[ad_1]

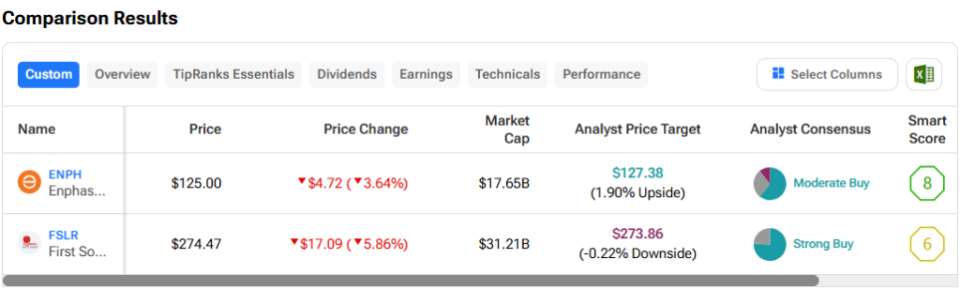

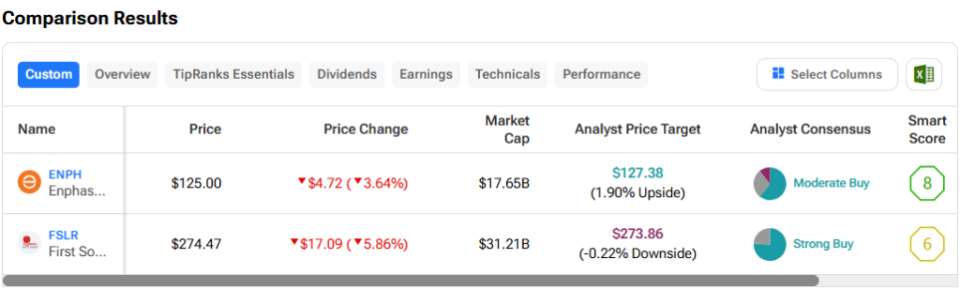

In this piece, I look at two photo voltaic shares, Enphase Energy (NASDAQ:ENPH) and First Solar (NASDAQ: FSLR), utilizing TipRanks’ Comparison Tool to see which one is healthier. A more in-depth look suggests a impartial view on each shares.

Enphase Energy provides vitality administration options for the worldwide photo voltaic {industry}, together with micro-inverters for photo voltaic panels and software program for residence vitality storage and options. Meanwhile, First Solar designs, manufactures, and sells photovoltaic solar energy techniques and photo voltaic modules.

Shares of Enphase Energy are down 5% year-to-date after plunging 31% final yr, although issues could possibly be turning round, because the inventory is up 9% for the final 5 days. Meanwhile, First Solar’s inventory is up 59% year-to-date, bringing its 12-month return to 42%.

With such a big distinction within the firms’ year-to-date returns, a niche between their valuations isn’t a surprise. However, what’s stunning is that Enphase Energy is the one with the very best valuation – even after the share sale.

Both shares acquired a lift on Wednesday from the cooling inflation report. High inflation and rates of interest make it difficult for customers and companies to finance new solar-energy techniques, so any indicators of potential reduction in these areas supply assist for of photo voltaic firms akin to Enphase Energy and First Solar.

Below, we evaluate the businesses’ price-to-earnings (P/E) ratios to measure their valuations towards one another and their {industry}. For comparability, the renewable vitality {industry} trades at a P/E of 60.5x, which is extra affordable than the three-year common of 420x.

Enphase Energy (NASDAQ:ENPH)

At a P/E of 69.1x, Enphase Energy trades at a premium to the renewable vitality {industry} regardless of promoting its shares. On a P/E foundation, the corporate’s valuation has rebounded from the intense highs it traded in 2021 and 2022, peaking at round 277 in July 2021. However, as a consequence of its excessive valuation relative to different renewables and with the truth that extra closeness is probably going forward, a impartial view appears acceptable for now.

Unfortunately, Enphase Energy lacked each income and earnings in its most up-to-date earnings report. The firm posted adjusted earnings of 35 cents per share on $263.3 million in income versus expectations of 41 cents per share on $276.3 million in income.

Enphase additionally missed estimates for its steering, which did not go down too effectively on Wall Street. For the second quarter, the corporate expects income between $290 million and $330 million in comparison with the earlier consensus of $350.7 million.

The greatest points dealing with Enphase Energy proper now are inflation and rates of interest, however these are industry-wide issues that ought to go away as soon as charges begin to rise. Unfortunately, the May Consumer Price Index (CPI) print once more revealed continued inflation rising to three.3% year-on-year, though this was barely higher than the consensus prediction of a 3.4 % improve.

As a outcome, when the Federal Open Market Committee concluded its June assembly on Wednesday, it up to date its dot-plot prediction of 1 rate of interest lower this yr – down from the three cuts deliberate on the assembly in March. Thus, the most important hazard for the photo voltaic {industry} could last more than the present worth expectations, as confirmed by the Enphase miss information.

