[ad_1]

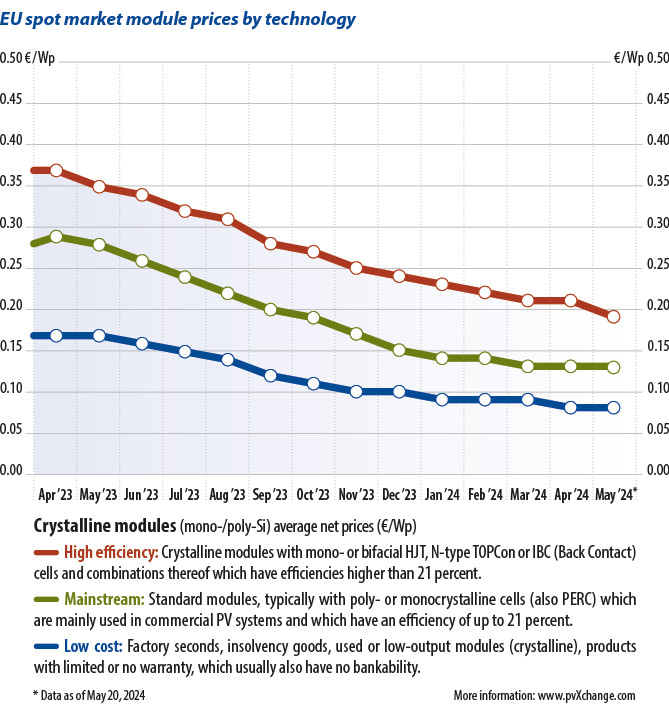

In May 2024, high-efficiency panels, principally glass-glass modules with tunnel oxide passivated contact (TOPCon) cells start to converge in worth with mainstream choices, writes Martin Schachinger, in pvXchange. Production volumes for these negatively-doped, “n-type” cells and modules have been ramped up in China whereas more and more restrictive customs situations within the United States could have an effect. For the European market, the fixed drop in costs for the most recent module expertise would recommend that demand would proceed to rise if not for a number of disruptive components.

In Europe, there are nonetheless extra shares of modules produced in 2023, or earlier with distributors and installers themselves. If they’ve small dimensions which might be usually used for roof methods in Germany, they don’t promote nicely due to the low output energy sorts. Building house owners usually need to see excessive wattage and the most recent expertise put in of their methods, making it tougher to promote present stock.

Despite the supposed decline in module manufacturing, and European import volumes, it seems that extra Asian panels nonetheless attain the European market than present demand. This, in flip, causes the expansion of inventories, even of high-performance sorts, which places further strain on module costs, particularly for older modules which might be produced and bought at increased costs.

The potential to downsize outdated inventory varies drastically from firm to firm, leading to very totally different costs for modules with passivated emitter rear contact (PERC) cell expertise. The general worth distinction between mannequin classes is narrowing.

Shelf heaters

It could be very tough to take away these outdated modules in markets exterior of Europe with out receiving a big lack of worth. Africa and Southeast Asia are additionally prone to be oversaturated with modules and merchandise made in China is not going to promote simply within the US market. A technique that’s more and more established is to make concessions on mushy enterprise components in commerce. There could also be some wiggle room in cost and delivery phrases. Instead of providing the modules at a cheaper price, a line of credit score is supplied – usually with out the necessity for collateral – and delivery may be provided free of charge. That mentioned, it is uncertain that this tactic will work in the long run. Many small firms are on the point of insolvency and the potential of defaults can’t be dominated out. The strain to promote ought to, subsequently, not exceed frequent sense and tempt suppliers to take numerous dangers.

Some suppliers additionally attempt to flip to on-line markets the place they hope to promote rapidly to worldwide clients with out the prices of gross sales and advertising. However, aggressive strain there’s additionally excessive and items are sometimes offered at throwaway costs.

Online enterprise fashions carry extra threat. They not often present stable alternatives to establish potential enterprise companions – salespeople simply take what they will get. Misunderstandings can come up in enterprise transactions, particularly throughout nationwide borders and the platform operator is just not all the time accessible to supply assist and recommendation. The effort concerned in an internet transaction can simply be better than shopping for or promoting inside a longtime enterprise relationship. Everything may go easily however that does not imply it would.

| Module class | €/Wp | Trend since April 2024 | Trend since January 2024 | Description |

|---|---|---|---|---|

| Crystal modules | ||||

| High effectivity | 0.19 | -9.5% | -17.4% | Crystal panels of 340 Wp and above, with PERC, heterojunction, n-type, or back-contact cells, or mixtures thereof |

| Mainstream | 0.13 | 0.0% | -7.1% | The modules usually have 60 cells, customary aluminum frames, white backsheets, and 275 Wp to 335 Wp |

| Low value | 0.08 | 0.0% | -11.1% | Factory seconds, insolvency objects, used or low output modules, and merchandise with restricted or no guarantee |

Note: Only tax-free costs for PV modules are proven, with acknowledged costs reflecting common customs-cleared costs within the European market. Source: pvXchange.com

Selling the undertaking

One risk for good use of surplus outdated photo voltaic modules is to put in them in bigger open-space initiatives or rooftop methods. Smaller codecs will not be a foul alternative in areas with increased wind or snow masses. Although the fabric and set up prices are low, the simple dealing with throughout set up makes up for this drawback. There is one other plain benefit right here – that the modules are already in inventory. This availability assure means no delivery issues and subsequently no delays within the building course of. Add some unsoldered inverters and cable reels and the parts are in place for a working PV system.

When a system is put in and linked to the grid, nobody cares if the photo voltaic modules belong to the most recent technology or not. The ensuing asset can then be offered higher than 400 W PERC modules within the present market state of affairs. This will also be carried out via an internet brokerage portal, for firms that aren’t but correctly arrange for undertaking gross sales.

The views and opinions expressed on this article are these of the writer, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and will not be reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: editors@pv-magazine.com.

[ad_2]

Source link