[ad_1]

In a weekly replace for pv journal, OPIS, a Dow Jones firm, gives a fast overview of the principle worth traits within the world PV trade.

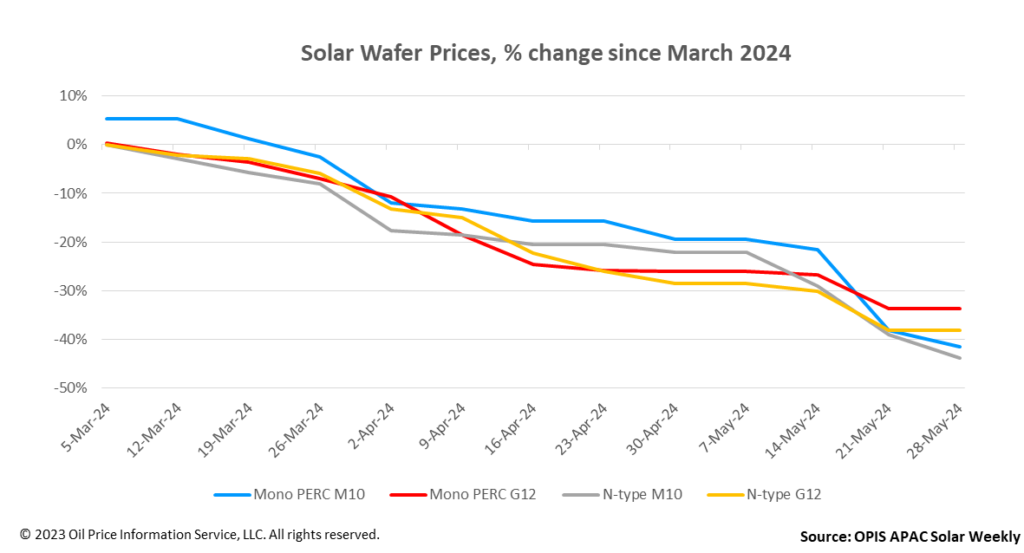

FOB China costs for M10 wafers continued their downward development this week. Prices for Mono PERC M10 and n-type M10 wafers decreased by 5.37% and seven.95% weekly, reaching $0.141 per piece (laptop) and $0.139/laptop, respectively.

FOB China costs for G12 wafers remained comparatively regular this week, with Mono PERC G12 and N-type G12 wafer costs remaining flat at $0.236/laptop and $0.238/laptop, respectively.

According to the OPIS market survey, the typical transaction costs of Mono PERC M10 and N-type M10 wafers within the Chinese home market decreased to CNY1.13 ($0.16)/laptop and CNY1.12/laptop, respectively. each. Even at this worth level, the variety of transactions stays low, in line with a circulate supply. Another trade insider even quoted a suggestion of CNY1.05/laptop for n-type M10 wafers, suggesting the potential course of n-type wafer costs within the close to future.

The present promoting worth of the wafer may be very completely different from the issues of the price of manufacturing, with the principle emphasis being to make sure gross sales, in line with a market participant.

Wafer stock stays excessive at greater than 5 billion items, equal to about 40 GW and twenty days of manufacturing, in line with a number of market sources. Against the backdrop of excessive wafer inventories, experiences emerged this week of some producers decreasing their working charges. As a consequence, the general working fee of wafer producers has decreased to between 50% and 60%, with month-to-month output anticipated to succeed in between 55 GW and 62 GW.

Recent discussions have emerged about cell producers stockpiling wafers, suggesting {that a} lower cost for wafers might have been reached. However, a supply from the cell market suspects that this could possibly be a deliberate try by wafer producers to unfold misinformation. The supply considers this step “pointless”, as “even when they’re on the backside, there isn’t any foundation for the worth enhance.”

As a results of modifications in worldwide commerce insurance policies, there may be an expectation that orders for cells and modules exported from Southeast Asia to the US will face obstacles within the close to future. . This improvement has prompted discussions inside the trade about melting wafers in Southeast Asia and the potential supply of wafers for future cell manufacturing within the US.

“It is predicted that till native cell manufacturing capability is established within the US, insurance policies won’t fully block the importation of Southeast Asian cells. Consequently, the affect of wafers in Southeast Asia just isn’t anticipated to be very important within the close to future,” a supply from the worldwide polysilicon market revealed to OPIS through the China Polysilicon Development Forum (CPDF) held in Leshan, Sichuan, China on May 23 and 24.

In the worldwide market, market insiders revealed {that a} vertically built-in producer’s preliminary part 3.3 GW wafer venture within the US is scheduled to be accomplished this 12 months. The manufacturing unit has already obtained the required quantity of polysilicon for its annual manufacturing capability. In addition, some wafer producers are exploring the viability of building factories outdoors of Southeast Asia, such because the United Arab Emirates, to navigate the complexities of the worldwide commerce setting, sources disclosed to OPIS. throughout CPDF.

OPIS, a Dow Jones firm, gives vitality costs, information, information, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. . It acquired pricing information property from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the creator, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and will not be reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: editors@pv-magazine.com.

[ad_2]

Source link