[ad_1]

In the brand new weekly replace for pv journalOPIS, a Dow Jones firm, supplies a fast overview of the primary worth traits within the international PV trade.

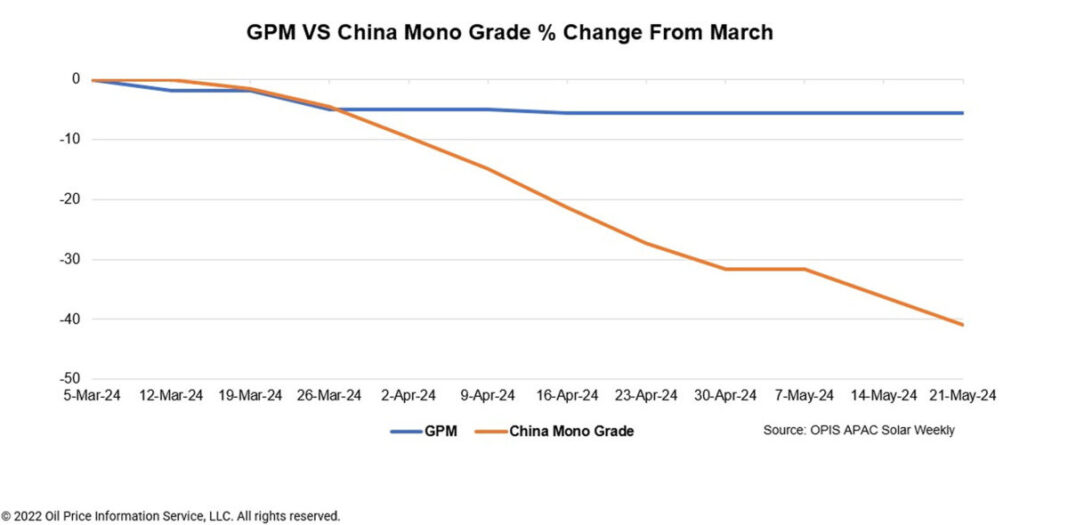

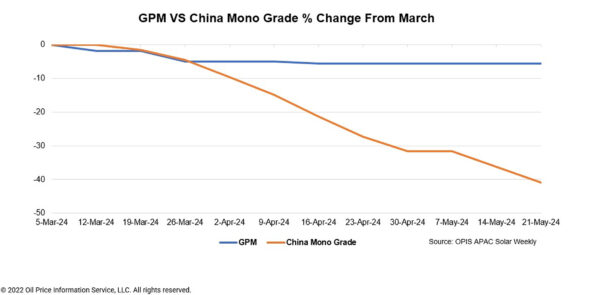

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon exterior of China, assessed at $22.90/kg this week, unchanged from final week, reflecting sturdy market fundamentals.

Recent discussions level to a possible slowdown in international gross sales of polysilicon, resulting from shifts in worldwide commerce insurance policies.

An upstream insider famous that the reinstatement of Section 201 tariffs on bifacial modules from 4 Southeast Asian international locations by the US in June will hinder the export of photo voltaic merchandise from Southeast Asia to the US market. In addition, the US Department of Commerce (DOC) has initiated investigations into photo voltaic cell and module imports from these international locations underneath antidumping and countervailing obligation (AD/CVD) rules, inflicting a slowdown in buying and selling actions in area. Consequently, this led to a major discount within the working price of manufacturing capability in Southeast Asia.

“As a outcome, the tempo of gross sales of polysilicon produced exterior of China, primarily destined for Southeast Asia, is predicted to gradual,” the supply added.

A supply from a worldwide developer expects that this example can be clearer within the second half of this 12 months. “There is not going to be a lot demand for modules from the US within the second half of 2024 as a result of the modules required for set up all through 2024 have already entered the US earlier than the primary quarter of 2024,” it added. he. It could take till 2025 to revive the gross sales state of affairs of worldwide polysilicon suppliers.

So the supply predicts that the worldwide polysilicon could accumulate some stock within the second half of 2024, which can result in a lower within the worth.

Another supply who is aware of concerning the international polysilicon market has a distinct view, stating that international polysilicon costs are in the end tied to closing product costs. Despite current reviews of spot costs for US modules rising to $0.4 per W, photovoltaic energy technology stays the bottom levelized value of electrical energy (LCOE) amongst obtainable energy sources in US Therefore, there’s nonetheless the potential of additional worth will increase for modules within the nation, which, in flip, will assist preserve the premium in international polysilicon costs.

China Mono Grade, the OPIS evaluation for polysilicon costs within the nation was assessed at CNY36.167 ($5.09)/kg this week, down CNY2.833/kg, or 7.26% from final week. Without a rise within the tempo of polysilicon purchases by wafer corporations, polysilicon stock continues to build up, additional placing stress on costs.

According to an upstream supply primarily based in China, the worth of polysilicon used for n-type merchandise from Tier-1 producers is between CNY40/kg and CNY43/kg, whereas that from Tier -2 and smaller producers vary between CNY36/kg and CNY40/kg. The worth of Fluidised Bed Reactor (FBR) granular polysilicon utilized in N-type merchandise has dropped beneath CNY35/kg.

“With the present worth virtually falling beneath the worth of cash for all polysilicon producers, polysilicon corporations face a median lack of almost 40% of present costs,” the supply added. .

Amid continued stock will increase, uncertainty looms over when polysilicon will cease its worth decline and stabilize inside the trade, in keeping with a market watcher. The observer additional defined that reviews point out that the stock of polysilicon is presently near 400,000 MT, roughly equal to virtually two months of manufacturing.

Many insiders report that many polysilicon producers are making manufacturing or upkeep stops to navigate the gradual market circumstances. According to a market participant, most Tier-1 producers have closed their outdated manufacturing strains, whereas some second- and third-tier producers with polysilicon manufacturing capability in Ningxia Autonomous Region , Inner Mongolia, and Shaanxi Province additionally began upkeep. Therefore, it’s anticipated that the manufacturing of polysilicon will lower each month in May and June, though it stays unsure whether or not this discount in manufacturing can be sufficient to reverse the decline in costs, the supply added.

OPIS, a Dow Jones firm, supplies power costs, information, knowledge, and evaluation on gasoline, diesel, jet gasoline, LPG/NGL, coal, metals, and chemical compounds, in addition to renewable fuels and environmental commodities. . It acquired pricing knowledge belongings from the Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed on this article are these of the writer, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and might not be reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link