[ad_1]

First Solar (NASDAQ: FSLR), a worldwide photo voltaic power options supplier headquartered in Arizona, is a low-cost AI beneficiary that has been ignored by the market to date. FSLR inventory rose greater than 30% between May 20 and 22 based mostly on two information objects. First, UBS (NYSE:UBS) recognized the corporate as a significant winner in AI-driven electrical energy demand. Second, China has pledged to help the photo voltaic business by ending a value warfare that has affected the sector’s profitability. I’m bullish on FSLR inventory, as I imagine the projected progress isn’t but precisely mirrored in its valuation.

The AI Opportunity

The rise of generative AI has put monumental stress on international electrical grids as a result of AI purposes require giant quantities of power to function. According to a research performed by Dr. Alexandra Sasha Luccioni, AI and Climate Lead at Hugging Face, generative AI methods use roughly 33 occasions extra power than computer systems working task-specific software program purposes.

According to knowledge from the International Energy Agency, the world’s knowledge facilities will use 460 terawatt hours of electrical energy in 2022 and can use greater than 1,000 hours of electrical energy in 2026, rising quickly on account of elevated utilization in AI. According to the findings of the IEA, this projected electrical energy consumption of information facilities might be equal to the consumption of Japan with a inhabitants of 125 million.

A fast have a look at the power consumption tendencies of main AI corporations confirms that energy consumption has elevated because of AI funding. For instance, Microsoft (NASDAQ:MSFT), in its Environmental Sustainability Report for 2023 revealed earlier this month, revealed that carbon emissions have elevated by virtually 30% since 2020, primarily pushed by the development of latest knowledge facilities to help AI expertise .

The AI alternative for First Solar arose because of carbon-neutral objectives promised by governments and multinational corporations amid the rise of AI. The US, for instance, has pledged to cut back carbon emissions by not less than 50% in comparison with 2005 ranges by 2030. Microsoft, alternatively, has pledged to develop into carbon-negative by 2030. The firm additionally has an formidable purpose. to take away all of the carbon emitted by the corporate since its founding in 2050.

Apple (NASDAQ:AAPL) additionally promised to be carbon impartial for its provide chain and merchandise by 2030. Due to the big enhance in electrical energy consumption on account of AI, giant corporations investing in AI might be compelled to acquire energy from sustainable sources, and First Solar will be seen as one of many greatest winners of this anticipated growth.

Investing for Growth

First Solar is investing to broaden its manufacturing capability within the US to satisfy the anticipated enhance in demand for solar energy. During the Q1 earnings name earlier this month, the corporate mentioned enlargement plans in Ohio, Alabama, and Louisiana.

The firm can also be centered on growing superior photo voltaic expertise to enhance price effectivity and, thus, revenue margins. For instance, First Solar plans to launch a perovskite growth line and a brand new innovation heart within the second half of this yr.

China Delivers Good News for FSLR Stock

On May 22, Chinese regulators promised to crack down on the sale of photo voltaic tools materials at low costs, which is sweet information for established photo voltaic corporations. Due to the rising variety of photo voltaic tools producers, the previous few years have seen a building of producing services, resulting in an oversupply out there. Solar corporations have been pushing the Chinese authorities to intervene for months with the hope of wiping out corporations which have undercut the market.

First Solar, as a longtime international participant, will profit from the Chinese authorities’s choice to behave to finish pricing wars within the photo voltaic sector.

Is First Solar Stock a Buy, According to Analysts?

On May 21, UBS analysts Jon Windham and William Grippin claimed that First Solar will profit from energy buy agreements with main tech corporations, as these tech giants have promised to -bank of renewable power sources to produce their elevated electrical energy consumption within the AI period. . Analysts are guiding for robust earnings per share progress for First Solar, from $7.74 in 2023 to $36.74 in 2027. UBS raised its value goal for First Solar to $270 from at $252 and saved its Buy score.

Piper Sandler analyst Kashy Harrison adopted go well with by elevating his value goal on First Solar to $219 from $195. Additionally, JPMorgan (NYSE:JPM) lately raised its value goal from $240 to $262 and maintained a Buy score, whereas Susquehanna issued a value goal of $258 after together with projected AI-induced demand for renewable power. Roth Capital Markets analyst Philip Shen additionally believes First Solar might be a key beneficiary of the rising AI sector.

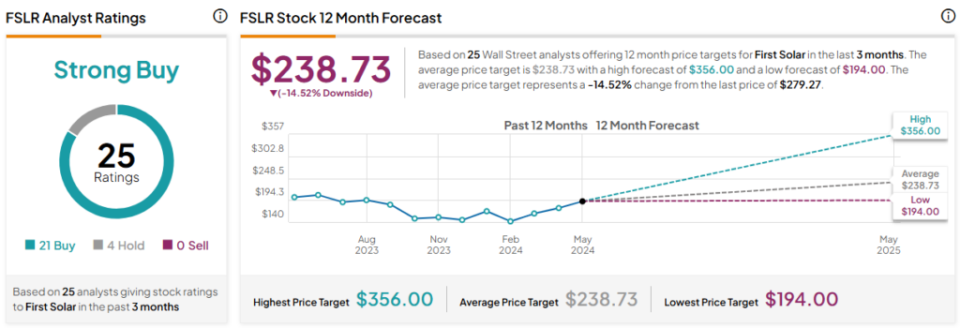

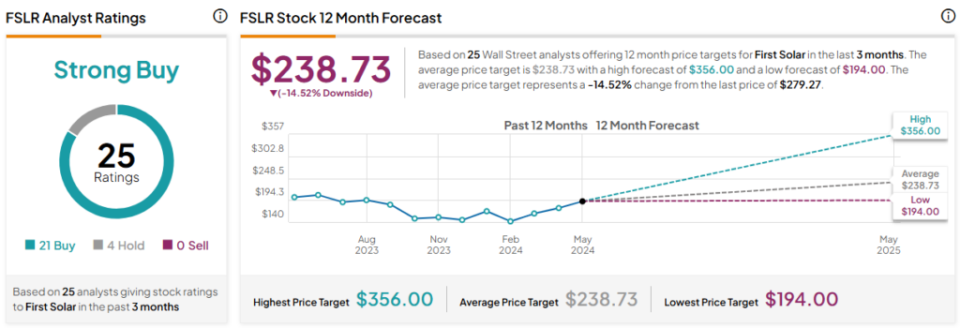

In common, based mostly on the scores of 27 Wall Street analysts, the typical FSLR inventory value goal is $238, which implies a draw back danger of 14.5% from the present market value.

Although analyst value targets recommend that investing in First Solar is a dangerous guess proper now, latest upgrades point out that the typical value goal could proceed to rise within the close to future. This expectation is predicated on the corporate’s favorable positioning within the renewable power market and its potential to profit from elevated electrical energy demand.

First Solar is at the moment valued at a ahead P/E of simply 20x, making it cheaply valued, as analysts mission a fivefold enhance in earnings per share by 2027.

The Takeaway: The First Solar is Cheap and Attractive

First Solar is effectively positioned to seize the rising demand for electrical energy arising from the rise of AI expertise. The firm appears cheaply valued out there and up to date upgrades from Wall Street analysts will probably act as a catalyst pushing the inventory value greater. China’s pledge to help the photo voltaic sector by concentrating on price-cutting suppliers can even add gas to the latest momentum behind First Solar’s inventory.

disclosures

[ad_2]

Source link