[ad_1]

BloombergNEF mentioned in a brand new report that it expects clear hydrogen provide to extend 30-fold to 16.4 million metric tons (MT) per 12 months by 2030, pushed by coverage assist and a maturing venture pipeline. However, it says governments around the globe will nonetheless fall wanting their targets, and most initiatives will probably be stopped or delayed.

“Most of the initiatives introduced in 2030 wouldn’t have the mandatory situations now that, in our opinion, they are going to be profitable and obtainable. [final investment decisions]”mentioned Adithya Bhashyam, lead writer of the report. pv journal. “The majority of electrolysis initiatives in our forecast, 60%, are nonetheless within the early phases of planning; they haven’t but finished detailed engineering research, and many others. They actually depend on the implementation of insurance policies to proceed .”

In its bottom-up evaluation, BloombergNEF mentioned it expects solely 30% of the 1,600 initiatives introduced to this point to truly materialize by 2030. It claims the remaining 70% will probably be delayed or canceled, on account of low demand. for hydrogen.

The introduced initiatives will produce 64.6 MT. According to BloombergNEF’s “Hydrogen Supply Outlook” report, the 477 initiatives more likely to proceed will produce 16.4 MT. The present grey hydrogen demand stands at 95 MT.

Image: BNEF

Green hydrogen initiatives are the newest.

“Electrolyzer initiatives will considerably decrease the federal government’s targets for electrolysis deployment,” Bhashyam mentioned. “Government targets for the deployment of electrolysis add as much as 114 GW at a nationwide degree. If you add the EU goal to supply 10 MT of hydrogen domestically, which means one other 120 GW. So we are saying by way of electrolysis capability, together with the EU, they may miss their targets by greater than half. There is a giant hole between ambitions and actuality.”

BloombergNEF mentioned it expects electrolysis capability to be based in China, with 37% of world capability, adopted by Europe with 27%. However, the put in capability of electrolysis doesn’t meet the guarantees of the world, primarily due to the low demand for inexperienced hydrogen from the worldwide financial system. As such, the manufacturing capability of the electrolyzer is extra consistent with the inexperienced hydrogen targets.

“The stack meeting capability for electrolyzers worldwide introduced by builders might attain 54 GW by the tip of 2024, which is able to improve to greater than 70 GW by the tip of 2025. Most of those suppliers, particularly in Western markets, cannot present this nameplate. capability as a result of they do not have an upstream provide chain,” Bhashyam mentioned. “But, should you add an enormous low cost to the out there manufacturing capability, we now have one a state of affairs of oversupply.”

Green, blue, grey

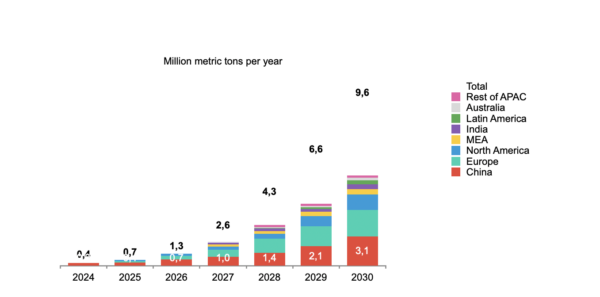

BloombergNEF says inexperienced hydrogen manufacturing ought to attain 9.6 MT per 12 months by 2030, with blue hydrogen hitting 6.8 MT. The world blue hydrogen targets will not be very formidable, however these initiatives are actually rather more superior than the manufacturing of inexperienced hydrogen.

“About 95 GW of electrolyzers will probably be out there by the tip of 2030, nearly 10x the capability that was already previous the final funding choice at present,” BNEF mentioned. “About 40% of this 95 GW has handed [final investment decision] or upfront planning in comparison with 60% for all low-carbon [hydrogen] provide, which reveals the low maturity of electrolysis initiatives in relation to blue [hydrogen].”

The report states that a lot of the predicted electrolyzer capability (~58 GW) is pushed by introduced insurance policies and, subsequently, continues to be topic to coverage implementation uncertainty.

The United States is more likely to lead the blue hydrogen market. The world’s main financial system ought to grow to be the most important producer of low-carbon hydrogen by 2030, accounting for round 37% of world provide, most of which is blue. The US market is anticipated to be left behind by Europe and China till 2027, however will conquer each areas by 2028.

Bhashyam mentioned Germany is much less reluctant to undertake blue hydrogen. Europe’s main financial system is coordinating its power insurance policies with future exporters comparable to Australia and Canada.

“The blue hydrogen initiatives are fairly superior, having nearly acquired an FID and all the mandatory engineering research have been accomplished,” Bhashyam mentioned.

He added that not all low-carbon hydrogen will substitute grey hydrogen.

“There are new makes use of for low-carbon hydrogen, as a gasoline for ships or steelmaking, for instance,” he mentioned.

The report says governments are more likely to miss their mixture 2030 hydrogen demand targets by almost two-thirds on account of inadequate coverage assist. China, Europe, and the United States can account for greater than 80% of low-carbon hydrogen. Latin America and Australia are anticipated to play a minor position within the world low-carbon hydrogen market till 2030.

“Export markets comparable to Latin America wouldn’t have sturdy insurance policies for the native use of hydrogen. Now they’ve a big venture pipeline proposed, export, however we wouldn’t have will see sufficient demand from importers for many of those initiatives to proceed in 2030,” mentioned Bhashyam, including that markets like Canada are in a greater place, because of the subsidy on export initiatives. .

Main dangers

BloombergNEF says it sees two key uncertainties: the deployment of hydrogen in China and the eventual change in introduced insurance policies, particularly because of the upcoming elections.

“The BNEF outlook accounts for delays in coverage however main modifications in introduced applications, such because the renewal of the U.S. [Inflation Reduction Act] Tax credit after the presidential election in November will have an effect on this forecast,” the corporate mentioned. “New insurance policies or superior initiatives that don’t take FID can even change the outlook of BNEF.”

Bhashyam famous that the upcoming European elections might additionally have an effect on inexperienced hydrogen initiatives, however to a lesser extent.

“The deployment in Europe could be very sturdy in our view because of the introduced insurance policies proposed by Europe on the EU degree, but additionally on the member-state degree. In phrases of electrolysis, a lot of our forecast in Europe is predicated the truth that the introduced auctions for hydrogen manufacturing proceed to happen,” mentioned Bhashyam, including that modifications in these auctions might change the tempo of inexperienced hydrogen adoption in Europe.

This content material is protected by copyright and will not be reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link