[ad_1]

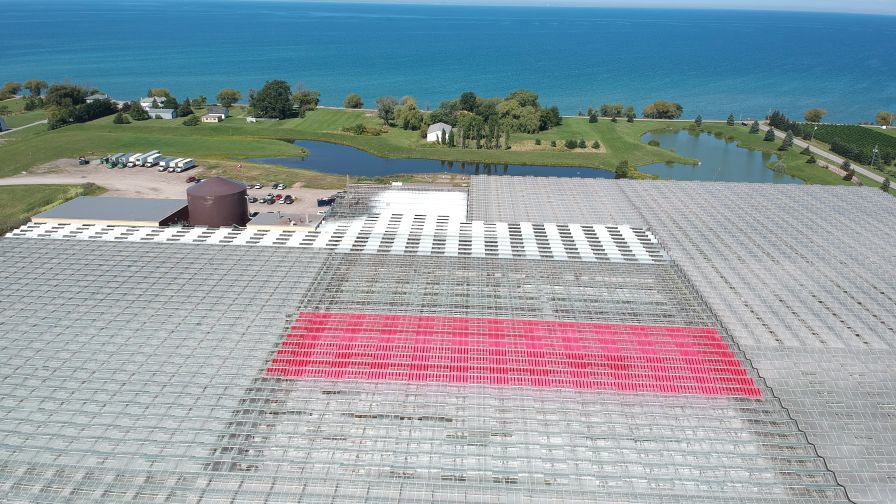

Freeman Herbs, situated in Ontario, Canada, has been utilizing agrivoltaics for a number of years Freeman Herbs

If you have not thought of it, 2024 could possibly be the 12 months so as to add solar energy to your operation. The obtainable incentives mix to supply a big discount in set up prices, however time for a few of the applications is restricted. With present applications, as much as 90% of the set up value may be recovered in a single 12 months.

Navigating the choices and choices for solar energy may be daunting. Trying to grasp the altering incentives, loans, and tax applications obtainable could make it worse. This is a full-time job. Solar consulting and set up corporations concentrate on monitoring incentives, mortgage choices, state and native applications, tax credit, and extra. Let’s have a look at present choices to assist ag producers and small companies put money into photo voltaic power, each conventional and agrivoltaics.

Rural Energy for America

You might have heard of the Rural Energy for America Program or REAP, administered by the USDA. You might not know that the Inflation Reduction Act of 2022 gives a big however non permanent funding increase to the grant program. It now covers as much as 50% of photo voltaic set up prices for certified producers. Whether your operation qualifies or not is determined by just a few components, however the primary requirement is to be an agricultural producer or small enterprise in a rural space.

You must get your geese in a row to make use of. There are two quarters left within the present funding, and until Congress approves extra funding, that is it. The legacy program with decrease charges will seemingly proceed. The upcoming utility deadlines are This autumn (April to June 2024) and Q5 (July to September 2024).

Use of photo voltaic power and agrivoltaics | Freeman Herbs

“Assuming you’re in an eligible location and meet the fundamental standards, you’ll be able to apply for the grant,” defined Warren Miller, Director of Sales and Marketing at Paradise Solar Energy. “They create a scorecard primarily based in your trade, taking a look at how a lot power you offset, how a lot you save.” Applications are scored on a 0 to 100-point scale. Solar consultants not solely assist design the system but in addition handle the grant utility course of for you.

Note: Regardless of state legal guidelines, REAP can’t be used to finance marijuana rising services.

Federal Investment Tax Credit (the ITC)

Tax credit are a extra acquainted and customary means for the federal government to encourage enterprise funding. Your tax skilled ought to consider any tax issues, however the normal rule is 30%. According to the US Department of Energy’s Federal Solar Tax Credits for Businesses webpage, “Solar techniques positioned in service in 2022 or later and starting building earlier than 2033 are eligible for a 30% ITC.”

