In the brand new weekly replace for pv journalOPIS, a Dow Jones firm, supplies a fast overview of the primary value traits within the world PV business.

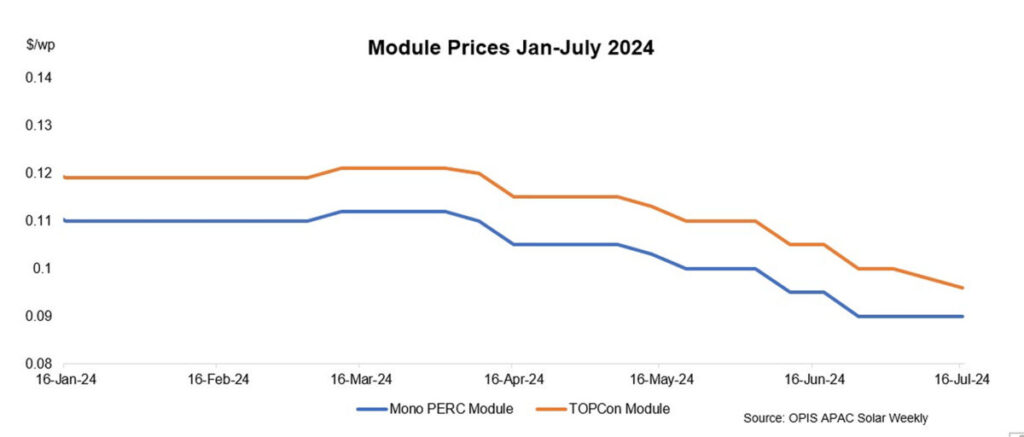

Module market costs had been assessed as stable-to-soft for the second consecutive week. The Chinese Module Marker (CMM), the OPIS benchmark evaluation for TOPCon modules from China was assessed at $0.096/W, under $0.002/W reflecting discussions heard whereas Mono PERC module costs had been assessed which is steady at $0.090/W from final week.

The TOPCon market was “chaotic” the week by Tuesday with costs heard in a variety. Some Tier 1 module producers continued to supply shipments at $0.100/W FOB China whereas decrease gives from Tier 2 and Tier 3 module sellers got here out at $0.085/W FOB China. These low costs “distort” the market and create a misunderstanding that TOPCon’s prime costs have fallen quickly so low in such a brief time frame, a market supply stated.

Market contributors OPIS surveyed anticipated additional reductions in TOPCon costs within the coming weeks as module makers compete to safe new orders and clear inventories. Although module makers are already burning money and there’s a restrict to how low costs can go, Tier 1 gamers are in a greater money circulation state of affairs in comparison with smaller market gamers. However, many main gamers have already introduced losses within the first half of the 12 months and if this vicious cycle of relentless value wars continues, the business will start to see a consolidation of the market in quickly, an business supply stated.

The enterprise slowed down so much with consumers asking for a smaller variety of shipments in comparison with earlier than and the gross sales efficiency this quarter was not good, a module vendor. Sales estimates for the third quarter are equally bearish as module costs are anticipated to drop additional with no obvious market restoration, the vendor added.

The unfold between TOPCon and Mono PERC costs is beginning to slender. It isn’t a surprise that Mono PERC costs will likely be barely decrease or the identical as TOPCon costs as a result of module makers promote primarily based on their Mono PERC stock ranges, a market supply stated. OPIS heard many of the Mono PERC discussions at $0.090/W FOB China though some distributors continued with gives of $0.093-0.095/W FOB China.

In the Chinese market, the Ministry of Industry and Information Technology (MIIT) printed proposals searching for public opinions on “Regulatory Conditions for the Photovoltaic Manufacturing Industry (2024 Edition)” and “Administrative Procedures for on Photovoltaic Manufacturing Industry Notification (2024 Edition)” on July 9.

One of the proposals is to lift the minimal capital ratio for brand spanking new building and broaden photovoltaic manufacturing tasks to 30% from 20% beforehand for wafer, cell and module manufacturing. Among different proposals, MIIT guides photovoltaic companies to cut back photovoltaic manufacturing tasks that broaden manufacturing capability.

A market veteran OPIS spoke to expressed skepticism that such measures would curb manufacturing growth and restore the stability of provide and demand within the Chinese market as capability growth plans are introduced virtually every day. Any constructive influence from these measures would require at the least two to 3 quarters from the date of implementation for any enhancements to be seen, added the veteran.

OPIS assessed the ahead pricing curve for US delivered duty-paid (DDP) mono PERC modules decrease this week, reflecting softer market values. Prices for PERC modules scheduled for This fall supply averaged $0.291/W from $0.240-0.365/W on a DDP US foundation, whereas costs for 2025 supply averaged $0.315-0.319/W from $0.270/W and $0.365/W DDP US

One producer famous that demand has weakened resulting from uncertainties surrounding US tariff insurance policies, whereas extra competitively priced shipments have emerged from Southeast Asian nations equivalent to Indonesia and Laos. The potential tariffs are anticipated to have an effect on supply schedules, and cargo stability stays a priority for consumers. Trade sources shared that TOPCon modules for spot loading from Indonesia and Laos can be found at $0.24/W to $0.28/W on a DDP US foundation.

In response to potential tariff problems, there was a rise in Indian module shipments to the US, as consumers are cautious about shopping for from Southeast Asia. According to an business supply, May module shipments from India to the US reached roughly 1 GW, accounting for about 20% of US module imports. The supply famous that India beforehand represented a small portion of US module imports earlier than May. In addition, the supply reported a 10-15% lower in Southeast Asian module imports in May in comparison with March and April.

OPIS, a Dow Jones firm, supplies vitality costs, information, knowledge, and evaluation on gasoline, diesel, jet gasoline, LPG/NGL, coal, metals, and chemical compounds, in addition to renewable fuels and environmental commodities. . It acquired pricing knowledge belongings from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the writer, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.