[ad_1]

In the brand new weekly replace for pv journalOPIS, a Dow Jones firm, offers a fast overview of the principle value tendencies within the international PV trade.

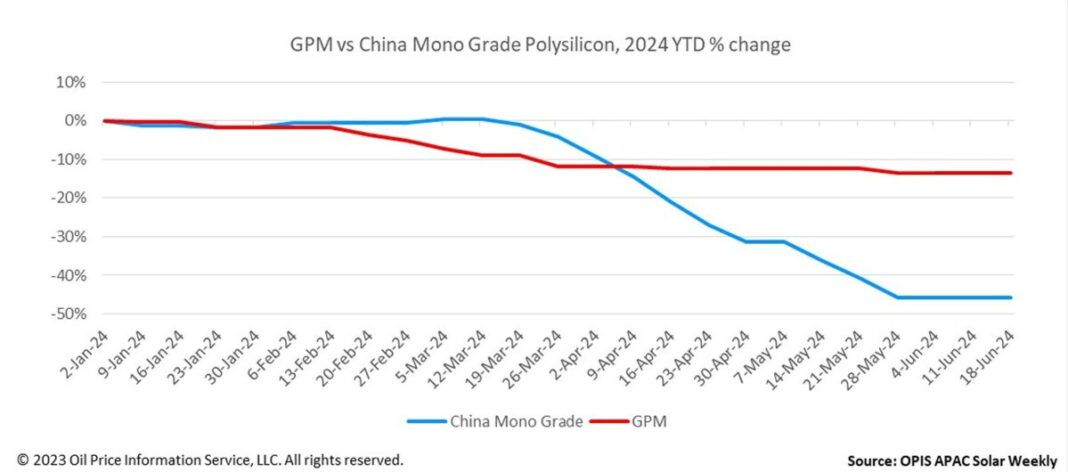

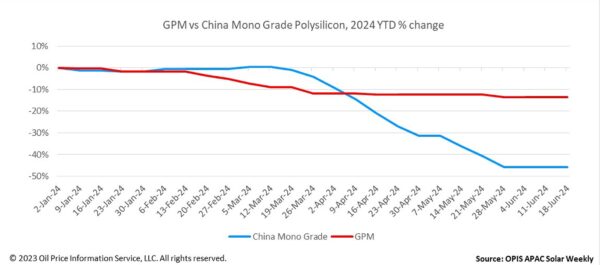

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon exterior China, assessed at $22.567/kg this week, unchanged from final week on the again of buy-sell indicators heard. The value has remained steady for 4 consecutive weeks.

According to a supply accustomed to the polysilicon market exterior of China, the worldwide polysilicon commerce state of affairs within the space markets is at the moment largely stagnant, with consumers ready for the preliminary order. from anti-dumping and countervailing investigations within the US anticipated in July.

A serious international polysilicon purchaser reported receiving spot costs from some distributors that had been decrease than long-term contract costs for related specs. However, because of the uncertainty of the US commerce coverage, they shunned inserting an order.

This info was confirmed by a worldwide polysilicon provider, who expressed concern: “We are apprehensive in regards to the accumulation of stock.”

However, there are optimistic voices remaining available in the market, with sources reporting continued optimistic gross sales experiences. One of the sources defined that the photo voltaic provide chain has three completely different supply-demand relationships: between polysilicon and wafers, wafers and cells, and cells and modules.

“It is argued that making use of the present pessimism from the module market to the worldwide polysilicon market is unreasonable,” the supply added. “Only the connection between polysilicon and wafers has immediately influenced international polysilicon pricing, which has confirmed steady with out notable adjustments.”

China Mono Grade, the OPIS evaluation for polysilicon costs within the nation, remained regular at CNY33 ($4.54)/kg this week, marking the fourth consecutive week of stability.

Market individuals typically imagine that the present costs of polysilicon don’t want additional discount, as a result of it doesn’t stimulate gross sales. Wafer firms are constrained by their working charges and money stream, limiting their means to speed up polysilicon purchases. “We are at the moment dealing with a lack of roughly 0.20 yuan for each bit of wafer produced,” disclosed a significant wafer producer.

Multiple sources have confirmed that whereas almost all polysilicon factories in China are present process tools upkeep, manufacturing cuts, or shutdowns, one main producer is working at full capability with a 100% utilization charge. operation.

As a consequence, this firm suffered a month-to-month lack of CNY600-700 million within the polysilicon manufacturing section, a supply commented, noting that because of the manufacturing unit’s massive manufacturing capability, the -operating at full capability will maintain polysilicon stock ranges excessive, which isn’t assured. on the prospects for polysilicon costs.

Sources indicated that along with working at full capability, the corporate’s new manufacturing capability can be progressing as scheduled. This technique emphasizes the corporate’s robust money stream and its intention to make use of its expanded capability and price benefits to slender the survival house of small firms within the ongoing value battle.

According to an trade observer, the present state of affairs of promoting polysilicon at a big lack of cash is unsustainable. By the tip of the 12 months, costs are anticipated to stabilize barely above the typical value of cash available in the market, the supply stated, who additional expects that at that time, some extra manufacturing capability, particularly already high-cost or outdated amenities, are more likely to be successfully eradicated.

OPIS, a Dow Jones firm, offers vitality costs, information, knowledge, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. . It acquired pricing knowledge property from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the writer, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link