Habit Climate has offered an funding tax credit score (ITC) switch value $600,000 for a 1.2 MW photo voltaic mission, full with a twelve-page switch settlement and due diligence paperwork. This transaction, facilitated underneath the brand new provisions of the Inflation Reduction Act (IRA), indicators a big change within the tax panorama, increasing entry to smaller tasks. in photo voltaic.

Tax fairness, a financing association wherein traders fund solar energy tasks in alternate for federal tax advantages resembling funding tax credit, is a fancy subject that mixes capital and labor. The preliminary prices of assembling these offers can begin underneath $100,000 however can rapidly climb into the tens of millions. These bills, which cowl charges for legal professionals, accountants, and engineers, assist the in depth assessment of knowledge rooms and the drafting of quite a few contracts, specializing in compliance and due diligence. The objective is to make sure that giant funding teams can safely deploy billions of {dollars} in compliance with US Internal Revenue Service rules.

The introduction of the IRA led to the switch of the ITC. This mechanism supplies a much less formal various to conventional tax fairness, facilitating using photo voltaic ITCs by traders.

When pv journal USA consulting tax fairness professionals, now additionally engaged on transfers, at The Solar Energy Industries Association’s annual Finance, Tax, and Procurement Seminar in March concerning the potential for less complicated “six to eight web page” tax switch contracts, their response was a mixture of skepticism and amusement. Such temporary paperwork might differ considerably from the in depth documentation required for photo voltaic tax fairness transactions attributable to their complexity and regulatory calls for. Our sources point out that shorter contract lengths are extra according to these utilized by the movie business, which additionally navigates its personal tax credit score course of.

In the previous, even the smallest tasks that attracted tax fairness traders required $1 to $2 million in tax advantages to offset the $75,000 price. That scene is now evolving.

