[ad_1]

In a brand new weekly replace for pv journalOPIS, a Dow Jones firm, offers a fast overview of the principle worth traits within the international PV business.

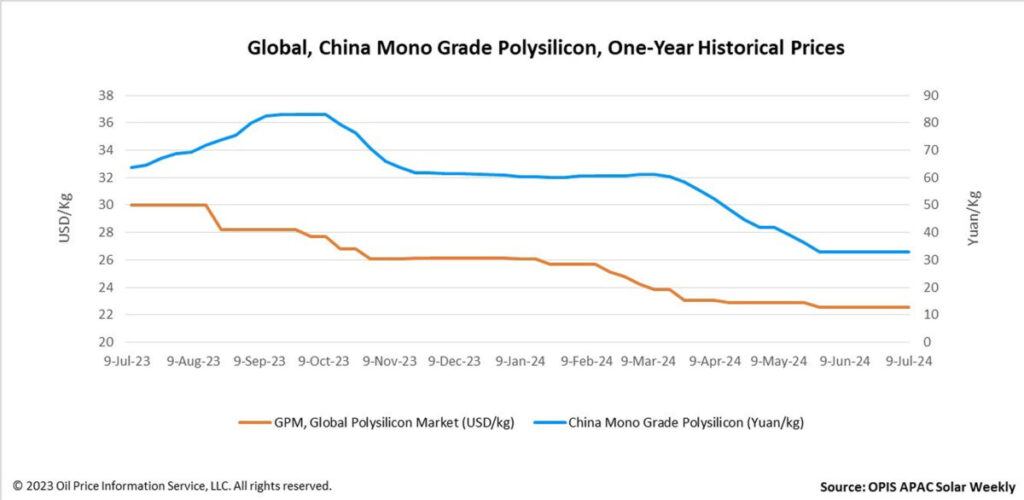

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outdoors China, assessed at $22.567/kg this week, unchanged from final week on the again of buy-sell indicators heard.

A supply conversant in the worldwide polysilicon market famous that spot polysilicon has largely been unsold for 2 months, with decreased supplies worsening.

However, international polysilicon suppliers have reported no discount in manufacturing up to now, and prospects with long-term agreements with suppliers are nonetheless below some stress and are getting merchandise at a comparatively secure charge. worth. “Signing a long-term settlement is meant to guard the pursuits of each events. Transferring all dangers to 1 occasion to fully keep away from dangers is a observe that lacks the spirit of a contract, ”commented a supply from a provider.

According to a China-based supply, a Chinese wafer producer that maintains a low 30% home working charge is sending wafer slicing tools to Laos and will take into account improve ingot capability there sooner or later. This growth suggests potential new gross sales channels for international polysilicon.

Due to the discount within the manufacturing charges of photo voltaic merchandise in 4 Southeast Asian nations, the present ingot manufacturing that requires international polysilicon can solely devour lower than 1,500 MT of those supplies per 30 days, in accordance with a supply. The supply additionally famous that the manufacturing capability of newly established ingot crops outdoors these nations will not be sufficient to completely stimulate the demand for international polysilicon.

“We consider that within the coming years, the ingot manufacturing capability outdoors of China and the 4 Southeast Asian nations will improve, introducing new elements that may affect the worldwide costs of polysilicon,” mentioned a market observer. However, the supply additionally famous that within the subsequent two years, US commerce coverage will stay largely decided by international polysilicon worth traits.

China Mono Grade, the OPIS evaluation for polysilicon costs within the nation, remained regular at CNY33 ($4.54)/kg this week, marking the sixth consecutive week of stability.

According to a market supply, the key producers of polysilicon that stopped worth reductions contributed to the stabilization of costs within the mainstream market. The supply added, “There is a powerful risk that polysilicon costs will stabilize on the present low level within the close to future.”

According to an upstream supply, a significant producer with sturdy monetary help and a excessive working charge is actively ramping up its new annual polysilicon manufacturing capability of 200,000 MT. in Yunnan. In addition, their new 200,000 MT polysilicon plant in Inner Mongolia is presently below building and is anticipated to be operational within the fourth quarter of this 12 months.

“However, we are able to count on some obstacles to the event of this challenge in Inner Mongolia as a result of present market downturn,” commented a market veteran.

Another market observer famous that regardless of the low manufacturing prices for fluidized mattress reactor (FBR) granular polysilicon, producers are presently unable to keep up a excessive working charge attributable to product market share limitations. . “There are two FBR granular polysilicon producers in China engaged in manufacturing and gross sales, with one other producer working a analysis and growth trial manufacturing line,” the supply added.

A market participant concluded that based mostly on present downstream working charges, an efficient discount in polysilicon stock on the finish of the 12 months appears difficult. An extra decline in polysilicon manufacturing is anticipated within the second half of the 12 months.

OPIS, a Dow Jones firm, offers power costs, information, knowledge, and evaluation on gasoline, diesel, jet gasoline, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. . It acquired pricing knowledge belongings from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the writer, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.

Popular content material

[ad_2]

Source link