[ad_1]

Due to the rising demand for renewable power options, international solar energy capability is anticipated to triple by 2033, in line with Wood Mackenzie. NEXTracker (NASDAQ:NXT), a supplier of progressive photo voltaic tracker applied sciences vital to the success of large-scale photo voltaic initiatives, is properly positioned to take part within the business’s progress.

By enabling photo voltaic panels to maneuver within the route of the solar, these applied sciences additional optimize power manufacturing, offering tools and energy technology initiatives with a excessive return on funding (ROI). Notably, NEXTracker reported a income enhance of 42% to $737 million in the newest quarter (This fall FY24), with income progress anticipated to be a minimum of 12% in Fiscal 2025. The inventory in firm elevated by nearly 43% final 12 months. Still, the shares look attractively valued, reinforcing Nextracker’s place as a compelling progress inventory within the renewable power sector.

NEXTracker Enjoys Strong Demand

NEXTracker has firmly established itself as a frontrunner within the growth of efficient photo voltaic monitoring applied sciences and software program. It is devoted to creating renewable energy accessible and inexpensive for everybody. His built-in photo voltaic tracker and software program options, utilized in utility-scale and distributed technology photo voltaic initiatives world wide, allow photo voltaic panels to observe the trail of the solar for optimized plant efficiency. The energy of Nextracker techniques is mirrored of their capacity to adapt to uneven terrain and stand up to excessive climate situations, thus bettering their sturdiness and reliability.

The firm lately bought US renewable power firm Ojjo, which makes a speciality of basis know-how and companies used for utility-scale ground-mount solar energy technology functions. The acquisition, paired with NEXTracker’s sensible photo voltaic tracker system, presents a extra complete resolution to engineering procurement building corporations and solar energy plant builders, bettering their mission growth, design, and set up capabilities in several land situations.

Since 2021, NEXTracker has expanded or constructed 20 new companion manufacturing amenities within the US, demonstrating its sturdy progress. The firm’s international annual provide capability now stands at 50GW, together with US capability of over 30GW.

NEXTracker ended FY2024 on a excessive word, having achieved the essential milestone of delivering 100GW worldwide since its inception. This vital achievement was accompanied by a file backlog of over $4 billion, highlighting sturdy demand from the US and worldwide markets and underpinning the agency’s sturdy progress.

NEXTracker’s New Financial Analysis

NEXTracker lately introduced monetary outcomes for the fourth quarter and Fiscal 2024, which ended March 31, 2024. Fourth quarter income of $737 million was up 42% year-over-year. -year and simply surpassed consensus expectations of $52.53 million. GAAP web earnings reached $223 million, whereas adjusted EBITDA elevated considerably by 120% year-over-year to $160 million. Revised EPS of $0.96 beat estimates of $0.31.

In Fiscal 2024, the corporate achieved a formidable income of $2.5 billion, a rise of 31% year-over-year. Adjusted web earnings for the 12 months was recorded at $451 million, with adjusted diluted EPS of $3.06. The 12 months witnessed working money move of $429 million and an adjusted free money move of $427 million.

Management issued annual steering for FY2025, projecting income between $2.8 billion and $2.9 billion. Adjusted EBITDA is estimated between $600 million and $650 million, and adjusted diluted EPS forecasts vary from $2.89 to $3.09.

What is the Price Target for NXT Stock?

Analysts who observe NEXTracker are cautiously optimistic concerning the inventory. For instance, HSBC analyst Sean McLoughlin lately lowered his worth goal on the shares from $65 to $60 whereas sustaining a Buy score. He famous “sturdy” This fall outcomes and Fiscal 2025 steering, underlining NEXTracker’s progress prospects within the US and worldwide markets.

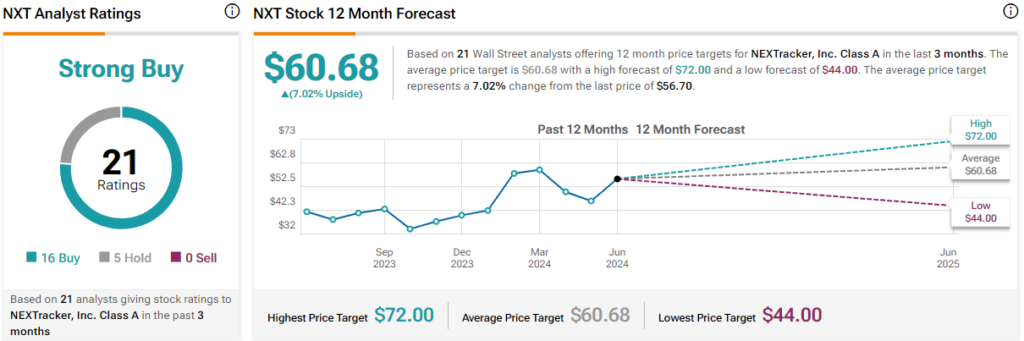

NEXTracker, Inc. rated Strong Buy primarily based on 16 Buys and 5 Holds within the final three months. The common worth goal for NXT inventory is $60.68, which represents a possible upside of seven.02% from present ranges.

The inventory is comparatively unstable, with a beta of 1.94, though it has been bettering total for a while, rising 86% over the previous three years. It is buying and selling on the larger finish of the 52-week worth vary of $32.14 – $62.31, whereas exhibiting continued constructive worth momentum by buying and selling above the 20-day (55.67) and 50-day (52.67) ranges. transferring averages. It trades at a sexy valuation relative to its business friends, with a P/E (price-to-earnings) ratio of 18.12x in comparison with the Solar business common of 26.10x.

Final Thoughts on NXT

NEXTracker’s positioning within the quickly rising renewable power market makes it a compelling funding consideration. Unique photo voltaic monitoring applied sciences and software program options present a sexy ROI for utilities and energy technology initiatives. The firm’s sturdy monetary efficiency in latest quarters, anticipated progress of a minimum of 12% for Fiscal 2025, and engaging present valuation additional underpin its funding attraction.

disclosures

[ad_2]

Source link