[ad_1]

In the brand new weekly replace for pv journalOPIS, a Dow Jones firm, offers a fast overview of the principle value tendencies within the international PV business.

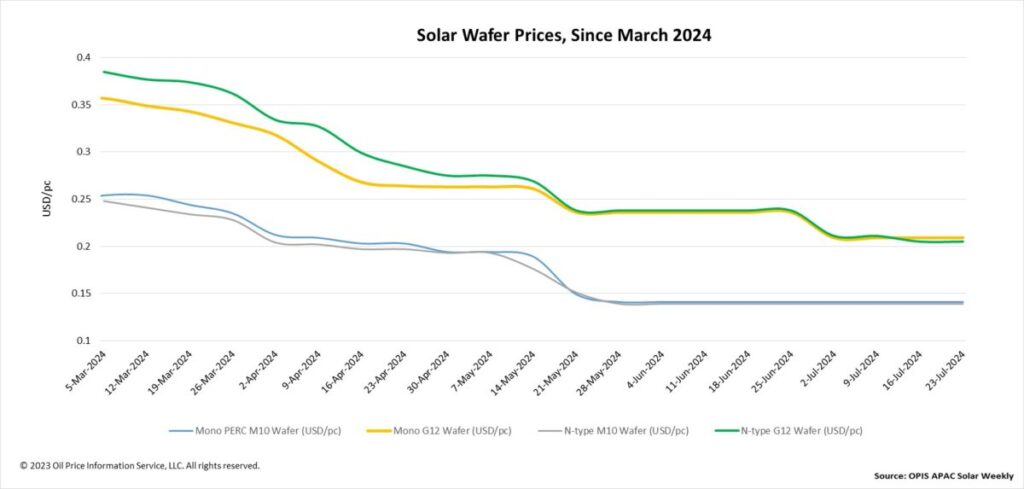

FOB China costs for wafers remained agency throughout the board this week. Mono PERC M10 and n-type M10 wafer costs remained regular at $0.141/computer and $0.139/computer, respectively. Likewise, Mono PERC G12 and nN-type G12 wafer costs remained unchanged at $0.209/computer and 0.205/computer, respectively, in comparison with final week.

Although there are reviews that n-type M10 wafer costs could enhance because of the shift of China’s home wafer manufacturing strains from full sq. wafers with a measurement of 182 mm x 182mm as much as rectangular wafers with sizes of 182 mm x 183.75mm and 182 mm x 210mm, precise transaction. costs stay unchanged aside from some firms which have elevated provides.

“Due to the sluggish downstream demand and the losses suffered by the downstream firms, it’s not possible to count on them to simply accept the rise within the prices of the fabric within the circulate,” mentioned a market supply.

In distinction, costs of n-type 210mm wafer units, together with full sq. 210 mm x 210mm wafers and rectangular 182 mm x 210mm wafers, softened twice final month, based on OPIS information. Industry insiders attribute this to a shift in manufacturing capability from the 182mm set to the 210mm set, resulting in extra stock of the latter.

“As the market share to a sure extent grows, its stock will increase and costs lower, which the 210mm wafer set is presently experiencing,” commented a market observer.

According to the OPIS market survey, the vast majority of wafer working charges in China’s home market are at 50% or decrease, aside from a Tier-1 wafer producer and a big specialist wafer producer that maintains an working fee of greater than 90%.

“Some built-in producers who stopped in-house wafer manufacturing as a consequence of low market costs, are actually getting most of their wafers from these two producers,” mentioned a market participant.

A number one Chinese wafer producer introduced final week that it’s going to construct a 20 GW ingot and wafering capability in Saudi Arabia. According to an insider, development is predicted to start this yr, with completion and operation scheduled for 2026.

The excessive gross margin from US module costs is presently the one vital supply of potential revenue for provide chain producers, based on a market veteran, noting that this wafer venture is predicted to focus on the US market sooner or later, doubtlessly taking polysilicon out of the three present ones. international polysilicon suppliers, the Oman and the UAE polysilicon crops that aren’t but in manufacturing, and traceability-compliant areas in China.

OPIS, a Dow Jones firm, offers power costs, information, information, and evaluation on gasoline, diesel, jet gasoline, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. . It acquired pricing information belongings from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the creator, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.

Popular content material

[ad_2]

Source link