[ad_1]

In a brand new weekly replace for pv journalOPIS, a Dow Jones firm, gives a fast overview of the principle value tendencies within the world PV business.

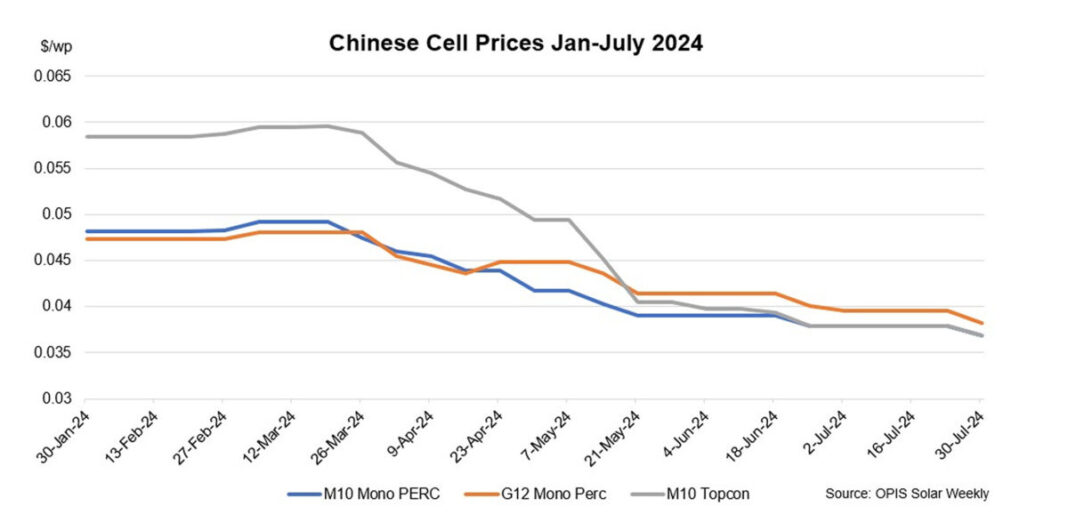

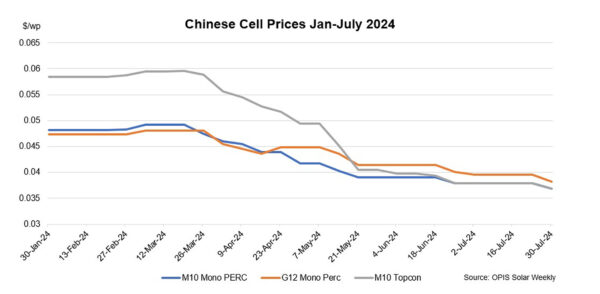

China’s mobile phone market costs have been revised decrease week-on-week indicating shopping for indicators. FOB China Mono PERC M10 cell and TOPCon M10 cell costs have been assessed down 2.64% at $0.0369/WW whereas FOB China Mono PERC G12 cell costs have been assessed down 3.29% at $0.0382/W weekly.

Market exercise remained quiet as most market individuals continued to remain on the sidelines, adopting a wait-and-see method. While costs have reached their lowest level, falling 59-63% year-on-year on July 30, in response to OPIS information, expectations of additional value reductions have stored most consumers from the market.

In the native market, some sellers lowered the worth of Mono PERC M10 and TOPCon M10 to CNY0.29 ($0.040)/W whereas others remained agency on the value of CNY0.30/W. The costs of Mono PERC M10 and TOPCon M10 cells have been checked at CNY 0.298/W, down 2.3% weekly. Mono PERC G12 costs are down 3.1% at CNY0.308/W.

