[ad_1]

In the brand new weekly replace for pv journalOPIS, a Dow Jones firm, gives a fast overview of the principle value developments within the international PV business.

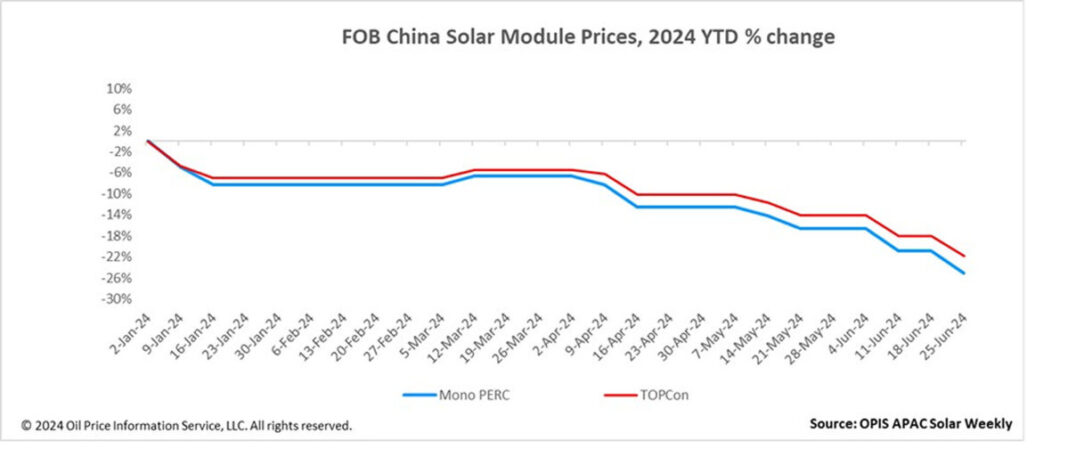

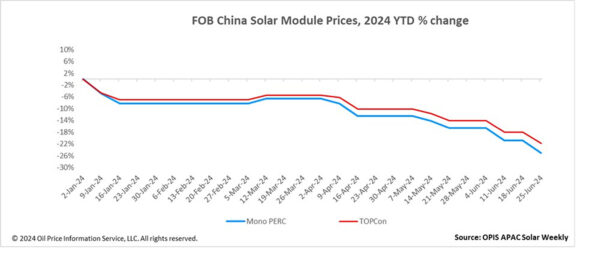

The Chinese Module Marker (CMM), the OPIS benchmark evaluation for TOPCon modules from China was assessed at $0.100/W, down from $0.005/W per week. Mono PERC module costs have been assessed at $0.090/W, down $0.005/W from final week. The new document lows for each costs based on OPIS knowledge come as market exercise stays under low demand.

Module makers are decreasing costs in a bid to safe new orders and keep money move with sell-through indications for TOPCon modules heard at $0.10/W Free-on-Board (FOB) China.

Solar modules exported to Europe proceed to battle with excessive freight costs within the Red Sea. OPIS has heard freight charges of about $0.0164-0.0175/W (excessive $6,000s-$7,000/FEU) for shipments from Shanghai to Rotterdam. Although this impacts shipments, it presents a possibility for module distributors to cut back their inventories in Europe.

A market observer mentioned that costs in the course of the Intersolar interval didn’t transfer and remained round $0.10/W FOB China (+/- 0.3cts) and that regardless of the lengthy set up interval simply began , the set up demand for Europe this 12 months doesn’t appear very sturdy, at the very least within the utility-scale area.

Latin America continues to look weak with value competitors on this market described as “excessive” by one module vendor. Prices within the Brazilian market are normally decrease than in different markets as a result of consumers are value delicate. TOPCon costs in Brazil fell within the vary of $0.08-0.09/W FOB China with lower-end costs supplied by Tier2-3 module distributors, the module vendor added.

A purchaser famous that present US Delivered Duty Paid (DDP) TOPCon costs have risen to the low to mid $0.30/W vary. This pricing consists of the 201 bifacial tariff however excludes the brand new antidumping/countervailing duties. With the exemption set to run out by mid-week, one other market supply advised OPIS that “any new offers can be topic to the 14.25% Section 201 tariff and can possible push costs into the mid- at $0.30s/W by 2024”.

Chinese home demand stays weak amid rising stock stress. Further value cuts within the coming weeks are anticipated as module distributors clear inventories to generate money move. The majority of market contributors surveyed by OPIS anticipate TOPCon costs to drop under CNY0.8/W or $0.099/W at FOB China equal, which is the present manufacturing value for built-in producers.

Popular content material

The working price of built-in module sellers stays between 60-80%, based on the Silicon Industry of the China Nonferrous Metals Industry Association. Estimates of module manufacturing capability in June stood at 50 GW, up from 52 GW beforehand anticipated and down 5 GW from May, the affiliation mentioned.

China exported 83.3 GW of modules in the course of the January-April interval marking a year-on-year enhance of 20%, based on the most recent knowledge from China’s Ministry of Industry and Information Technology. The whole worth of shipped modules within the January-April interval reached $12.7 billion.

Looking forward to the FOB China market, broader bearish circumstances stop any rise in module costs within the quick time period though continued manufacturing cuts by way of July could present some respite to provide pressures.

OPIS, a Dow Jones firm, gives power costs, information, knowledge, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. . It acquired pricing knowledge property from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the creator, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link