[ad_1]

In the brand new weekly replace for pv journalOPIS, a Dow Jones firm, offers a fast overview of the principle value developments within the international PV trade.

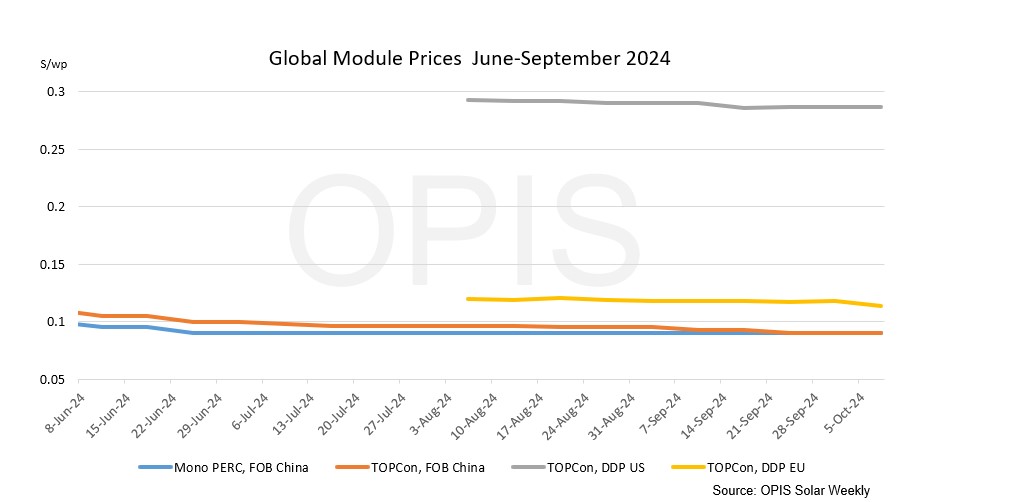

FOB China: The Chinese Module Marker (CMM), the OPIS benchmark evaluation for TOPCon modules from China was assessed at $0.090/W Free-On-Board (FOB) China, steady amid unchanged market fundamentals. Although China’s market reopened on Tuesday after the Golden Week holidays from October 1-7, buying and selling exercise remained muted with most market gamers anticipating the occasion. to purchase which will increase on the finish of the week.

Marketable indications are heard at $0.085-0.09/W FOB China from the Top 10 module sellers. There are expectations of costs weakening within the coming weeks as module distributors start clearing their inventories in October and rush for ultimate gross sales orders earlier than the tip of the 12 months. October working charges are anticipated to stay excessive this season, a market supply stated. China will produce about 50 GW of modules in October, up from about 49 GW in September, the supply added.

DDP Europe: TOPCon module costs drop barely every week. OPIS assessed the typical value at €0.104 ($0.113)/W, with indications nonetheless starting from a low of €0.090/W and a excessive of €0.122/W. According to market individuals, the DDP Eastern Europe TOPCon value varies between €0.090/W and €0.130/W. European sources report TOPCon module pricing for ‘Made in Europe’ panels, between €0.20/W and €0.30/W.

Freight charges for the China/East Asia-North Europe Ocean route have been seen at $5,074 per forty foot equal unit (FEU). This equates to $0.0120/W, steady week-to-week.

DDP US: The spot value for TOPCon modules DDP US remained flat this week at $0.287/W, with additional indications exhibiting a small bump within the new 12 months at $0.297/W and $0.300/W within the second quarter of 2025. The market continues to observe for coverage information this fall, as new anti-dumping charges and proposed Section 301 tariffs on Chinese polysilicon and wafers might increase costs.

A serious North American photo voltaic developer says the proposed Section 301 tariffs on Chinese polysilicon and wafers might be extra impactful than the 50% price proposed, as they might apply to 2 earlier provide steps. chain, and have interaction in a litany of different relevant duties. The US Trade Representative offered feedback on the matter till October 22.

The identical supply suggests {that a} 15-cent premium could also be utilized to home modules for the residential and business & industrial (C&I) sectors, whereas the utility-scale market might solely convey 2-to-3- cent bump on imports. The home content material bonus might be a better value-add for smaller initiatives, the place capex represents a better share of the full value, the supply stated.

OPIS, a Dow Jones firm, offers vitality costs, information, information, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical compounds, in addition to renewable fuels and environmental commodities. . It acquired pricing information property from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the writer, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and might not be reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: editors@pv-magazine.com.

Popular content material

[ad_2]

Source link