[ad_1]

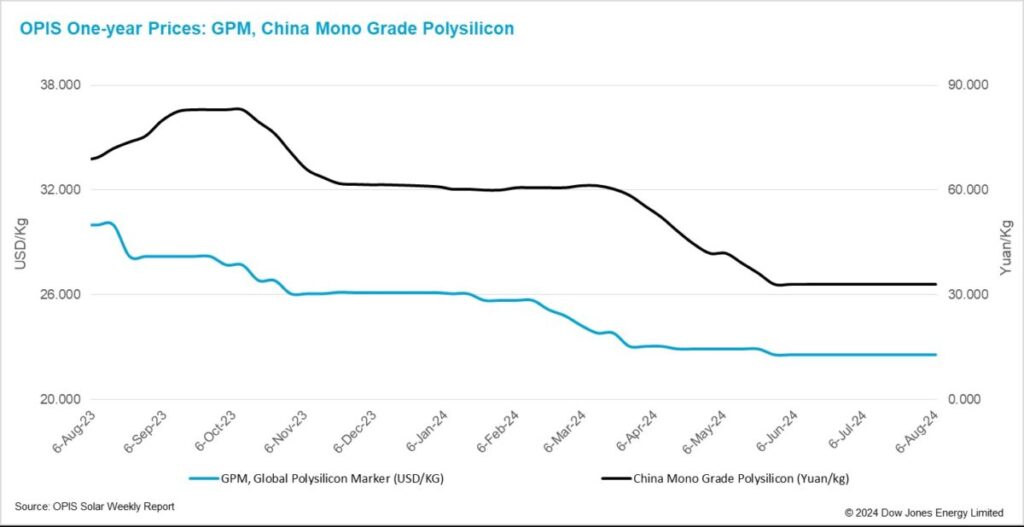

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outdoors of China, was assessed at $22.567/kg this week, reflecting robust market fundamentals.

Industry insiders within the international polysilicon market at the moment are indignant on the information of the delay within the preliminary ruling outcomes of US investigations on imported cells and modules from 4 nations in Southeast Asia.

According to a supply, the deadline for the countervailing obligation investigation, initially anticipated on July 18, has been delayed to September 30. every week, with the opportunity of being prolonged till the final week of November.

Other sources agreed, with one saying that “suspending to November is a excessive chance occasion.” The US is more likely to wait till after the 2024 presidential election to launch the particular penalties of the tariffs, the supply added.

Another business insider famous that the uncertainty surrounding main built-in producers that export modules to the US has prompted them to contemplate all doable technique of suspending their month-to-month purchases of worldwide polysilicon acquired by suppliers underneath long-term contracts throughout this era.

Uncertainty in regards to the operations of huge enterprises has additionally elevated consequently. “Because the excessive gross margins from US module costs at the moment are a big supply of potential revenue for provide chain producers, they can not afford to desert this market, regardless of the growing commerce obstacles,” stated an business insider. The supply added that many module producers are reportedly delivering small module orders by paying a US customs deposit throughout this window.

The international market of polysilicon is able to endure one other two to a few months of an extended “winter chill”, a market observer concluded, saying that this time, the small fluctuations in value is predicted resulting from market actions.

A market observer gives a long-term perspective, suggesting that with the assist of US commerce insurance policies, the demand for international polysilicon ought to stay fixed within the coming years. The subsequent main issue more likely to affect international polysilicon costs is adjustments in supply-demand dynamics between international polysilicon manufacturing and newly established ingot capability outdoors of China and the 4 Southeast Asian nations – a shift that may solely be vital after just a few years.

China Mono Grade, the OPIS evaluation for mono-grade polysilicon costs within the nation, remained regular at CNY 33/kg ($4.60/kg) this week, marking the tenth consecutive week of stability. . China Mono Premium, the OPIS value evaluation for mono-grade polysilicon used for N-type ingot pulling, was reported at CNY 39/kg ($5.44/kg). Sources point out that Chinese polysilicon producers are nonetheless persevering with to cut back manufacturing and proceed to lose cash.

According to an upstream supply, a serious Chinese polysilicon producer with an annual capability of 300,000 mt has scheduled solely 13,000 mt for August. Similarly, one other main producer of comparable scale plans to supply 8,000 mt in August.

Recent market consensus means that polysilicon costs have fallen and are unlikely to fall additional, resulting in studies of wafer firms and merchants beginning to stockpile polysilicon.

According to a market participant, wafer firms are growing their asking costs for polysilicon, and a few with robust money stream have expressed intentions to stockpile, although with out but noticed concrete actions.

“A slight enhance in gives from some polysilicon producers has been seen this week, though this enhance has not but affected the precise transaction costs,” added the supply.

Spot and futures merchants are additionally elevating their questions on polysilicon costs. Multiple sources have revealed to OPIS that China’s polysilicon is about to be listed as a commodity futures in October. This growth may immediate some merchants to hoard and construct inventories, which may drive up polysilicon costs.

However, in accordance with a market survey carried out by OPIS, there are some business insiders who doubt that the itemizing of polysilicon as a futures product can have a lot optimistic impact on the value enhance.

“Given the present provide and demand state of affairs, I imagine that the itemizing of polysilicon as a futures commodity is not going to lead to a big value enhance, as the issue of elevating polysilicon costs is matched by the problem of lowering of polysilicon stock,” a market supply stated. commented. “Currently, the polysilicon stock of 200,000 to 300,000 mt may be very giant, and it isn’t doable for all of it to be saved by the sellers; to not point out that the manufacturing of polysilicon remains to be occurring.”

Another market supply gives a unique view, saying that the success of itemizing polysilicon as a future commodity additionally is determined by the assist from main producers of polysilicon. If the present low costs proceed, these main producers might drive smaller rivals out of the market. However, itemizing polysilicon as a commodity futures may take in extra manufacturing capability, which may result in value will increase and supply a lifeline to small producers – a state of affairs that the most important producers at the moment are reluctant to assist.

In the early phases of itemizing a product as a futures commodity, market operations are sometimes underdeveloped, a market veteran commented, including that that is very true for polysilicon, a product with just a few who’re market individuals and simply manipulate costs. “Due to the present inactivity of the polysilicon market, this will not be a super time for a future launch of the commodity, thus a serious value shift isn’t predicted,” the supply concluded.

OPIS, a Dow Jones firm, supplies power costs, information, knowledge, and evaluation on gasoline, diesel, jet gasoline, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. . It acquired pricing knowledge belongings from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the writer, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.

[ad_2]

Source link