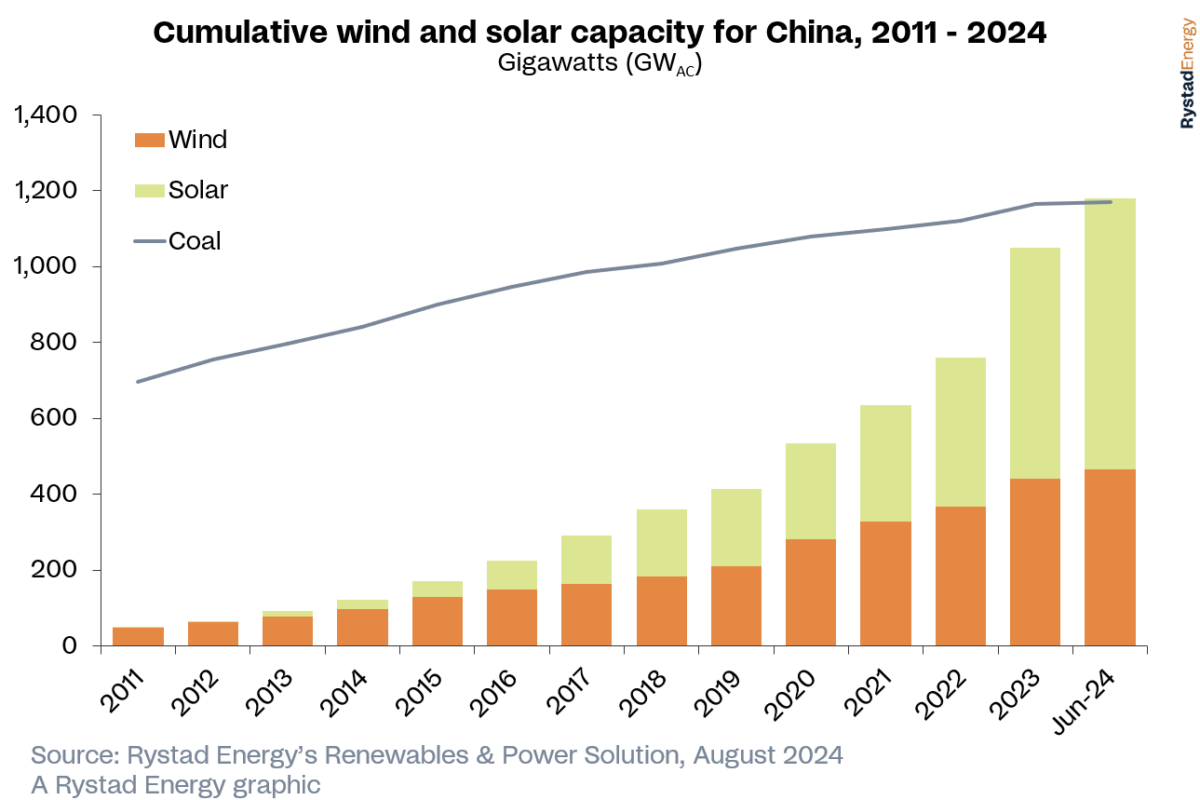

China produced a complete of 310 GW of cells within the first half of 2024, a rise of 37.8% year-on-year regardless of makes an attempt by cell producers to scale back cell manufacturing in June and July in a bid to scale back the oversupply state of affairs available in the market. .

Although cell exports for a similar interval elevated by 26.2% to 142.16 GW, the achieved gross sales costs have been a lot decrease in comparison with a 12 months in the past, leading to tighter margins for cell producers, an business supply mentioned. The business is experiencing a interval of persistently low costs all through the photo voltaic worth chain and if this continues for a very long time, the business may go right into a consolidation quicker than anticipated.

Meanwhile, cell producers proceed to chop manufacturing charges in a bid to revive market provide and demand stability. China’s cell manufacturing in July is predicted to achieve 49-51 GW, up from 53 GW in June, in response to the Silicon Industry of the China Nonferrous Metals Industry Association.

OPIS, a Dow Jones firm, gives power costs, information, information, and evaluation on gasoline, diesel, jet gasoline, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. . It acquired pricing information belongings from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the creator, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link