[ad_1]

Solar shares have proven among the strongest performances throughout sectors for the reason that begin of the month, buoyed by favorable market circumstances and constructive company earnings.

the Invesco Solar ETF TAN, which tracks the efficiency of roughly 40 photo voltaic vitality firms, has skilled vital development. Over the previous 10 classes, this ETF has risen 10%, rebounding from its lowest level since July 2020. This rally is especially necessary as a result of it displays broader investor optimism within the renewable vitality sector .

Several elements have contributed to this constructive momentum. One notable issue is the decline in long-term US Treasury yields, which have fallen sharply since late April.

Specifically, the 30-year Treasury yield fell from a excessive of 4.85% to 4.63%, and the 10-year yield fell from 4.73% to 4.50%. These yield reductions cut back the price of borrowing and are significantly useful for capital-intensive industries similar to photo voltaic vitality.

The sensitivity between photo voltaic inventory efficiency and Treasury yields is robust. Solar firms typically depend on vital capital to fund their giant initiatives. When Treasury yields rise, so do borrowing prices. Higher rates of interest improve the price of loans for photo voltaic firms, which reduces their earnings and makes their initiatives much less economically viable.

Additionally, the worth of photo voltaic shares is usually decided by the current worth of their anticipated future money flows. When Treasury yields rise, so does the low cost charge used to calculate these money flows. As a outcome, a rise in yields could cause a lower within the current worth of those money flows, which negatively impacts inventory costs.

This inverse relationship between photo voltaic shares and Treasury yields is proven within the chart under

Chart: Solar Stocks Are Negatively Correlated to Long-Term Treasury Yields

Industry Leader First Solar Signals A Turning Point

First Solar Inc. FSLR, a frontrunner within the photo voltaic trade, not too long ago reported first-quarter revenues of $794 million—above estimates of $718 million. The firm additionally beat earnings expectations, posting an adjusted EPS of $2.20 versus forecasts of $2.00.

Brian Lee, CFA, an fairness analyst at Goldman Sachs, believes that “the pricing surroundings might change quickly.”

In explicit, the analyst flagged that “renewables demand from information facilities represents a major a part of FSLR’s demand combine” which can affect the corporate’s order backlog within the close to time period.

Reflecting this optimism, Goldman Sachs has set a 12-month value goal of $268 for First Solar, indicating a possible 38% upside from its present value stage.

Are photo voltaic shares costly or low cost?

When contemplating the valuation of photo voltaic shares, the Invesco Solar ETF is at present buying and selling at 22 instances its ahead earnings. This quantity is considerably decrease than the estimates seen throughout 2020-2021 when photo voltaic shares have been buying and selling at as much as 80 instances their ahead earnings. This reveals that photo voltaic shares are comparatively cheaper now in comparison with their peak valuations.

The future trajectory of the photo voltaic trade relies upon closely on macroeconomic elements, significantly inflationary pressures and the Federal Reserve’s financial coverage.

The discount of inflationary pressures, which led to decrease Treasury yields on expectations of a shift in coverage by the Federal Reserve, might additional brighten the outlook for the photo voltaic trade.

The chance of the Federal Reserve implementing charge cuts will play an necessary function in shaping the prospects for photo voltaic shares within the coming months.

Read now: Chinese Stocks Soar as Investors Bet on Economic Turnaround: 7 ETFs to Watch

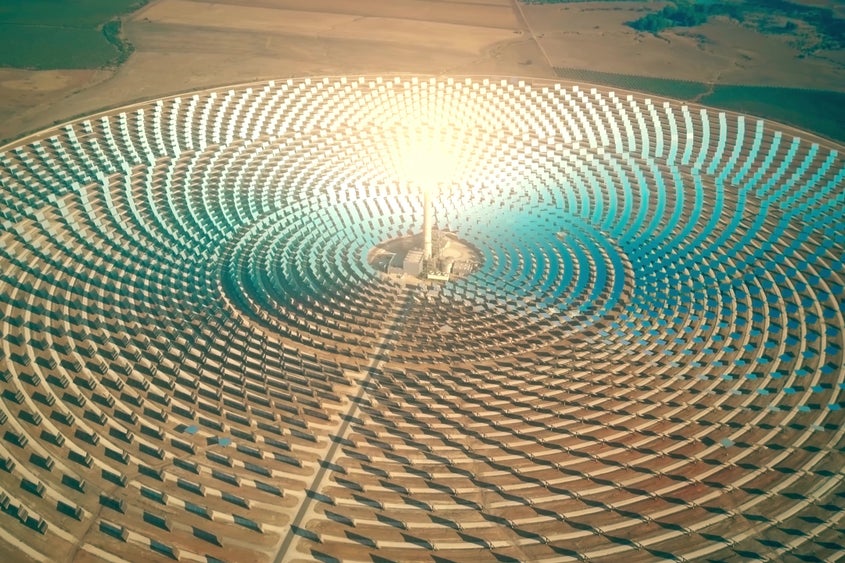

Photo: Shutterstock

[ad_2]

Source link