[ad_1]

Unfortunately for some shareholders, the Shanghai Aiko Solar Energy Co., Ltd. (SHSE:600732) share value has fallen 29% within the final thirty days, extending the latest ache. For any long-term homeowners, final month ended a 12 months to overlook by locking in a 69% drop within the share value.

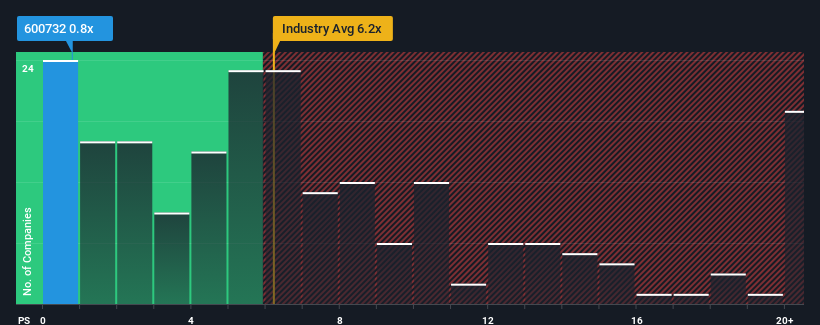

After a heavy value fall, Shanghai Aiko Solar EnergyLtd could also be sending very sturdy alerts proper now with a price-to-sales (or “P/S”) ratio of 0.8x, as nearly half of all firms within the Semiconductor business. in China there are P/S ratios larger than 6.2x and even P/S larger than 11x will not be uncommon. However, it’s unwise to easily take P/S at face worth as there could also be an evidence as to why it’s restricted.

Check out our newest evaluation for Shanghai Aiko Solar EnergyLtd

How Shanghai Aiko Solar Energy Ltd. Performed

Shanghai Aiko Solar EnergyLtd may do higher as its earnings have been pulling again currently whereas most different firms have seen constructive earnings progress. The P/S ratio might be low as a result of buyers assume this poor earnings efficiency is not going to get higher. If you want the corporate, you hope this is not the case so you’ll be able to decide a inventory whereas it is out of favor.

Want to know what analysts assume the way forward for Shanghai Aiko Solar EnergyLtd will likely be in opposition to the business? In that case, ours free The report is an effective place to begin.

Is There Forecasted Earnings Growth For Shanghai Aiko Solar EnergyLtd?

The solely time you might be snug seeing a P/S as depressed as Shanghai Aiko Solar EnergyLtd’s is that if the corporate’s progress is on monitor to lag the business.

In retrospect, final 12 months delivered a disappointing 37% decline within the firm’s high line. However, some very sturdy years earlier than that meant it nonetheless managed to develop income by a formidable 102% total over the previous three years. Although it has been a bumpy trip, it is nonetheless truthful to say that income progress just lately has been greater than sufficient for the corporate.

Moving to the longer term, estimates from eight analysts protecting the corporate counsel that income ought to develop by 51% subsequent 12 months. That’s materially larger than the 35% progress forecast for the broader business.

Because of this, it’s outstanding that Shanghai Aiko Solar EnergyLtd’s P/S sits beneath most different firms. It appears that almost all buyers usually are not satisfied that the corporate will meet future progress expectations.

What Does Shanghai Aiko Solar EnergyLtd’s P/S Mean For Investors?

Shanghai Aiko Solar EnergyLtd’s P/S seems as weak as its inventory value currently. We can say that the facility of the price-to-sales ratio will not be primarily as a valuation instrument however to measure present investor sentiment and future expectations.

A take a look at Shanghai Aiko Solar EnergyLtd’s earnings reveals that, regardless of glowing future progress forecasts, its P/S is decrease than we anticipated. The cause for this depressed P/S might be discovered within the dangers priced available in the market. At least the worth dangers look very low, however buyers appear to assume that future earnings will see a variety of volatility.

It can be value noting that we discovered 1 warning signal for Shanghai Aiko Solar Energy Ltd which you must contemplate.

bother, worthwhile firms with a historical past of considerable earnings progress are usually safer bets. That’s why you need to see it free assortment of different firms with cheap P/E ratios and robust earnings progress.

Valuation is sophisticated, however we assist make it easy.

Find out if Shanghai Aiko Solar Energy Ltd be overvalued or undervalued by checking our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Check out the Free Analysis

Have suggestions about this text? Worried about content material? Contact with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This Simply Wall St article is normal in nature. We present commentary based mostly on historic knowledge and analyst forecasts utilizing solely an unbiased strategy and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t have in mind your objectives, or your monetary state of affairs. We goal to carry you long-term centered evaluation pushed by elementary knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any of the shares talked about.

Valuation is sophisticated, however we assist make it easy.

Find out if Shanghai Aiko Solar Energy Ltd be overvalued or undervalued by checking our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Check out the Free Analysis

Have suggestions about this text? Worried about content material? Contact us instantly. Alternatively, electronic mail [email protected]

[ad_2]

Source link