[ad_1]

In the brand new weekly replace for pv journalOPIS, a Dow Jones firm, gives a fast overview of the primary worth developments within the international PV trade.

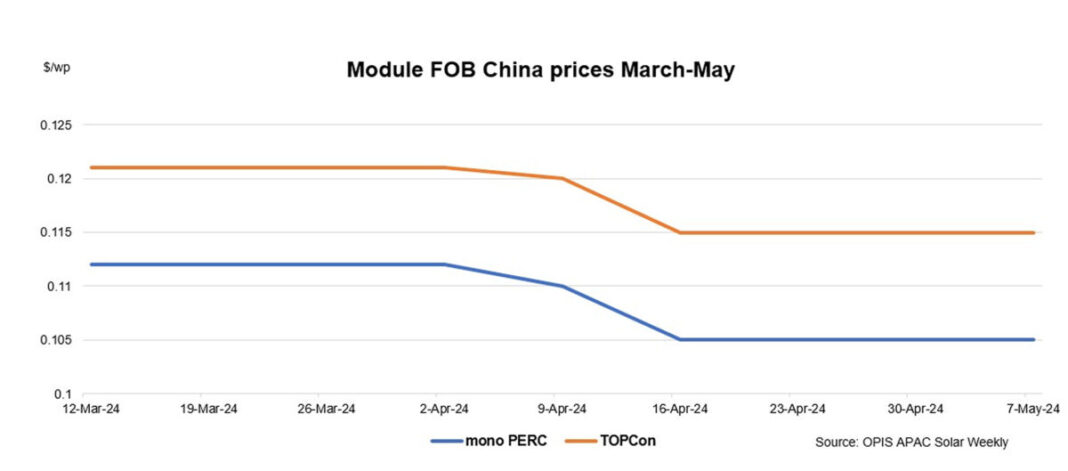

The Chinese Module Marker (CMM), the OPIS benchmark evaluation for TOPCon modules from China and mono PERC module costs remained regular at $0.115 per W and $0.105/W, respectively.

Market exercise within the Chinese market has but to choose up at the same time as Chinese photo voltaic corporations bounce again after the Labor Day vacation. Trading stays low with few consumers available in the market and these consumers are largely in search of bargains, a market supply mentioned.

Demand stays weak as feed-in costs throughout the photo voltaic worth chain lengthen losses forward of the Labor Day vacation. Although upstream costs remained regular this week in a quiet market, market sources anticipate costs to fall within the coming days as buying and selling exercise continues.

Module costs are anticipated to proceed a downtrend amid weak point within the upstream sector, many agreed throughout OPIS’s weekly market survey. However, different market individuals level out that module costs have already fallen beneath the price of manufacturing which stands at $0.126/W, and there’s no room for additional worth reductions.

There is an expectation that mono PERC costs will proceed to be steady as provide will progressively tighten with demand shifting to TOPCon modules. The restricted availability of mono PERC modules might end in mono PERC buying and selling costs being increased, a market veteran mentioned.

Module producers might scale back their working charges in May to mitigate the decline in costs and restore the provision/demand steadiness available in the market. Last April, the working charge of module producers was between 70% and 100%.

The international photo voltaic cell and module manufacturing trade is at present working at a utilization charge of roughly 50%, in line with the EIA.

Trading exercise for modules in Southeast Asia is proscribed as uncertainty about antidumping/countervailing duties (AD/CVD) continues. Buyers are adopting a wait-and-see strategy relating to coverage developments and there have been comparatively few new contracts signed lately, a module producer in Southeast Asia mentioned. .

Another market participant famous that module costs are prone to rise in anticipation of potential duties. However, this anticipated worth improve has not but affected the market as consumers stay reluctant to take new contracts because of excessive stock ranges within the United States.

OPIS, a Dow Jones firm, gives vitality costs, information, information, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. . It acquired pricing information property from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the creator, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and will not be reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link