Miller defined, “You can use it within the present 12 months in case you have a tax legal responsibility. If not, you’ll be able to return three years and get your taxes again. And if you have not used it but, you’ll be able to proceed.” Some potential ITC add-ons can increase credit score as much as 40-50%, relying in your scenario.

More Options for Solar Installation

Beyond federal grants and tax credit, there’s extra assist to make photo voltaic installations and upgrades inexpensive. You wish to get your folks to tax for it.

“Solar, like different gear, can depreciate. It falls beneath the five-year modified accelerated value restoration system (ACRS) depreciation schedule,” stated Miller. And you’ll be able to speed up as much as 60% of the federal depreciation tax financial savings in a single 12 months.

In addition to grants, the USDA additionally gives a mortgage assure program. REAP loans are for small companies and ag producers to assist set up renewable power techniques or make power effectivity enhancements. You can contact your state rural growth power coordinator for assist with questions. Like different mortgage assure applications, the federal government does not really lend the cash, however the assure helps a lender get the mortgage accepted.

Some applications in your state may also make photo voltaic set up cheaper. Many states (38) have necessary internet metering, which means your electrical firm buys extra power that your photo voltaic system does not want to supply in the course of the day. You are credited for that manufacturing and you’ll draw in opposition to it at evening or in cloudy climate. Think of it as storing your extra electrical energy manufacturing within the grid as an alternative of a battery. Solar Renewable Energy Credits (SRECs) and rebates or grants out of your electrical supplier can also be obtainable.

Agrivoltaics Eligible for Incentives

If you’ve got heard of agrivoltaics or agrophotovoltaics (APV) earlier than, you may consider rows of conventional photo voltaic panels put in in a meadow or on the fringe of a subject. Not like that anymore. Several corporations produce commercial-scale semi-transparent photo voltaic panels which are supposed to behave as glazing in your greenhouse. This is an thrilling risk to generate electrical energy to scale back your power payments whereas the yields proceed. And better of all, it qualifies for the photo voltaic incentives talked about above.

This tomato greenhouse in Greece makes use of Brite Solar panels | Solar Brite

Modern semi-transparent agrivoltaics use a simple strategy. Traditional photo voltaic panels are opaque and fully lined with tiny particular person photovoltaic cells. Agrivoltaics use the identical particular person cells, however with fewer of them. They are separated to permit mild to move via. Imagine a checkerboard the place solely the black squares have PV cells, and the purple squares are empty to let in mild. The panels vary from 75% transparency to 30% transparency, with energy output inversely proportional to transparency.

You might imagine that low mild robotically equates to low yield or development. After all, growers do not buy supplemental LED lighting as a result of they want much less mild. However, subject exams present fascinating outcomes. We spoke with Marco de Leonardis, R&D Operations Manager at Freeman Herbs in Ontario. They have been utilizing the panels for years.

“In our greenhouse, we’ve LUMO panels from Soliculture. In the six exams we ran, we seen little or no distinction between the crops grown beneath the photovoltaic panel or beneath a management (clear glass). There is a little bit decrease contemporary weight, however the normal look of the plant is not any totally different. Because we’re promoting a completed plant, we will additionally promote.” According to manufacturing facility exams in business greenhouses, some crops will see a rise in yield.

The know-how actually shines in new building due to photo voltaic incentive applications. Since the greenhouse construction serves as a photo voltaic panel rack system, the complete value of the construction is eligible for the applications, not simply the price of photo voltaic. That’s large.

“When you construct a greenhouse with the clear photo voltaic panels we manufacture, the complete value of the greenhouse: building, supplies, and so on., is all obtainable at ITC,” stated Rick Orlando, VP of Business Development at Brite. Solar. “If you have a look at constructing a 100,000-square-foot greenhouse and evaluate the price of constructing with regular glass versus utilizing our glass, which has a 30% ITC, the glass pays off and also you get the free electrical energy. It’s a stunning scenario.”

If you are on the fence about putting in photo voltaic, the present incentive scenario is taking a tough look, as a result of it will not occur once more.

[ad_2]

Source link