[ad_1]

Total company funding within the photo voltaic trade reached $22.3 billion within the first 9 months of 2024, down 23% 12 months over 12 months. Mercom Capital Group says international uncertainties are affecting investor confidence, however the improve in debt financing and the energy of the newly introduced giant venture fund are shiny spots for the sector. .

Total company funding within the photo voltaic sector stood at $22.3 billion within the first 9 months of 2024, in keeping with figures from Mercom Capital Group.

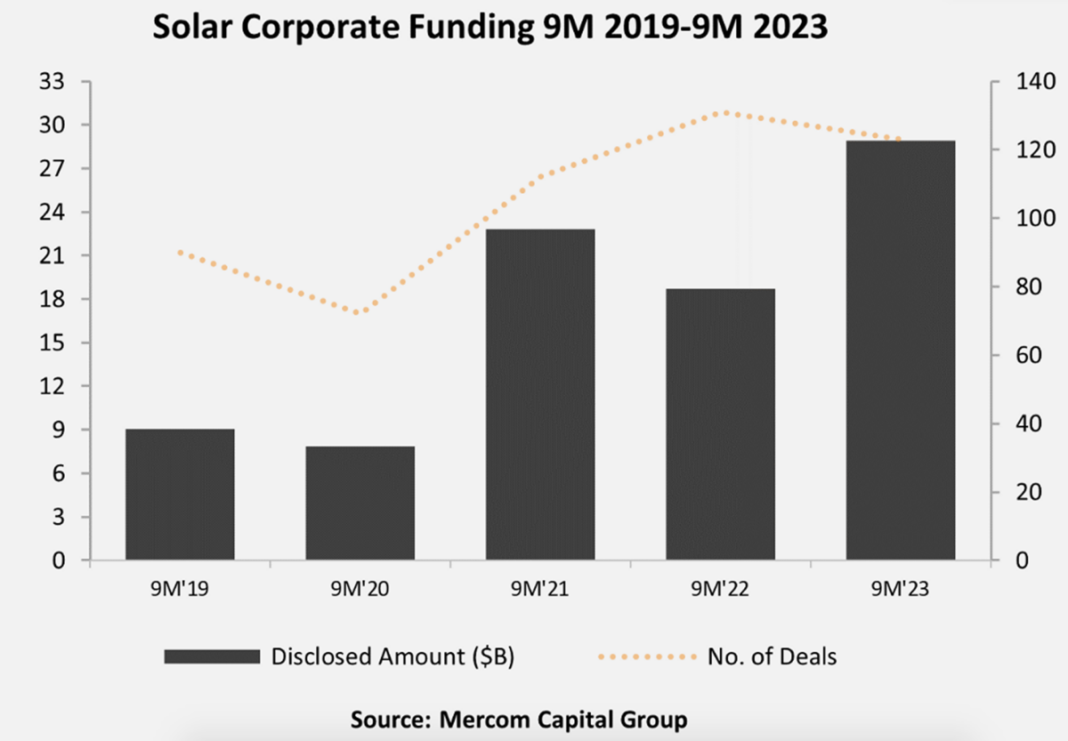

The complete determine, which incorporates enterprise capital/personal fairness funding, public market and debt financing, represents a 23% year-on-year lower in comparison with the primary 9 months of 2023, when $28.9 billion was raised. The variety of offers additionally decreased, by 6% 12 months on 12 months, with 117 offers within the first 9 months of 2024 in comparison with 124 offers within the first 9 months of 2023.

This year-to-date end result was largely pushed by a 39% year-over-year decline in photo voltaic enterprise capital funding, which reached $3.5 billion in 39 offers thus far this 12 months, and a 71% year-over-year -year-over-year decline in photo voltaic public market financing, which stands at $2.1 billion in 10 offers this 12 months thus far.

But the rise in debt financing has reversed this 12 months’s downward pattern. Mercom recorded $16.7 billion raised in 68 offers within the first 9 months of 2024, in comparison with $16 billion raised in 54 offers within the first 9 months of 2023.

Raj Prabhu, CEO of Mercom Capital Group, says the photo voltaic sector faces a number of tax uncertainty.

“Regulatory considerations about antidumping and countervailing duties and tariffs, the US Section 45X steering, potential coverage adjustments attributable to election outcomes, unpredictable international commerce insurance policies, Supply chain disruptions, increased prices, tight labor markets, and ongoing venture delays have undermined investor confidence and delayed key funding choices,” Prabhu mentioned latest 50 foundation level fee minimize is optimistic, the market wants extra readability and course on future fee cuts to stimulate a restoration in funding momentum.”

Despite the lower in complete funding, the Mercom Capital Group evaluation added that the introduced giant venture funding confirmed stability this 12 months, reaching $34.3 billion within the first 9 months of 2024, a improve from final 12 months.

Mercom Capital Group additionally recorded 62 mergers and acquisitions (M&A) transactions carried out within the first 9 months of 2024, in comparison with 75 within the first 9 months of 2024.

Almost 28.3 GW of photo voltaic tasks had been acquired within the first 9 months of 2024, in comparison with 31.6 GW within the first 9 months of 2023. The variety of tasks acquired within the first 9 months of each years was the identical, which is at 166.

This content material is protected by copyright and is probably not reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link