[ad_1]

In the brand new weekly replace for pv journalOPIS, a Dow Jones firm, gives a fast overview of the primary value developments within the international PV business.

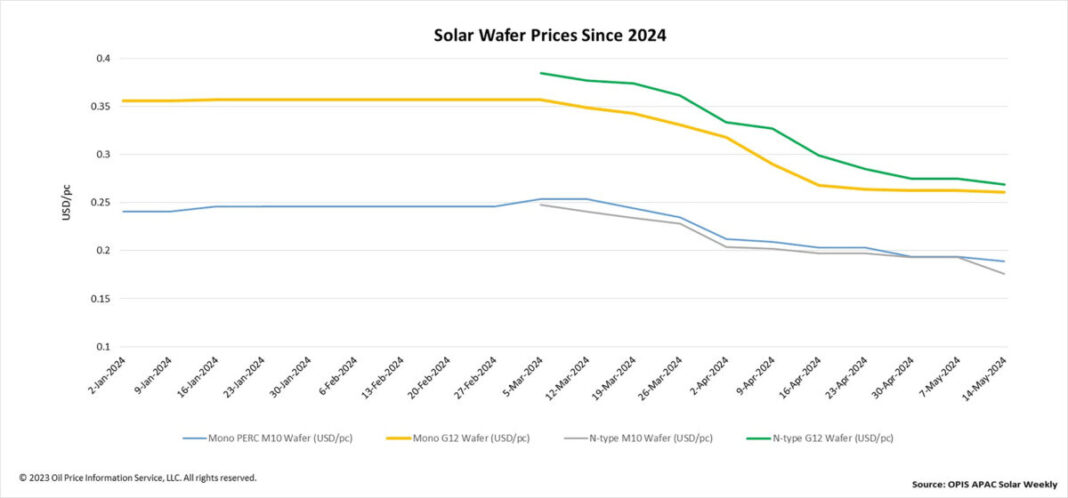

FOB China costs for wafers once more skilled a large decline this week, highlighting the widespread oversupply and the dearth of demand available in the market. Mono PERC M10 and N-type M10 wafer costs decreased by 2.58% and eight.81% weekly, reaching $0.189 per computer and $0.176/computer, respectively.

Similarly, Mono PERC G12 and n-type G12 wafer costs fell 0.76% and a pair of.18% weekly to $0.261/computer and $0.269/computer, respectively.

According to the OPIS market survey, the typical transaction costs of Mono PERC M10 and N-type M10 wafers within the Chinese home market decreased to CNY1.52 ($0.21)/computer and CNY1.41/computer respectively. computer, respectively. An business insider even quoted a transaction value of CNY1.35 for n-type M10 wafers, suggesting the potential path of n-type wafer costs within the close to future.

Wafer stock stays excessive at roughly 4 billion items, equal to about 32 GW and a half of a month’s manufacturing, in accordance with a movement supply. Amid the backdrop of excessive wafer inventories, there have been studies this week of some producers growing their working charges.

“The majority of wafer producers which have elevated their working charges are specialist factories which have obtained OEM orders,” defined one supply.

Within your entire wafer market, crucibles and different superior crystal progress furnace gear reminiscent of graphite warmth zone parts and carbon-carbon composites stand out as the one worthwhile segments. now, in accordance with a market veteran. However, even the costs of those parts have seen a major discount, as a result of diminished capability of wafer producers to bear the prices of auxiliary supplies, the supply stated.

According to a market watcher, the enterprise mannequin of wafer producers presents extra flexibility in comparison with polysilicon producers. They can alter their working charge as wanted, relying on their money place, stock standing, and engagement with the OEM enterprise mannequin. However, because the supply added, vital modifications within the provide and demand panorama should still necessitate the inevitable closure and exit of some wafer factories.

Several photo voltaic producers have just lately revealed their first quarter 2024 monetary studies, sparking loads of curiosity amongst business insiders. According to a market watcher, this curiosity comes from the need to know the views of the working state of affairs of the businesses and to know the components such because the low costs of the merchandise or the prospects of survival of corporations.

The massive wafer makers, regardless of incurring CNY billion in money losses as a result of intensive manufacturing capability, can nonetheless proceed to compete as a result of they’ve a producing value benefit, the supply added.

Another market participant elaborated that it’s troublesome to foretell when some wafer producers will go bankrupt to facilitate the advance of the sample of provide and demand. Factors reminiscent of money movement standing, funding capabilities, and whether or not a wafer firm has a background in state-owned enterprises contribute to the uncertainty surrounding every wafer firm’s survival timeline available in the market. .

In the worldwide market, business discussions revolve across the potential for increasing home manufacturing capability for modules and cells within the US, which might stimulate the nation’s demand for wafers from Southeast Asia. However, a market observer emphasised that vital demand for wafers within the US might solely emerge after cell manufacturing initiatives are established, a course of that sometimes takes 18 to 24 months.

Furthermore, the supply added that many of the wafer manufacturing capability in Southeast Asia is presently owned by vertically built-in producers who primarily use it for their very own cell and module manufacturing throughout the area and infrequently promote to these wafer exterior. Consequently, the supply expects the speedy emergence of enormous wafer manufacturing capability in Southeast Asia within the subsequent two years, given the area’s standing as a mature marketplace for photo voltaic manufacturing.

Recent information releases about manufacturing capability additionally appear to assist this commentary. According to OPIS knowledge from the final two months, there have been a minimum of 5 updates on wafer initiatives in Southeast Asia. This week, it was introduced that US-based SEG Solar has signed a Land Utilization Agreement to construct its built-in PV manufacturing hub, together with a 5 GW wafer manufacturing unit, in Indonesia.

In addition, Singapore-based G-Star introduced on April 30 the beginning of development of a 3 GW ingot/wafer plant in Indonesia. VSUN began manufacturing at its 4 GW wafer manufacturing unit in Vietnam on April 18, whereas Astronergy began manufacturing at its 5 GW wafer manufacturing unit in Thailand on April 15. In addition, Imperial Star introduced on March 16 that the corporate is approaching to begin manufacturing at its 4 GW wafer plant in Laos.

OPIS, a Dow Jones firm, gives power costs, information, knowledge, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. . It acquired pricing knowledge belongings from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the creator, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link