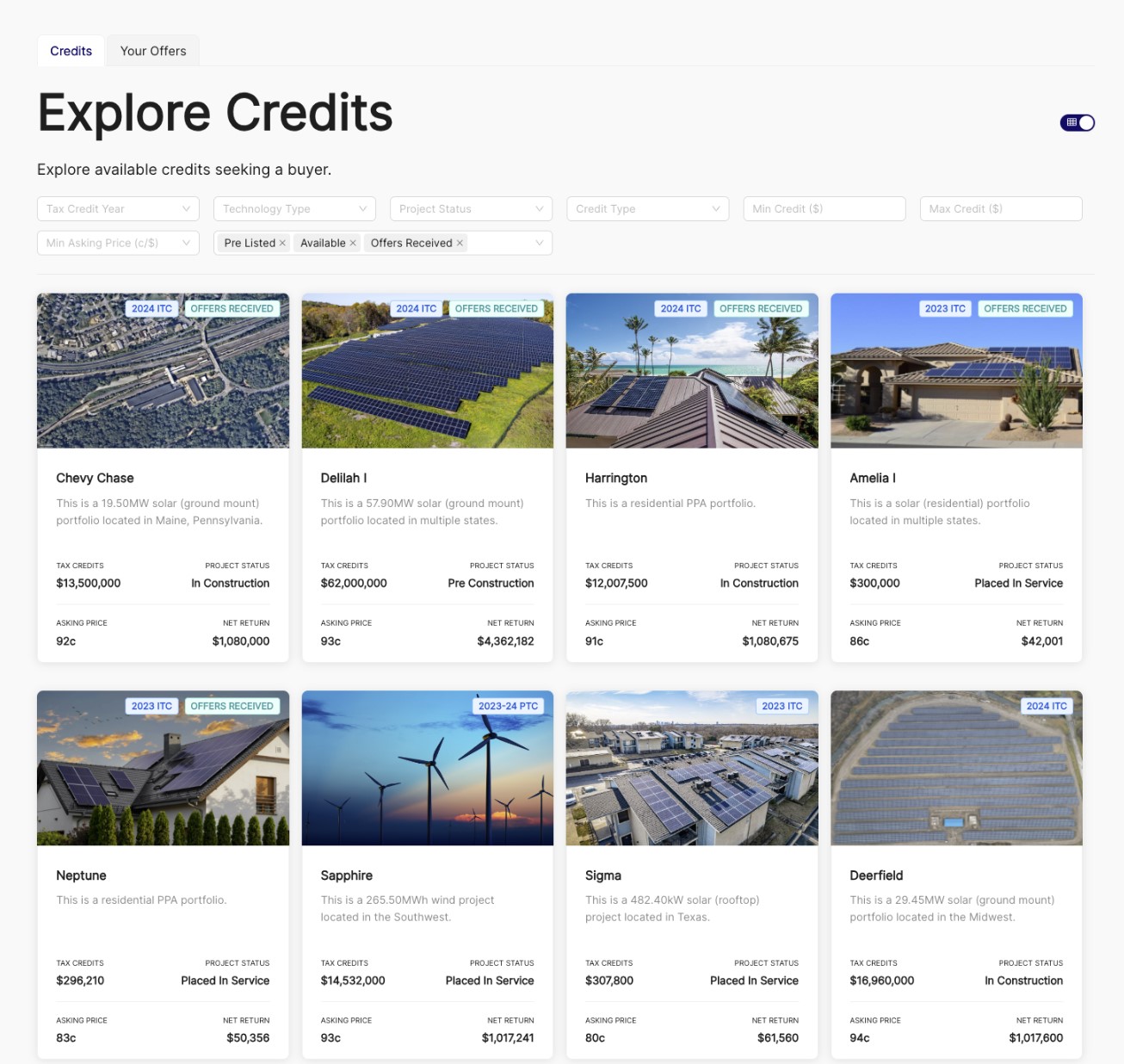

Source: Basis Climate’s on-line portal

Basis Climate, an internet-based tax credit score switch platform, has closed practically $250 million in offers and boasts a $2 billion pipeline of varied applied sciences, together with photo voltaic, power storage, renewable pure fuel, wind, and electrical car charging. Last month, the corporate managed greater than $50 million in time period sheets and gives, with greater than $70 million in signed offers progressing towards closing.

ITC’s $600,000 Basis Climate mission is partnering with WeWould Solar, a purpose-built entity that gives further energy to on-site agricultural processing in Gainesville, Florida. The mission is for a net-metered, behind-the-meter solar energy initiative inside the utility area managed by Clay Electric Cooperative. The transaction happened by means of the Basis Climate web site, the place ITC was acquired by Creditable Capital.

Derek Silverman, co-founder and chief product officer of Basis Climate, shares insights pv journal USA.

