more in-depth take a look at SolarPower and Sunrun reveals any buy-the-dip alternatives.

Unfortunately, neither firm is worthwhile right this moment, so let’s examine their price-to-sales (P/S) ratios to measure their valuations towards one another and their trade. For comparability, the renewable power trade trades at a P/S of 1.8x, barely decrease than the three-year common of 2x.

SolarPower (NASDAQ:SPWR)

At a P/S of 0.22x, SolarPower is buying and selling at an especially depressed valuation, and a better ahead P/S of 0.31x means that analysts count on the corporate’s gross sales to say no. A better take a look at the corporate’s monetary state of affairs suggests {that a} smaller view could also be applicable.

In the fourth quarter of 2023, SolarPower posted a GAAP (usually accepted accounting rules) web lack of $115.6 million from persevering with operations in comparison with web earnings of $5.1 million within the prior 12 months quarter. The firm would not report per-share numbers, maybe as a result of extra shares could also be issued quickly as a consequence of new financing phrases (extra on that beneath), and it hasn’t but reported the most recent quarter.

In truth, SolarPower obtained a deficiency discover from Nasdaq for delaying its newest quarterly report. In its press launch, SolarPower mentioned it “gives uncertainty as to timing” however is “working diligently to finalize” its Form 10-Ok for 2023 and 10-Q for Q1 2024.

The firm introduced a $50 million draw on its beforehand introduced second-lien mortgage, issuing warrants to Sol Holding in change. Those warrants give the corporate the precise to purchase 33.4 million shares at an train worth of 1 cent per share. These monetary phrases alone point out an organization in decline, particularly when mixed with widening losses.

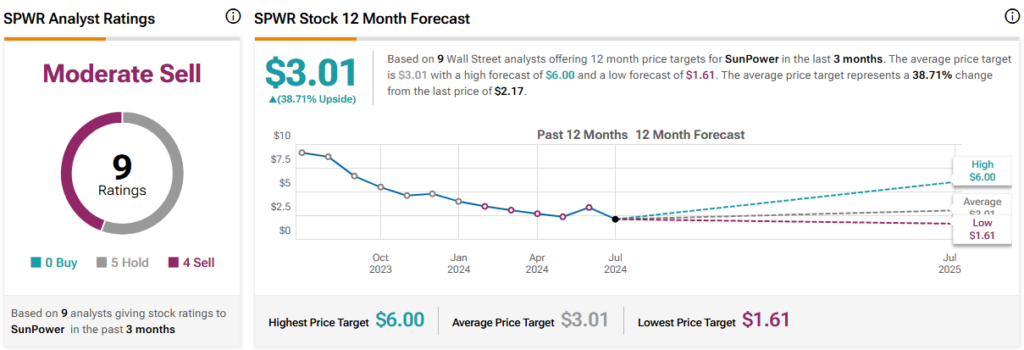

What is the Price Target for SPWR Stock?

SolarPower has a Moderate Sell consensus ranking primarily based on zero Buys, six Holds, and 4 Sell rankings assigned up to now three months. At $3.01, SolarPower’s common inventory worth goal implies an upside potential of 38.71%.

Sunrun (NASDAQ:RUN)

At a P/S of 1.25x, Sunrun trades at a reduction to its trade, which is warranted as a result of it will not be worthwhile for a full 12 months via 2022. Meanwhile, this firm is not in an important place both. in finance , some inexperienced shoots recommend {that a} impartial view could also be applicable, ready for any adjustments for the higher.

For instance, Sunrun has adopted a storage-first mindset to extend ticket sizes by including storage capability to the photo voltaic panel methods it sells. In truth, storage-attachment charges hit 50% within the first quarter, which is an indication of potential life.

Additionally, Sunrun’s “web incomes belongings” elevated $487 million sequentially within the fourth quarter, hitting $5.6 billion and together with $953 million in complete money. Annual recurring income exceeds $1 billion, with a mean remaining contract lifetime of 17.6 years. Sunrun additionally reported 5.7 gigawatts of networked photo voltaic power capability.

Other indicators of potential embrace a partnership with Ford (NYSE:F) to function the popular installer of its Intelligence Backup Power and for installations of the 80-amp Ford Charge Station Pro and Home Integration System. Sunrun may even assist Puerto Rico rebuild its power system by growing a 17-megawatt digital energy plant that’s the island’s first large-scale, distributed storage program.

Unfortunately, the corporate continues to be going through an uphill battle to recuperate. Although the corporate is worthwhile, its margins are poor. In 2022, its web earnings margin is 7.5%, and earlier than that, the corporate was final worthwhile in 2019, with a web earnings margin of three.1%. Thus, I recommend to watch out till these inexperienced shoots begin to develop.

What is the Price Target for RUN Stock?

Sunrun has a Moderate Buy consensus ranking primarily based on 11 Buys, 4 Holds, and nil Sell rankings assigned up to now three months. At $18.46, Sunrun’s common inventory worth goal implies upside potential of 45.9%.

Conclusion: Bearish on SPWR, Neutral on RUN

While SolarPower and Sunrun have entered a depressed interval together with different solar-energy firms, Sunrun is the clear winner right here. When an organization accepts financing phrases that embrace giving up shares at an train worth of 1 penny per share, it is often an indication of desperation that means it might be spiraling down the drain. .

On the opposite hand, Sunrun could also be in a greater place for the long run, nevertheless it stays a show-me story.

disclosures