[ad_1]

Corporate funding within the photo voltaic sector reached $16.6 billion within the first half of this yr, in keeping with Mercom Capital Group. It says that a lot of the funds from debt financing, resembling enterprise capital and public market financing fell.

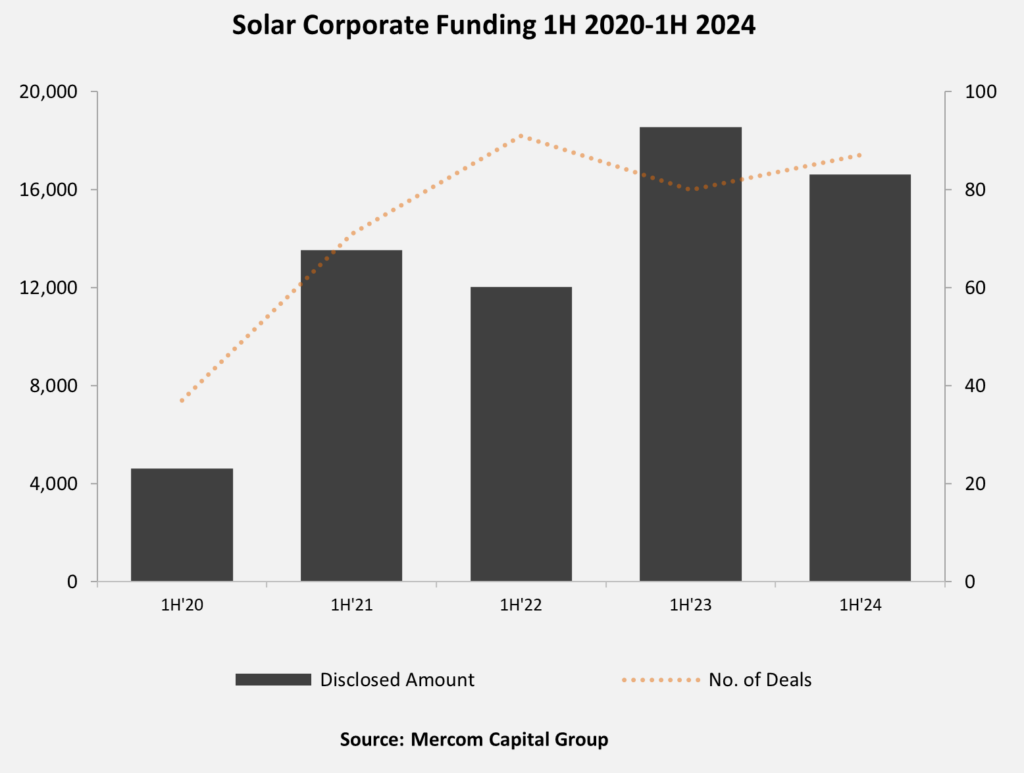

Total company funding within the photo voltaic sector reached $16.6 billion within the first half of 2024, in keeping with knowledge launched by Mercom Capital Group on the newest photo voltaic funding and merger and acquisition (M&A) report.

The complete quantity, which incorporates enterprise capital/non-public fairness funding, public markets, and debt financing, is 10% decrease year-over-year than the $18.5 billion raised within the first half of 2023. However, the variety of offers elevated 9% yr on yr with 87 recorded within the first half of 2024, in comparison with 80 offers in the identical interval final yr.

VC funding exercise decreased 29% yr over yr within the first half of 2024, with $2.7 billion raised in 29 offers. Solar public market financing hit $1.7 billion in eight offers within the first half of 2024, down 75% from $6.7 billion in 14 offers within the first half of 2023.

Solar corporations raised $12.2 billion in 50 debt funding offers within the first half of 2024, marking a 53% improve from the $8 billion raised in 33 offers within the first six months of 2023 According to Mercom Capital Group, this era represents the very best first-half complete for photo voltaic debt financing in a decade.

“Financial exercise within the photo voltaic sector stays constrained regardless of tailwinds from the Inflation Reduction Act and favorable world insurance policies,” stated Raj Prabhu, CEO of Mercom Capital Group.

Prabhu added that top rates of interest, an unsure price trajectory and timeline, rising commerce obstacles, provide chain challenges, considerations in regards to the impression of the US presidential election on the sector , and ever-evolving commerce insurance policies have created an “unpredictable and unsure local weather … down improvement, investments and decision-making.”

There have been 40 photo voltaic M&A transactions within the first half of this yr, up from 48 in the identical interval in 2023. The largest deal concerned Canada’s Brookfield Asset Management which acquired majority stake of French renewable firm Neoen for greater than $6.5 billion.

This content material is protected by copyright and is probably not reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link