[ad_1]

New analysis from Denmark exhibits that PV-to-methanol services can obtain a 30% decrease stage of methanol value by collaborating in reserve markets. The researchers evaluated the power of a PV-to-methanol plant to contribute to the grid’s frequency containment reserves (FCR), computerized frequency restoration reserves (aFRR), and handbook frequency restoration reserves (mFRR).

A gaggle of researchers led by scientists from the Technical University of Denmark (DTU) investigated how PV-to-methanol vegetation might take part in reserve markets to cut back the levelized quantity of methanol and located that these services obtain potential financial advantages.

Academics have examined, specifically, the power of an precise PV-to-methanol plant to contribute to the grid in frequency containment reserves (FCR), computerized frequency restoration reserves (aFRR), and handbook frequency restoration reserves (mFRR).

“To optimize the cost-effectiveness of power-to-X (PtX)-based gas manufacturing, a proposal suggests utilizing PtX vegetation’ inherent flexibility to offer frequency reserves to {the electrical} grid,” they defined. “The evaluation of hybrid renewable power system (HRES) know-how and present reserve markets revealed that HRES qualifies for certification to offer frequency reserve, consisting of FCR, aFRR, and mFRR, to the transmission operator system.”

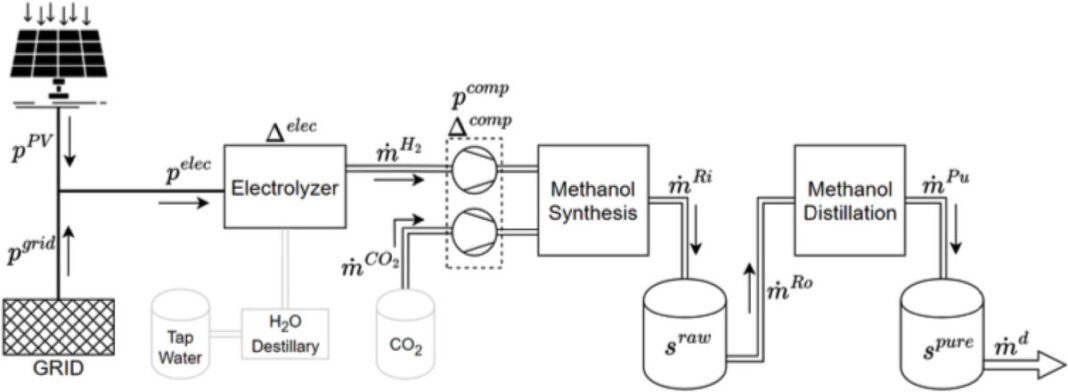

The PV-to-methanol plant analyzed will produce about 32,000 tons of e-methanol per yr. It is powered by the grid and a 300 MW PV plant related to proton trade membrane electrolyzers (PEM) with a capability of 52.5 MW. The PEM unit has a minimal load of 5%.

“While current research primarily simulate short-term situations, this analysis expands its focus to the entire yr, shedding gentle on the dynamics of renewable power integration and market administration in the long run. ,” acknowledged the analysis group. “The comparability contains two situations: participation solely within the futures market (DA) and participation within the DA and reserve (RE) markets for the years 2020 and 2021.”

The plant is positioned close to the German border, in Kassø, South Jutland. In the mathematical mannequin, photo voltaic PV energy accounts for 66% of the entire power utilized by the system annually. However, through the summer time months, the PV capability exceeds the power-to-X capability, leading to extra PV manufacturing, which can be utilized for grid export and reserve participation. out there.

“In each years, the aFRR market proved to be the primary supply of extra income, whereas the participation of mFRR and FCR contributed to a lesser extent,” stated the group. “In 2020, market reserve revenues totaled €4.82 million ($5.23 million), with an FCR of 16%, aFRR 79%, and mFRR 5%.”

For the DA market solely, the mannequin finds a stage value of methanol (LCoM) of €1,508/t in 2021 and €1,276/t in 2020. For the DA and RE markets, the mannequin exhibits of LCoM of €1,059/t for 2021 and €1,117/t for 2020. According to the researchers, these outcomes will trigger a discount in LCoM of 30% for 2021 and 12% for 2020.

“The mannequin effectively allocates the capability of the electrolyzer to maximise market returns, with the ensuing LCoM values virtually equal to the estimates of the worldwide renewable power company (IRENA),” the teachers concluded. “It highlights the financial advantages of HRES participation in reserve markets, demonstrating the potential for bettering the sustainability of the renewable power system via market participation.”

Their findings are introduced in “Cost discount of a hybrid PV-to-methanol plant by collaborating in reserve markets: A Danish case research,” revealed in International Journal of Hydrogen Energy. Academics from Denmark’s DTU and China’s University of Chinese Academy of Sciences carried out the analysis.

This content material is protected by copyright and might not be reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link