As such, photo voltaic shares will see extra near-term volatility. Additionally, since Enphase’s valuation is so excessive in comparison with the remainder of the renewables {industry}, I’d wish to see a extra engaging entry worth earlier than the inventory turns into extra worthwhile.

What is the Price Target for ENPH Stock?

Enphase Energy has a Moderate Buy consensus ranking primarily based on 17 Buys, eight Holds, and three Sell rankings assigned within the final three months. At $127.38, Enphase Energy’s common inventory worth goal implies a draw back potential of two.1%.

First Solar (NASDAQ:FSLR)

At a P/E of 31.3x, First Solar trades at a steep low cost to its {industry} regardless of crushing earnings estimates in the latest quarter. However, its present P/E is towards the excessive finish of the normalized vary of about 15x to 35x since August 2019, and the inventory is out of overbought territory. Therefore, a impartial view appears acceptable.

In the latest quarter, First Solar posted adjusted earnings of $2.20 per share on $794.1 million in income versus expectations of $2 per share on $720.3 million in income. While preliminary response to the May 1 report was tepid, First Solar shares surged after the announcement that the Biden administration was ending the exemption from tariffs on bilateral photo voltaic panel imports. from Southeast Asia. That announcement got here a day after the administration doubled tariffs on imported photo voltaic panels.

While each developments are good news for First Solar and Enphase Energy in the long term, the businesses aren’t out of the woods but. In addition to the inflation and interest-rate issues highlighted above, many photo voltaic panel firms have used the tariff-exemption interval to inventory giant portions of panels from Asia.

Now, to keep away from paying tariffs on the panels, firms should promote all of them in lower than 180 days, which can lead to discounted costs weighing on their near-term gross sales. Enphase Energy is dealing with greater than an oblique impression from the state of affairs, as evidenced by the corporate’s assertion that shipments fell within the fourth quarter as a consequence of excessive inventories at its distribution companions. distribute it.

However, First Solar’s impression is more likely to be direct. The firm boasts U.S. manufacturing amenities amongst others, but when the U.S. market is flooded with deeply discounted photo voltaic panels as a consequence of mass stockpiles, First Solar’s gross sales might drag, suggesting the close to order of its outcomes.

Finally, First Solar tipped into overbought territory on Wednesday because the Relative Strength Index (RSI) rose to 80.5. It has since moved decrease, however it’s nonetheless not removed from overbought territory.

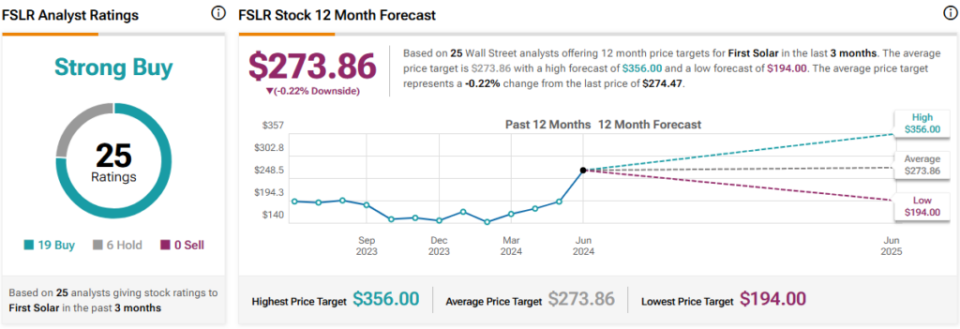

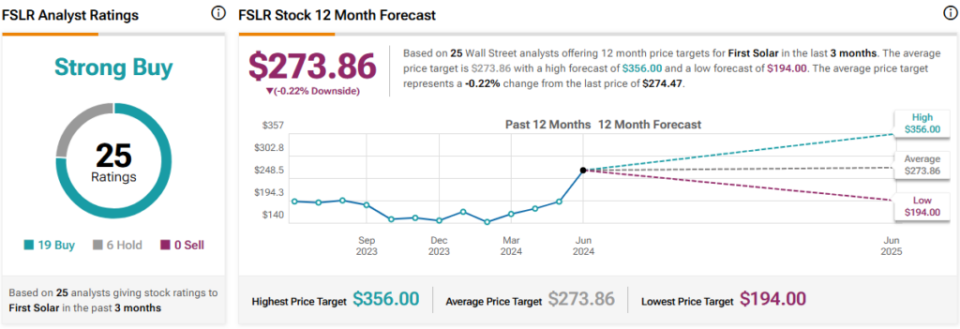

What is the Price Target for FSLR Stock?

First Solar has a Strong Buy consensus ranking primarily based on 19 Buys, six Holds, and 0 Sell rankings assigned prior to now three months. At $273.86, the typical worth goal on First Solar’s inventory implies a draw back potential of 0.2%.

Conclusion: Neutral on ENPH and FSLR

In the long term, Enphase Energy and First Solar are more likely to be glorious performs within the photo voltaic market, however for now, there are too many points weighing on the US photo voltaic market to warrant a extra constructive have a look at both. inventory. Thus, I’d advocate a wait-and-see strategy for each firms to see which valuation involves a extra acceptable vary as quickly as attainable.

disclosures

[ad_2]

Source link