[ad_1]

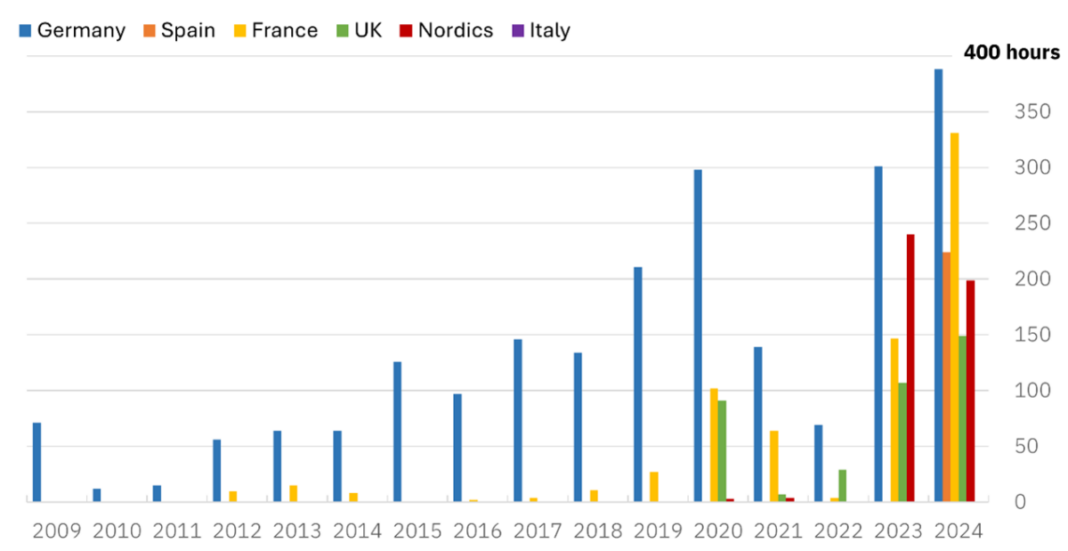

European power markets have skilled a number of hours of destructive costs – a pattern normally related to the speedy enlargement of renewable power. However, this enhance stems from a mixture of components.

“While the deployment of extra photo voltaic and wind is among the important drivers, it’s not the one one,” Antonio Delgado Rigal, chief government of AleaSoft Energy Forecasting, mentioned. pv journal. “Demand additionally performs an vital position.”

He mentioned destructive costs normally happen at midday when photo voltaic manufacturing is excessive, on windy days with excessive wind output, or durations of excessive hydroelectric manufacturing. These situations usually coincide with low demand, akin to weekends, holidays, or milder seasons akin to spring.

“It is the mixture of excessive renewable manufacturing and low demand that results in destructive costs,” he added. “The speedy enhance in put in renewable power capability seen in Europe along with the discount in electrical energy demand because of the Covid disaster in 2020 and the following power value disaster in 2022 and 2023 brings the variety of destructive value will increase in recent times.

Generators typically supply their power at costs beneath zero to make sure its sale out there, which ends up in destructive costs.

“This is feasible due to the marginalist design of the electrical energy market, the place the provides are listed in ascending order in line with the worth provided, and the bottom is the primary matched,” defined Delgado Rigal. “Although it could appear counterintuitive, mills have causes to supply destructive costs. One of them is that they obtain a hard and fast fee for producing power, whatever the market value, if they’ve a [power purchase agreement] or turn into winners in an public sale. In addition, some mills might have an unavoidable dedication to a counterparty that purchases that power. Another cause is that some mills, akin to nuclear energy vegetation, can’t simply cut back their manufacturing, as is the case in France and Spain, the place nuclear vegetation should proceed to supply as a result of their technical limitations. habits.”

Delgado Rigal known as for extra storage capability to forestall this occasion from occurring extra usually. Batteries take up extra renewable power throughout low demand and launch it when wanted.

He mentioned that the variety of hours with destructive costs will most likely enhance within the subsequent two to a few years. This is principally because of the speedy enlargement of renewables and slower-than-expected demand development, affecting decarbonization and emission discount targets.

“However, in the long run, durations of destructive costs usually are not anticipated to symbolize a big danger to the profitability of the mission,” he mentioned. “Even if destructive costs proceed to happen, they aren’t anticipated to be frequent or repeated sufficient to jeopardize the monetary viability of investing in renewable power.”