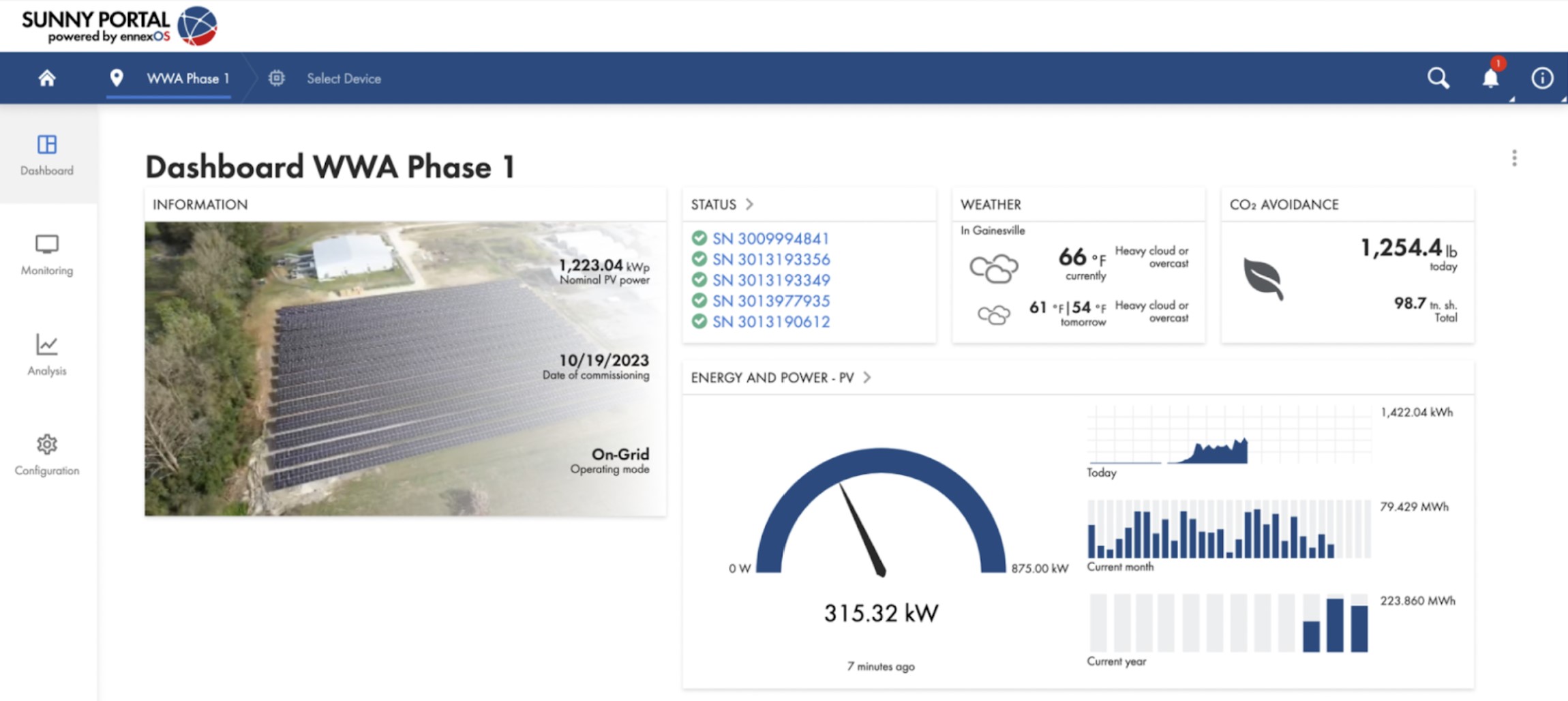

The mission is ready for improvement in three phases, every anticipated to be 1.2 MW. In explicit, for the reason that preliminary part is under 1 MWac, it’s exempt from the earlier wage or apprenticeship necessities. The set up will use SMA Sunny High Power PEAK3 inverters, Canadian Solar bifacial BiHiKu 425 W modules, and TerraSmart’s Glade Wave racking.

Source: WeWouldSolar power monitoring dashboard

Creditable disclosed that it underwrites ITC switch transactions concentrating on a ten% to fifteen% return on funding, internet of charges and bills, for its traders. For a $600,000 transaction, with restricted data accessible, returns on this vary counsel that Creditable Capital pays roughly 85 to 87 cents on the greenback. This cost charge is on the decrease finish of the business common vary, the place 90 to 95 cents on the greenback is typical for bigger solar energy tasks involving investment-grade asset house owners and complicated improvement and development firms.

First Solar, then again, obtained 97 cents on the greenback when it bought manufacturing tax credit.

Risk administration

Silverman emphasised that mission due diligence consists of roughly 20 key areas, together with organizational paperwork, mission design, development plans, operational methods, insurance coverage placement, and valuation and qualification of mission. Completing these core areas early helps Creditable Capital focus on increased danger elements, resembling figuring out the mission’s feasibility and mitigating restoration dangers, which embody the chance of getting to repay the mortgage. tax advantages if the mission fails to adjust to regulatory necessities.

For tasks the place asset house owners lack a stable monetary basis, consumers typically get hold of tax insurance coverage to guard towards the chance of repossession. This insurance coverage additionally supplies a monetary security internet, often called backstop indemnity, if the mission’s liabilities exceed its property. In the case of Creditable, the monetary ensures offered by the asset proprietor are adequate, eliminating the necessity for tax insurance coverage. However, if sellers lack a powerful stability, consumers can normally get hold of tax insurance coverage to make sure complete safety.

Adam Stern, founding accomplice of Creditable Capital, commented on their funding technique, saying:

The creditable turns into extra comfy with the funds in some unspecified time in the future in time after finishing the due diligence with the maintain for registration with the IRS. Creditable, by means of traders and relationships with monetary establishments, works to offer bridge loans to tasks that it purchases credit for.

A remaining danger in these transactions is how the IRS requires consumers and sellers to confirm elements of the deal, resembling figuring out foundation.

Determining the suitable ITC is a fancy course of as a result of US Internal Revenue Service’s (IRS) detailed and evolving definitions of what constitutes an eligible mission ‘foundation’. For instance, important infrastructure resembling fences and roads, that are required by code for mission deployment, aren’t thought-about a part of the eligible foundation, subsequently don’t qualify for the 30% ITC. Similarly, interconnection prices have been excluded till latest adjustments underneath the IRA, which now permit tasks under 5 MWac to incorporate these prices of their ITC calculations.

In the standard tax fairness market, ITC consumers should display important involvement in photo voltaic tasks, take important operational and improvement dangers, and safe long-term revenue from these mission flows to them by means of complicated monetary preparations. Some of the necessities have been relaxed, though due diligence and accountable funding practices stay important.

A group photo voltaic mission developed by Wunder Power in Maryland, a part of an ITC sale facilitated by Basis in 2023. Image: Habitual Climate.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].