[ad_1]

From pv journal 06/24

In Germany, three-digit progress charges illustrate the latest curiosity in large-scale battery techniques. The Federal Network Agency (Bundesnetzagentur) has registered 169 websites bigger than 1 MW, the oldest since 2014. They have 1.26 GW output and 1.43 GWh capability.

The Norwegian firm Eco Stor AS and the German subsidiary Eco Stor GmbH plan so as to add 1.4 GWh in simply three initiatives. Eco Stor plans 300 MW/600 MWh batteries within the southwestern state of Rhineland-Palatinate and in Saxony-Anhalt, within the northeast. A 100 MW/200 MWh battery can be situated within the northern state of Schleswig-Holstein. The firm desires 20% of the rising market, with the Bundesnetzagentur monitoring 123 initiatives with an output of 1.55 GW and a pair of.4 GWh of capability within the starting stage.

Others are not on time however with many bulletins anticipated by 2024, Germany expects a 190% improve in vitality storage capability from deliberate and unbuilt batteries.

Storage capability ratios are rising, too, from the everyday 1:1.1 output-to-capacity determine to 1:1.6. Today’s “one-hour,” 1:1 batteries generate most of their income from avoiding grid expenses and even small grid modifications inside seconds, in a service generally known as which is “major vitality management.” The latter, nevertheless, is simply concerned in tenders for round 555 MW of battery output capability and avoids the earnings of the grid price not paid for the websites commissioned since January 1, 2023.

Two hour development

Large batteries can take part in vitality markets forward of the day and the five-minute lead-time steady intraday market. Electricity transmission system operators (TSOs) additionally pay for secondary vitality balancing companies, which can be found inside 5 minutes, as a substitute of major vitality management.

However, “if I solely do intraday sooner or later, I would like to do a two-hour storage system,” stated Hans Urban, renewables advisor at Eco Stor.

Wider purposes for longer-term storage and the rise in renewable vitality era result in the necessity for regulatory measures, and batteries working within the simultaneous short-term markets should be effectively managed. “That’s the purpose the place individuals within the electrical energy market are available with their enterprise,” Urban added.

They determine, for instance, whether or not a gas-fired plant ought to cowl short-term demand and when a pumped storage plant will soak up and launch vitality. With the appearance of huge batteries, these choices are extra sophisticated and sooner.

Electricity is normally offered in models of 100 kW. Each of the ten models provided with a megawatt-capacity battery can provide major vitality management within the morning, secondary vitality management at midday, after which be used sooner or later market. German tenders for vitality balancing normally have four-hour slots, however 15-minute slots can be found, relying on sub-markets and buying and selling platforms.

Software, not individuals

Munich-based Entrix usually quotes 200 trades per megawatt per day. That’s 20,000 trades per day for a 100 MW battery. Not surprisingly, that requires software program as a result of the transactions, as Urban says, “are so quick that they can not be executed manually.”

It could also be that “plenty of buying and selling within the electrical energy market remains to be executed manually,” in line with Bastian Hechenrieder, head of product growth at Entrix, however the aim is to completely automate the capabilities of the storage market. battery with an algorithm that displays related markets across the clock and makes buying and selling choices. As a end result, firms are actually providing to promote battery storage as a service.

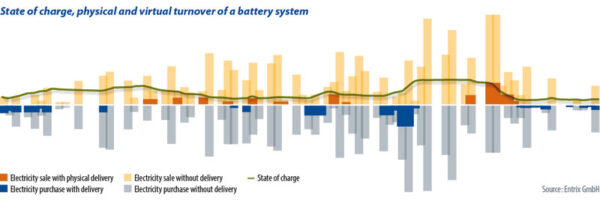

Those nervous about battery degradation could also be alarmed by the big variety of transactions concerned however the day of promoting a big battery is comparatively leisurely, normally with two full cycles per day. Most trades do not have an effect on the battery in any respect. As with some transactions on the inventory change, revenue is made just by the truth that a specific product has a cheaper price on the time it’s purchased than at one other time it’s resold.

The basic distinction to high-frequency buying and selling within the inventory change is that everybody concerned can profit from algorithm-driven buying and selling within the electrical energy market. As Urban factors out, arbitrage operators “concurrently dampen value fluctuations the place they really achieve.” The electrical energy market operates on the precept of provide and demand. If electrical energy is ample, and due to this fact low-cost, merchants can be comfortable to purchase, which is able to stabilize the value once more. When electrical energy is scarce, and due to this fact costly, everybody desires to earn a living and extra presents trigger costs to drop.

Almost digital

The artwork of a well-written algorithm is to finish as many trades as potential the place battery storage doesn’t must be actively used. At Entrix, that is known as “digital buying and selling.”

For digital buying and selling, it will be important {that a} dealer also can execute the transaction that’s at present pending. If they agreed to ship one megawatt hour and so they cannot purchase it in good time at an advantageous value, they need to nonetheless honor the settlement. This massive variety of quickly altering choices constitutes a big a part of the work of merchants. Lennard Wilkening, CEO of Hamburg-based startup Suena, stated that he’s typically requested if the proportion of digital trades will be counted on the fastened value. That’s not simple, he stated, as a result of the vary is “three to 10 instances what bodily goes via the battery.” With returns generated by a big storage facility, the proportion of all these trades is decrease, because of decrease margins.

In Entrix, the non-physically recognized a part of the buying and selling quantity can comprise “greater than 90%.” Despite the low margins, this is a crucial assertion for buyer acquisition, as a result of the battery solely serves as a backup. It earns its cash in its “sleep,” so to talk, and due to this fact trades haven’t any impact on the battery itself by way of battery injury. It can be vital {that a} battery be cycled as slowly as potential. Entrix’s Hechenrieder defined that there are “completely different levels of freedom” that depend upon a producer’s particular guarantee situations, native situations, and a battery operator’s specs.

Commercial storage

The potential for storage techniques beneath the 1 MW threshold to make use of automated buying and selling is at present being examined by Levl Energy, a by-product from Enpulse Ventures, which is a subsidiary of the German vitality firm EnBW set as much as promote the vitality startup.

The Levl idea is centered on industrial storage techniques with a capability of a number of dozen to a number of hundred kilowatt-hours. These ought to proceed to satisfy their unique objective of peak load capping or optimizing self-consumption with out restriction. The software program developed by Levl permits industrial storage models to be built-in into the community with out further {hardware}.

As the working time will increase, the calculations turn out to be extra correct. In this manner, and aggregated in a balancing group, industrial batteries will be instantly transferred to a dealer and used for arbitrage transactions. Levl can, due to this fact, bridge the hole between firms comparable to Suena, Entrix, and different battery entrepreneurs and industrial storage operators. The search is now for cooperative grid operators.

The variety of events concerned in multi-layered and quick electrical energy gross sales from battery storage techniques will be enormously elevated by gamers like Levl. The necessities for software program used on this market couldn’t be easier however the business is powerful. Suena CEO Wilkening stated that there ought to nonetheless be “an choice for handbook intervention,” not just for technical causes, but additionally when there’s a worthwhile buying and selling alternative that’s not acknowledged by the algorithm. – paradoxically, with the intention of stopping this from taking place. within the first place.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link