To make this occur, the primary actions embrace the implementation of power storage applied sciences, bettering the flexibleness of demand, growing the electrification of sectors akin to business, transportation, and heating, and growing the manufacturing of inexperienced hydrogen and its derivatives.

“This will permit renewables to stay aggressive and worthwhile, even in an atmosphere the place destructive costs are typically recorded,” mentioned Delgado Rigal.

Negative costs have traditionally been mirrored in markets akin to Germany, which have deployed giant renewable power capacities. In distinction, markets such because the United Kingdom, which depends closely on fuel and coal, and France, which depends on nuclear power, expertise destructive costs much less steadily.

“Negative costs are likely to happen often, particularly in occasions of low demand, akin to through the Covid disaster in 2020 or within the years after the monetary disaster of 2008,” mentioned Delgado Rigal. “In the case of the Spanish market, destructive costs haven’t occurred till April of this yr and to date the bottom value is €2 ($2.21)/MWh. This is as a result of in Spain, [power purchase agreements] and the auctions have non-payment clauses in case of destructive costs, which stop renewables from being produced throughout such durations.

In nations like Germany, renewable power mills nonetheless obtain agreed funds even when the market value is destructive, so long as the destructive value doesn’t final greater than three consecutive hours.

“From 2023 onwards, the variety of hours with destructive costs begins to extend considerably in virtually all markets,” mentioned Delgado Rigal. “The key issue is the speedy development of photo voltaic PV and a lower in demand after the worth disaster in 2022 and 2023. In most markets, the variety of hours with destructive costs till now in 2024 has exceeded the variety of hours recorded throughout the entire of 2023. And then there are instances just like the Italian market, the place a lot of the demand is roofed by gas-fired mixed cycles and power imports market, destructive costs are uncommon and virtually non-existent.

In the longer term, markets that combine and adapt their power techniques extra successfully can be higher protected against the danger of repeated destructive costs.

“Markets with larger power storage capability, akin to batteries, pumped hydro storage or inexperienced hydrogen storage capability, are capable of retailer extra renewable power in occasions of low demand and launch it when wanted ,” mentioned Delgado Rigal. “This helps to cut back the frequency of destructive costs, as a result of the power doesn’t must be offered at any value out there. Markets which have extra capability in electrical energy connections with their neighboring nations can to export their extra manufacturing when home demand is low, thus avoiding system saturation and destructive costs.This will permit provide and demand to be balanced, keep away from power spills and cut back volatility on the value.

Green hydrogen manufacturing capability can play an vital position by utilizing extra renewable electrical energy to supply hydrogen. This hydrogen will be saved and used as a supply of power or uncooked materials in industrial sectors, decreasing the necessity to promote power throughout destructive costs.

“Markets that encourage larger demand flexibility, via demand administration applications or dynamic tariffs, will have the ability to modify consumption primarily based on the provision of renewable power,” added Delgado Rigal. “This will permit the necessity to higher reply to the provision, decreasing the danger of destructive costs. These parts will present extra stability to the system and permit the utmost use to be made from the renewable technology that with out creating distortions in market costs.

He mentioned that destructive costs, though unhealthy, shouldn’t be seen as an issue that requires direct intervention out there. Instead, they sign a brief inefficiency out there, usually as a result of a mismatch between renewable power provide and demand. Intervening to forestall destructive costs distorts the pure market alerts and incentives essential for environment friendly self-regulation.

“Instead of avoiding destructive costs via restrictive laws, it’s higher to incentivize hedging and long-term contracts akin to [power purchase agreements],” he mentioned. “In this fashion, the worth danger is mitigated for producers and customers, whereas the market supplies, always, the right value sign. It is just not a good suggestion to intervene immediately within the markets to keep away from destructive penalties value, because it is a vital market sign to stimulate innovation and funding in options akin to storage and demand administration.

Delgado Rigal additionally mentioned that the destructive costs are extra indicative of the present cannibalization of the renewable power sector, particularly PV.

“The similar solar energy vegetation compete with one another, which lowers costs when there’s loads of manufacturing,” he mentioned, noting that, particularly for the economic sector, destructive costs symbolize a chance which may entry power at extra aggressive costs. “If industries are capable of adapt and modify their consumption to benefit from these occasions of oversupply, or in the event that they transfer to markets the place renewable power is cheaper because of giant put in capability, they’ll cut back their power prices. This flexibility would be the key to profiting from the power transition.”

This content material is protected by copyright and is probably not reused. If you need to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

Popular content material

[ad_2]

Source link