[ad_1]

With an oversupply of photo voltaic modules inflicting a freefall in worth by 2023 and no restoration in sight, market consolidation, stock accumulation, expertise switch, and challenges to renewing PV manufacturing are set which impacts all ranges of the photo voltaic provide chain.

The photo voltaic manufacturing business will consolidate in 2024, after oversupply and declining materials prices drive a downstream worth conflict within the second half of 2023. Small, tier-2 and tier-3 producers with low value module costs will proceed to face unfavourable margins. Tier-1 Chinese producers are additionally affected by the crash in common gross sales costs and are attempting to distinguish themselves from rivals with new merchandise or distinctive costs.

As a consequence, skinny or unfavourable margins will proceed to make 2024 a difficult 12 months for producers, and greater than 75% of the market share held by the ten largest polysilicon, wafer, cell , and module firms are set to develop.

Inventory points

The least diversified photo voltaic distributors and installers are in danger because of price-fall-related write-offs of their intensive inventories, particularly in Europe. By the top of 2023, the full stock of the module in Europe exceeded the installations of the 12 months. Despite extra stock in Europe over the previous two years, there are not any indicators of a pointy decline in shipments from mainland China in 2024.

Manufacturers and distributors are utilizing methods like hearth gross sales, reshipping, and longer fee phrases to cut back stock and assist prospects cope. A current report from S&P Global Commodity Insights predicts {that a} normalization of the European module stock won’t occur earlier than 2025.

Technology switch

Oversupply and skinny producer margins are forcing photo voltaic firms to speed up adjustments in product expertise, corresponding to from the passivated emitter rear cell (PERC) to the tunnel oxide passivated contact (TOPCon) which panels. PERC expertise will probably be phased out by 2025, besides in sure markets.

By 2024, two out of three modules shipped will probably be primarily based on negatively doped, “n-type” expertise. The transition from positively doped, “p-type” to n-type shipments will happen sooner in Europe as a result of warehouses nonetheless have extra p-type imports from final 12 months’s slowdown. that sells. On the opposite, n-type modules have a greater probability to promote on the present worth degree, because of their higher efficiency.

Think in regards to the hole

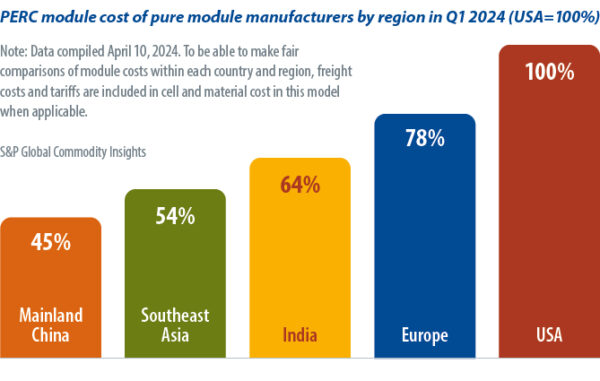

This new oversupply cycle has direct implications for coverage efforts to reshore photo voltaic provide chains within the United States and Europe. Following the decline in module uncooked materials prices, the hole in manufacturing prices has solely widened throughout areas. In the primary quarter of 2024, the common value in mainland China will probably be 45 – when the indexation within the United States is price 100 (see the chart under). A 12 months in the past, China’s prices had been nearer to these of Europe and the United States, at 67.

It is more and more troublesome and costly to construct manufacturing capability in Western nations, jeopardizing ongoing localization efforts and the survival of current native manufacturing bases. Incentives included in home manufacturing packages, such because the US Inflation Reduction Act (IRA), might show inadequate to spice up US photo voltaic manufacturing capability and the competitiveness of home gamers. .

India has emerged as a rustic with aggressive value constructions, permitting the subcontinent to guide the enlargement of photo voltaic manufacturing outdoors of mainland China. In addition to producers attracted by the incentives linked to manufacturing, new entrants produce modules, stimulated by alternatives to fabricate in India and ship to worldwide markets, particularly the United States.

The value hole is probably not the one problem to the reshoring coverage. TOPCon has shortly turn out to be the dominant expertise out there and greater than 90% of the market relies in China, the place firms have invested within the methodology within the final two years.

In distinction, a lot of the manufacturing capability situated in Western nations and India is PERC expertise, which can quickly disappear. Upgrading previous manufacturing strains or constructing new capability requires large investments that many Western producers discover too troublesome. Finally, on this context, making the reshoring module within the United States or Europe is the simplest possibility if the n-type cells may be imported.

These powerful occasions will proceed for Western photo voltaic producers as China’s bulging overcapacity exhibits no signal of abating, placing Western firms vulnerable to falling behind. -technological advances.

S&P Global Commodity Insights expects the worldwide manufacturing base to proceed to develop at a sooner tempo than demand, and far of this enlargement will happen in China. Over the subsequent two years, producers will add 300 GW of annual photo voltaic module manufacturing capability – the equal of greater than 70% of the world’s whole demand by 2023.

How shortly shipments from this huge new capability will attain worldwide markets is one thing that continues to be to be seen. In 2024, the photo voltaic business will face one other world wave of coverage in key markets together with the United States, Europe, and India. Examples embody new international subsidy investigations opened by the European Union, the implementation of a strict Approved List of Models and Manufacturers for Indian authorities initiatives; and within the United States, the top of the antidumping obligation and countervailing obligation moratorium, and the Uyghur Forced Labor Prevention Act.

These steps will decide not solely the destiny of ongoing onshoring efforts within the areas but additionally the form of worldwide provide chains as they adapt to proceed serving key markets.

About the creator: Edurne Zoco is the manager director of the Clean Energy Technology group at S&P Global Commodity Insights. He leads analysis throughout photo voltaic, provide chains, and carbon sequestration.

About the creator: Edurne Zoco is the manager director of the Clean Energy Technology group at S&P Global Commodity Insights. He leads analysis throughout photo voltaic, provide chains, and carbon sequestration.

This content material is protected by copyright and is probably not reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link