[ad_1]

Global photo voltaic demand will proceed to develop in 2024, with module demand more likely to attain 492 GW to 538 GW. Amy Fanga senior analyst at InfoLink, appears at module demand and provide chain inventories in a market nonetheless affected by oversupply.

From pv journal 05/24

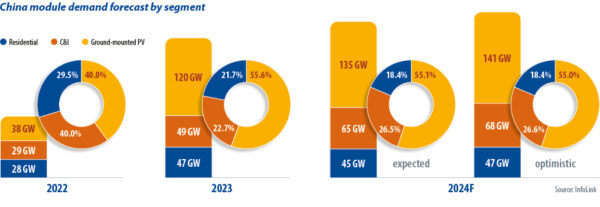

China’s photo voltaic market has witnessed speedy progress in demand over the previous two years. The excessive worth of the PV module in 2022 hinders the deployment of very small utility scale tasks, “distributed technology” (DG) tasks that make up round 60% of the market. Following provide chain points, module costs started to fall in 2023, driving utility-scale tasks to produce 55% of the market within the fourth quarter as DG photo voltaic matured.

In 2024, China’s module demand will attain 245 GW to 255 GW, rising 7% to 11% in 2023. Growth has slowed however the market remains to be massive. According to the National Energy Administration, China added 36.7 GW of photo voltaic in January 2024, and February 2024, up from 20 GW in January 2023 and February 2023. Ground-mounted tasks boosted the market after the 2024 lunar new yr vacation. .

Some provinces are limiting grid connections for DG tasks within the second half of 2023 and InfoLink believes the house photo voltaic market will sluggish in 2024. A nationwide 5% cap on photo voltaic and wind energy curtailment eased however a rise in curtailment will inject uncertainty into new challenge returns and grid capability is lagging behind photo voltaic demand.

The authorities’s Regulatory Measures for the Whole Purchase of Grid Enterprises in Renewable Energy Electricity Legislation categorizes renewable power tasks linked to the grid into these with assured portions of fresh electrical energy purchases and people topic to gross sales available in the market for his or her electrical energy, which impacts the return of the challenge. Long-term demand is estimated conservatively and a few DG end-users have canceled their plans.

Businesses searching for price reductions might drive China’s industrial and industrial photo voltaic share by 2024. Ground-mounted PV will depend upon grid connections, though provincial guidelines for agrivoltaics, fishery PV, and floating photo voltaic ready.

While InfoLink expects no new polysilicon manufacturing capability within the first quarter of 2024, producers corresponding to Yongxiang, Daqo, and GCL are scheduled to fee new strains in late June 2024 and the output within the second quarter might hit 250 GW to 255 GW, together with extra. 79 GW to 80 GW in April 2024 and 84 GW to 85 GW in May 2024. Despite some producers set to postpone poly strains, gross sales stress and stock pileup are seemingly.

Monthly wafer manufacturing of 65 GW to 68 GW within the second quarter will drive quarterly output of 200 GW to 205 GW. Some producers plan to cut back output in April 2024 however vertically built-in producers proceed to scale manufacturing to take care of line operations and feed their cell and module companies.

Cell manufacturing is predicted to achieve 200 GW to 210 GW throughout the second quarter, with month-to-month output of negatively-doped, “n-type” merchandise set to hit 69 GW to 71 GW in April. and May 2024. Shipments grow to be tough from late March 2024 as module makers attempt to stop price reductions. Some module corporations might have lower cell purchases by doubling distribution in April 2024.

With greater than 60 GW of month-to-month module manufacturing capability in China, tier-1 producers who can not scale back costs can scale back shipments. Tier-2 suppliers have reasonable plans for 170 GW to 175 GW tasks per quarter and will scale back manufacturing.

Regarding inventories, polysilicon reached a historic excessive of greater than 20 days of inventory available on the finish of March 2024 and the quantity will proceed to rise. Wafer inventories are virtually half a month in hand and will start to slowly decline from late April 2024, because of manufacturing cuts. Cell and module inventories are a wholesome seven days and one to 1 and a half months available, respectively, together with transit inventory.

Competitive pricing

Overall, competitors within the module sector is rising in 2024, set in opposition to a backdrop of excessive stock ranges all through the availability chain, extra manufacturing capability, and reasonable demand progress. The continued fall in module costs implies that InfoLink expects premiums for passivated tunnel oxide contact merchandise to slim and even result in comparable costs for n-type and older, optimistic doped “p-type” modules in some tasks.

If the appliance of laser-enhanced contact optimization matures and replaces encapsulants within the second half of 2024, prices might lower barely, enabling tier-1 costs to hover at CNY 0.85 ($ 0.12) / W to CNY 0.90 / W in China. Meanwhile, intense competitors within the low worth vary might result in a stage decrease than CNY 0.80/W available in the market.

Module costs largely depend upon producer methods in 2024. Given the proof supplied early within the second quarter, module producers appear to have grow to be conservative within the face of low costs and weak income. Module producers might attempt to negotiate greater costs however finish customers, particularly massive prospects, have little tolerance for worth will increase. For consumers, the business hopes to ascertain a rule for adjusting the mannequin of successful auctions with decrease bids, provided that costs have reached the fee stage, and a few tier -2 module producers compete at costs beneath price, jeopardizing order success.

About the creator: Amy Fang is an InfoLink senior analyst specializing in the photo voltaic cell and module a part of the PV provide chain, working throughout worth development forecasting and manufacturing knowledge.

About the creator: Amy Fang is an InfoLink senior analyst specializing in the photo voltaic cell and module a part of the PV provide chain, working throughout worth development forecasting and manufacturing knowledge.

The views and opinions expressed on this article are these of the creator, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and will not be reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link